Does Hawkins (NASDAQ:HWKN) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hawkins (NASDAQ:HWKN). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Hawkins

Hawkins' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Hawkins' EPS has grown 21% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

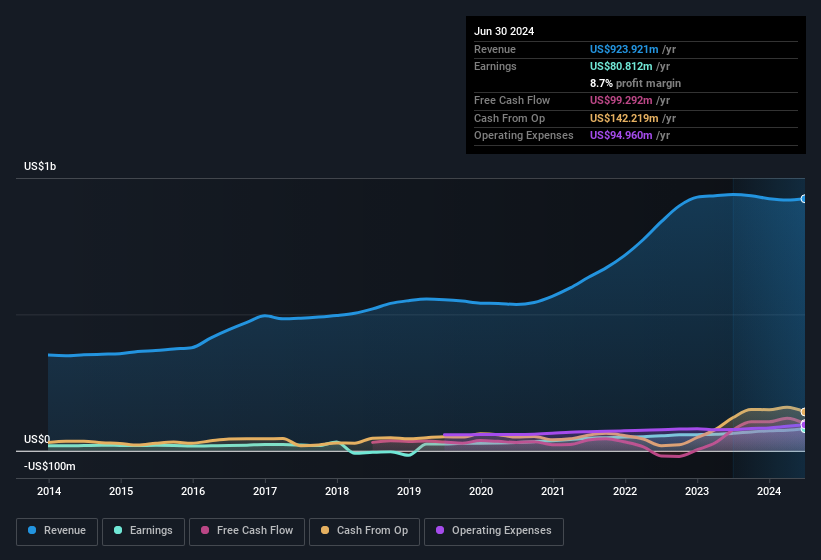

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While revenue is looking a bit flat, the good news is EBIT margins improved by 2.2 percentage points to 12%, in the last twelve months. Which is a great look for the company.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Hawkins' future EPS 100% free.

Are Hawkins Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for Hawkins is the serious outlay one insider has made to buy shares, in the last year. In one fell swoop, Independent Director James Faulconbridge, spent US$351k, at a price of US$89.27 per share. It doesn't get much better than that, in terms of large investments from insiders.

Along with the insider buying, another encouraging sign for Hawkins is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$107m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Patrick Hawkins is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between US$2.0b and US$6.4b, like Hawkins, the median CEO pay is around US$6.7m.

The CEO of Hawkins only received US$2.6m in total compensation for the year ending March 2024. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Hawkins Deserve A Spot On Your Watchlist?

For growth investors, Hawkins' raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. These things considered, this is one stock worth watching. Now, you could try to make up your mind on Hawkins by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Keen growth investors love to see insider activity. Thankfully, Hawkins isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal