October 2024's Noteworthy Stocks Estimated to Be Below Intrinsic Value

As global markets continue to experience mixed signals, with U.S. indices reaching new highs amidst modest inflation surprises and economic uncertainties in Europe and China, investors are keenly observing opportunities for value. In this environment, identifying stocks that are potentially undervalued can be crucial for those looking to capitalize on discrepancies between market price and intrinsic value, particularly as earnings season unfolds with unexpected performances across various sectors.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF144.00 | CHF287.84 | 50% |

| Densan System Holdings (TSE:4072) | ¥2659.00 | ¥5308.52 | 49.9% |

| VersaBank (TSX:VBNK) | CA$20.69 | CA$41.31 | 49.9% |

| Biotage (OM:BIOT) | SEK183.00 | SEK365.07 | 49.9% |

| Litium (OM:LITI) | SEK8.12 | SEK16.22 | 49.9% |

| Trisura Group (TSX:TSU) | CA$43.92 | CA$87.82 | 50% |

| Mpac Group (AIM:MPAC) | £4.50 | £8.99 | 49.9% |

| Little Green Pharma (ASX:LGP) | A$0.085 | A$0.17 | 49.8% |

| SysGroup (AIM:SYS) | £0.325 | £0.65 | 50% |

| OKEA (OB:OKEA) | NOK23.30 | NOK46.45 | 49.8% |

Let's uncover some gems from our specialized screener.

monday.com (NasdaqGS:MNDY)

Overview: monday.com Ltd. develops software applications globally and has a market cap of $14.44 billion.

Operations: The company's revenue segment is Internet Software & Services, generating $844.78 million.

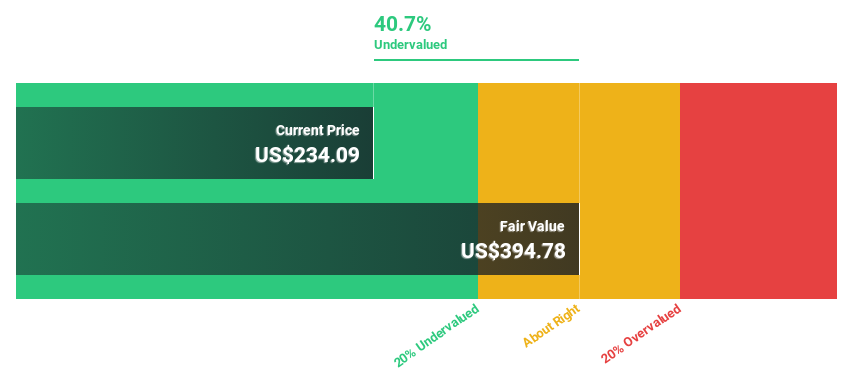

Estimated Discount To Fair Value: 17.8%

monday.com is trading at US$289.56, below its estimated fair value of US$352.25, indicating potential undervaluation based on discounted cash flow analysis. The company has recently become profitable, reporting a net income of US$14.32 million in Q2 2024 compared to a loss last year. Earnings are forecast to grow significantly at 28% per year, outpacing the market average. However, past shareholder dilution and low future return on equity projections may temper enthusiasm for some investors.

- Our comprehensive growth report raises the possibility that monday.com is poised for substantial financial growth.

- Dive into the specifics of monday.com here with our thorough financial health report.

Evercore (NYSE:EVR)

Overview: Evercore Inc. is an independent investment banking advisory firm operating in the United States, Europe, Latin America, and internationally, with a market cap of approximately $11.66 billion.

Operations: The company's revenue is primarily derived from its Investment Banking & Equities segment, which generated $2.55 billion, and its Investment Management segment, contributing $73.80 million.

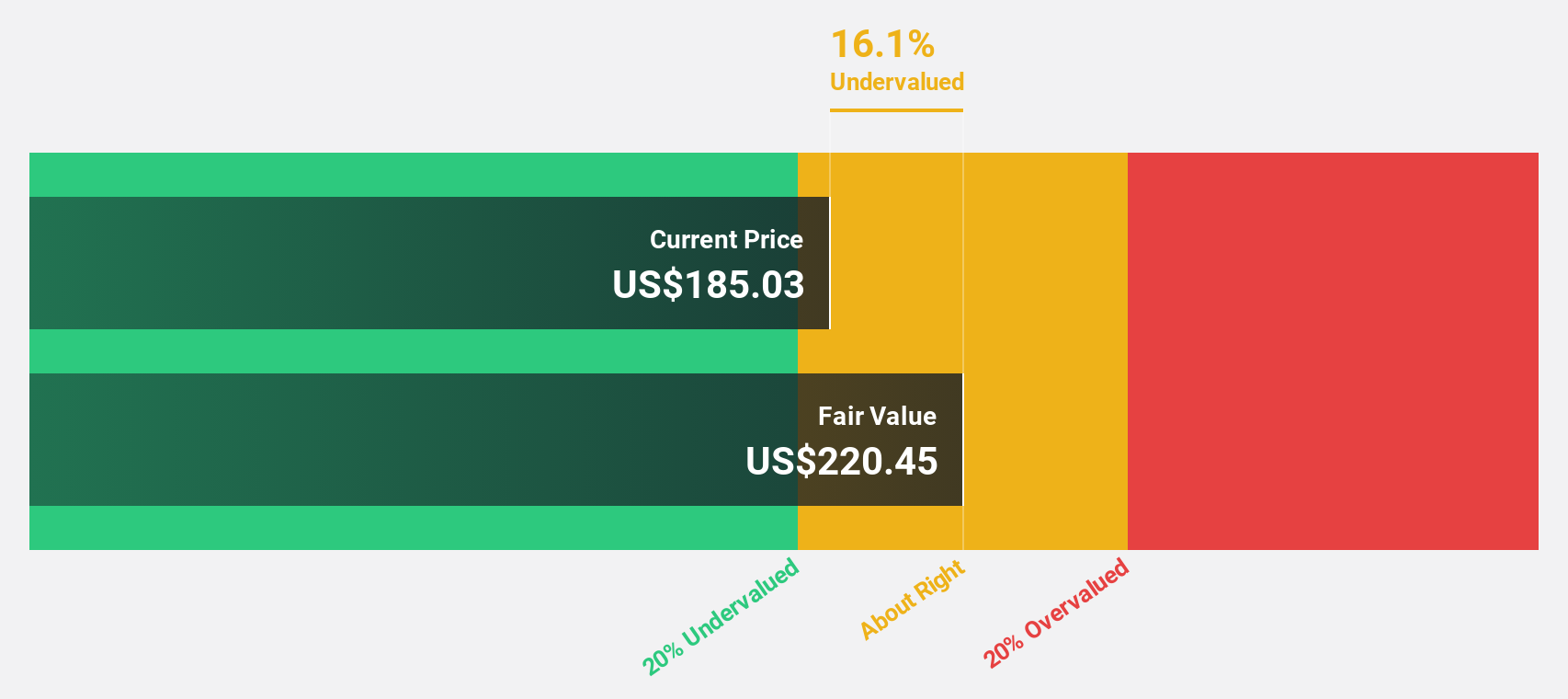

Estimated Discount To Fair Value: 22.6%

Evercore is trading at US$265.61, significantly below its estimated fair value of US$343.02, highlighting potential undervaluation based on discounted cash flow analysis. Recent financial results show strong revenue growth to US$693.41 million in Q2 2024, with net income nearly doubling from the previous year. Earnings are projected to grow at a robust 28.63% annually, surpassing market averages, although past shareholder dilution may be a concern for some investors.

- Our growth report here indicates Evercore may be poised for an improving outlook.

- Take a closer look at Evercore's balance sheet health here in our report.

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. is a company that focuses on the research, development, production, and sale of optical communication transceiver modules and optical devices in China, with a market cap of CN¥176.35 billion.

Operations: The company's revenue segments primarily include the research, development, production, and sale of optical communication transceiver modules and optical devices in China.

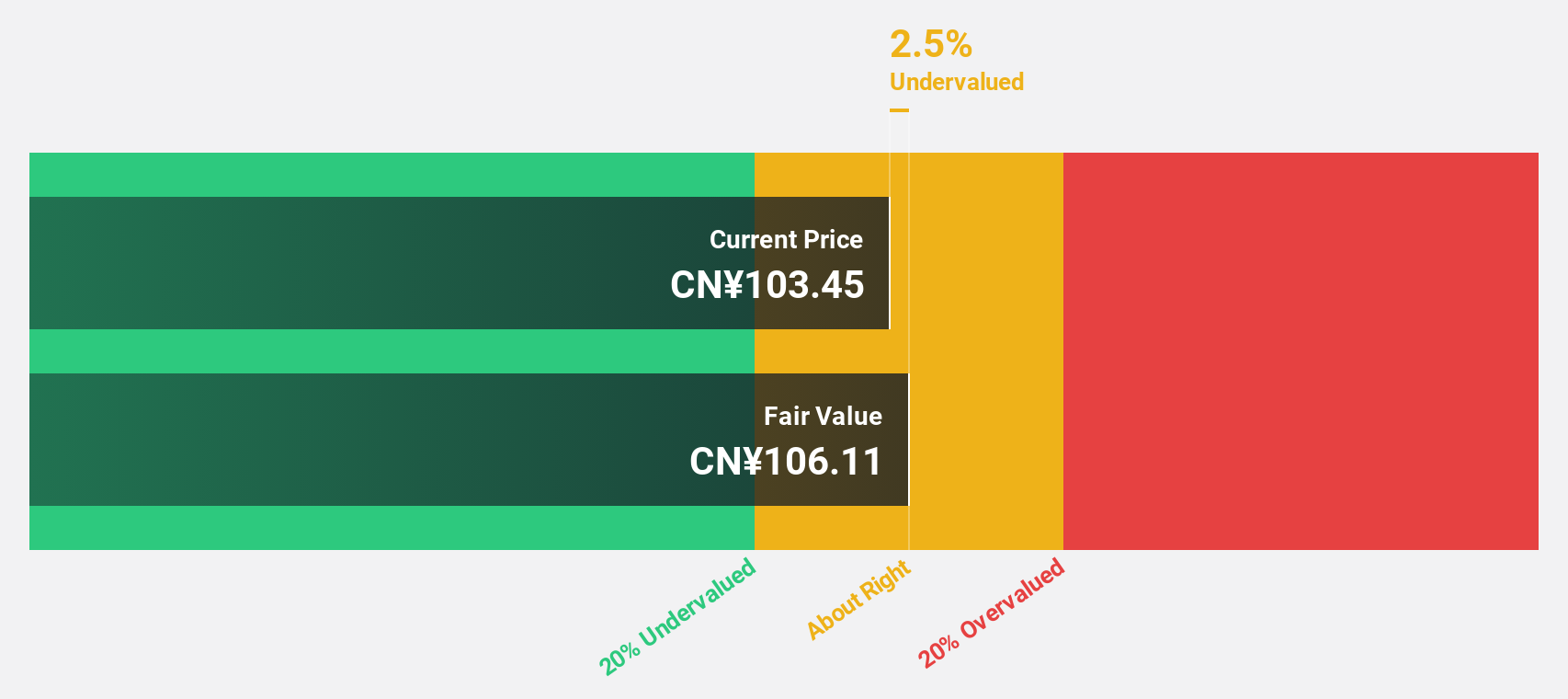

Estimated Discount To Fair Value: 29.5%

Zhongji Innolight is trading at CN¥162, significantly below its fair value estimate of CN¥229.94, suggesting undervaluation based on discounted cash flow analysis. The company reported substantial growth in its half-year results, with revenue reaching CN¥10.80 billion and net income climbing to CN¥2.36 billion compared to the previous year. Earnings are expected to grow significantly at 31.72% annually over the next three years, outpacing both revenue and market averages in China.

- The analysis detailed in our Zhongji Innolight growth report hints at robust future financial performance.

- Click here to discover the nuances of Zhongji Innolight with our detailed financial health report.

Next Steps

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 955 more companies for you to explore.Click here to unveil our expertly curated list of 958 Undervalued Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal