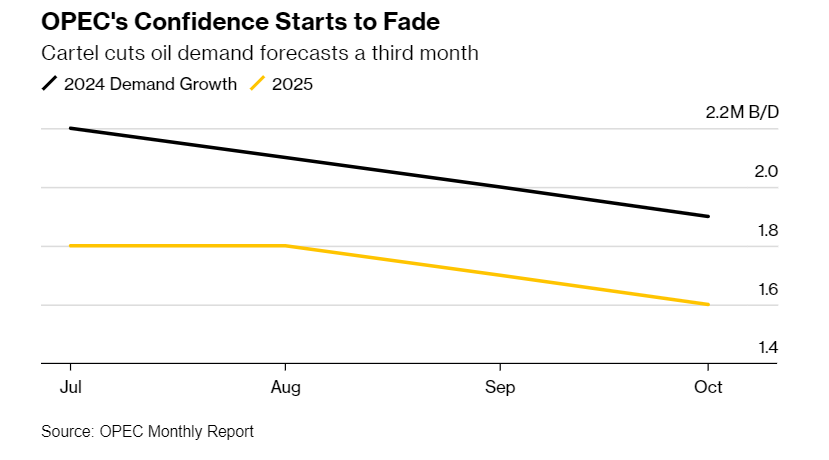

Three consecutive drops! OPEC also lowered its forecast for global oil demand growth

OPEC lowered its oil demand growth forecast for this year and next for the third month in a row, and the organization was slow to recognize the slowdown in global fuel consumption.

OPEC said in its monthly report that global crude oil demand is expected to grow at 1.93 million b/d in 2024, compared to a previous forecast of 2.03 million b/d. Global crude oil demand is expected to grow at 1.64 million b/d in 2025, compared with the previous forecast of 1.74 million b/d. The agency said the amendment was “mainly due to actual data received and a slight decrease in demand expectations in some regions”.

Lowering the global oil demand growth forecast for the third time in a row marks the beginning of OPEC's retreat from the strong bullish expectations it has maintained since this year. Even after the downgrade, the agency is still an anomaly in terms of demand forecasting. Its forecast is higher than Wall Street banks and traders, and is at the top of Saudi Aramco's expectations, about twice the International Energy Agency (IEA) forecast.

The actions of OPEC member states themselves also show a lack of confidence in the oil prospects. The agency delayed plans to increase production, although its forecast indicated that there would be a serious shortage of supply.

Under Saudi leadership, OPEC and its allies will gradually resume production of 2.2 million barrels per day starting in December, two months later than originally planned. Market observers like J.P. Morgan Chase and Citi still doubt whether they will continue to increase production in the face of slowing economic growth and increased supply in the Americas.

Although the Middle East conflict has boosted crude oil prices, the current price of $77 per barrel of Brent crude oil is still too low for some OPEC member countries. Some countries have failed to cut production as promised, particularly Iraq, Kazakhstan, and Russia, undermining OPEC's efforts to boost oil prices.

The above report shows that Iraq has made progress in implementing the share of production cuts that should have been fulfilled since the beginning of this year, but production is still above the agreed quota.

Iraq reduced production by 155,000 barrels per day to 4.112 million barrels in September, close to the target of 4 million barrels, but it is still above this target, and no progress has been made in promising compensatory production cuts. An Iraqi official claimed last weekend that its production was below the quota.

Kazakhstan's daily production increased by 75,000 barrels to 1,545,000 barrels, in breach of its promise to cut production. Russia's daily production fell by 28,000 barrels to about 9 million barrels, but it is still above the production limit.

OPEC+ is expected to make a decision on its December production increase plan in the next few weeks. The agency will meet on December 1 to consider production policies for 2025.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal