Alibaba's Lazada Courts Armani and Other Luxury Brands, Seeks Edge Over Rivals in Southeast Asia

Alibaba Group Holding (NYSE:BABA) is ramping up efforts through its international e-commerce division, Lazada, to attract top European fashion and design brands to stay relevant versus rivals like Sea Ltd’s (NYSE:SE) Shopee, ByteDance’s TikTok, and PDD Holdings Inc (NASDAQ:PDD).

The Chinese e-commerce juggernaut’s international arm aims to position itself as a critical player in the competitive Southeast Asian market, targeting $100 billion in e-commerce volume by 2030.

As part of this push, Lazada executives, including Chief Business Officer Jason Chen, met with over 100 Italian luxury brands, including Armani, Dolce & Gabbana, and Ferragamo, during an event in Milan this week, SCMP reports.

Also Read: What’s Going On With Trump Media & Technology Stock On Monday?

For the first time, Lazada became EBITDA positive in July 2024, backed by its artificial intelligence-enabled operations and improved online marketing, the division’s chief James Dong told SCMP. He said Alibaba had injected $7.4 billion into Lazada.

For the first quarter, Alibaba’s international commerce retail business topline grew by 38% to $3.26 billion, compared to its total revenue of $33.47 billion.

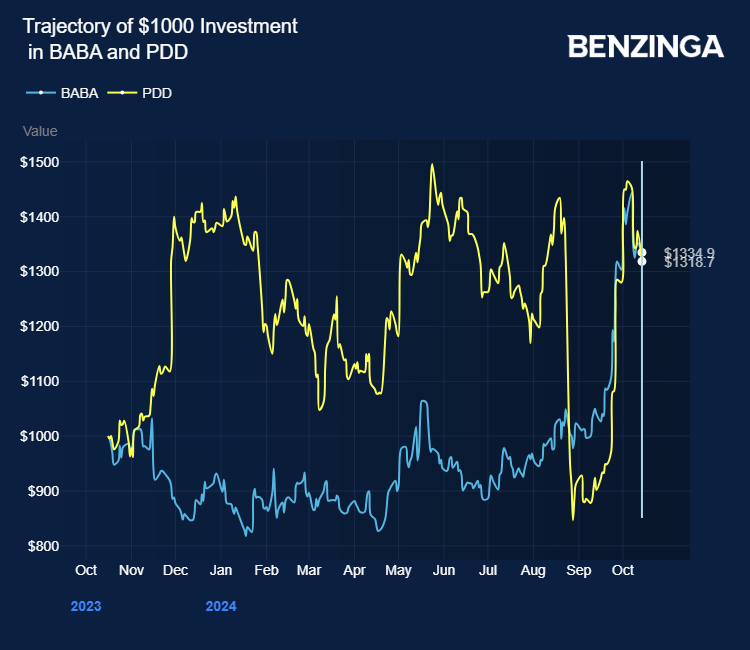

China’s tech barometer Alibaba Group stock gained over 28% in the last 30 days, marking a stimulus-driven rally as it grappled with a weak domestic economy coupled with geopolitical tensions with the US, further stunting its growth prospects. Alibaba is grappling with an intense price war with its domestic e-commerce rivals.

Will Alibaba Stock Go Up?

When trying to assess whether or not Alibaba will trade higher from current levels, it's a good idea to take a look at analyst forecasts.

Wall Street analysts have an average 12-month price target of $107.27 on Alibaba. The Street high target is currently at $130.0 and the Street low target is $85.0. Of all the analysts covering Alibaba, 9 have positive ratings, 2 have neutral ratings and no one has negative ratings.

In the last month, 2 analysts have adjusted price targets. Here's a look at recent price target changes [Analyst Ratings]. Benzinga also tracks Wall Street's most accurate analysts. Check out how analysts covering Alibaba have performed in recent history.

Stocks don't move in a straight line. The average stock market return is approximately 10% per year. Alibaba is 45.85% up year-to-date. The average analyst price target suggests the stock could have further downside ahead.

For a broad overview of everything you need to know about Alibaba, visit here. If you want to go above and beyond, there's no better tool to help you do just that than Benzinga Pro. Start your free trial today.

Price Action: BABA stock is down by 1.26% at $108.76 at the last check Monday.

Also Read:

Image by Quality Stock Arts via Shutterstock

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal