Unveiling Canada's Hidden Stock Gems For October 2024

Over the last 7 days, the Canadian market has risen by 1.3%, contributing to a remarkable 23% increase over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying stocks that combine strong fundamentals with growth potential can uncover hidden opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Lithium Chile | NA | nan | 30.02% | ★★★★★★ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

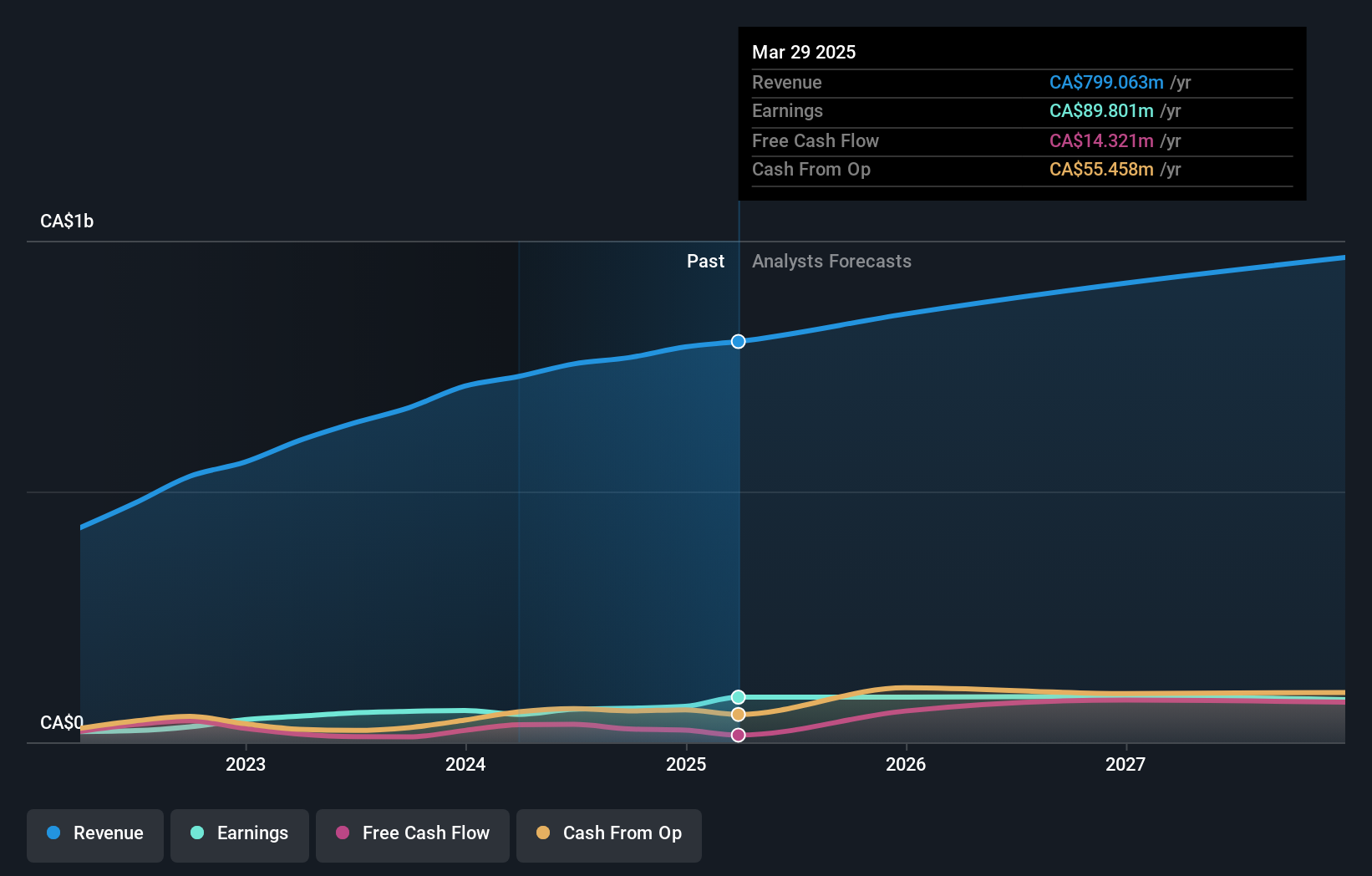

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Hammond Power Solutions Inc., along with its subsidiaries, focuses on designing, manufacturing, and selling a range of transformers across Canada, the United States, Mexico, and India with a market capitalization of CA$1.79 billion.

Operations: Hammond Power Solutions generates revenue primarily from the manufacture and sale of transformers, totaling CA$754.37 million.

Hammond Power Solutions, a compact player in the electrical industry, has seen its debt to equity ratio drop from 28% to 5% over five years. With earnings growth of 12.3%, outpacing the industry's 7.9%, and trading at a discount of 35% below estimated fair value, it presents intriguing prospects. Despite significant insider selling recently, the company remains profitable with high-quality earnings and solid interest coverage at nearly 88 times EBIT. Recent follow-on equity offerings raised C$57 million, underscoring its strategic financial maneuvers.

- Navigate through the intricacies of Hammond Power Solutions with our comprehensive health report here.

Understand Hammond Power Solutions' track record by examining our Past report.

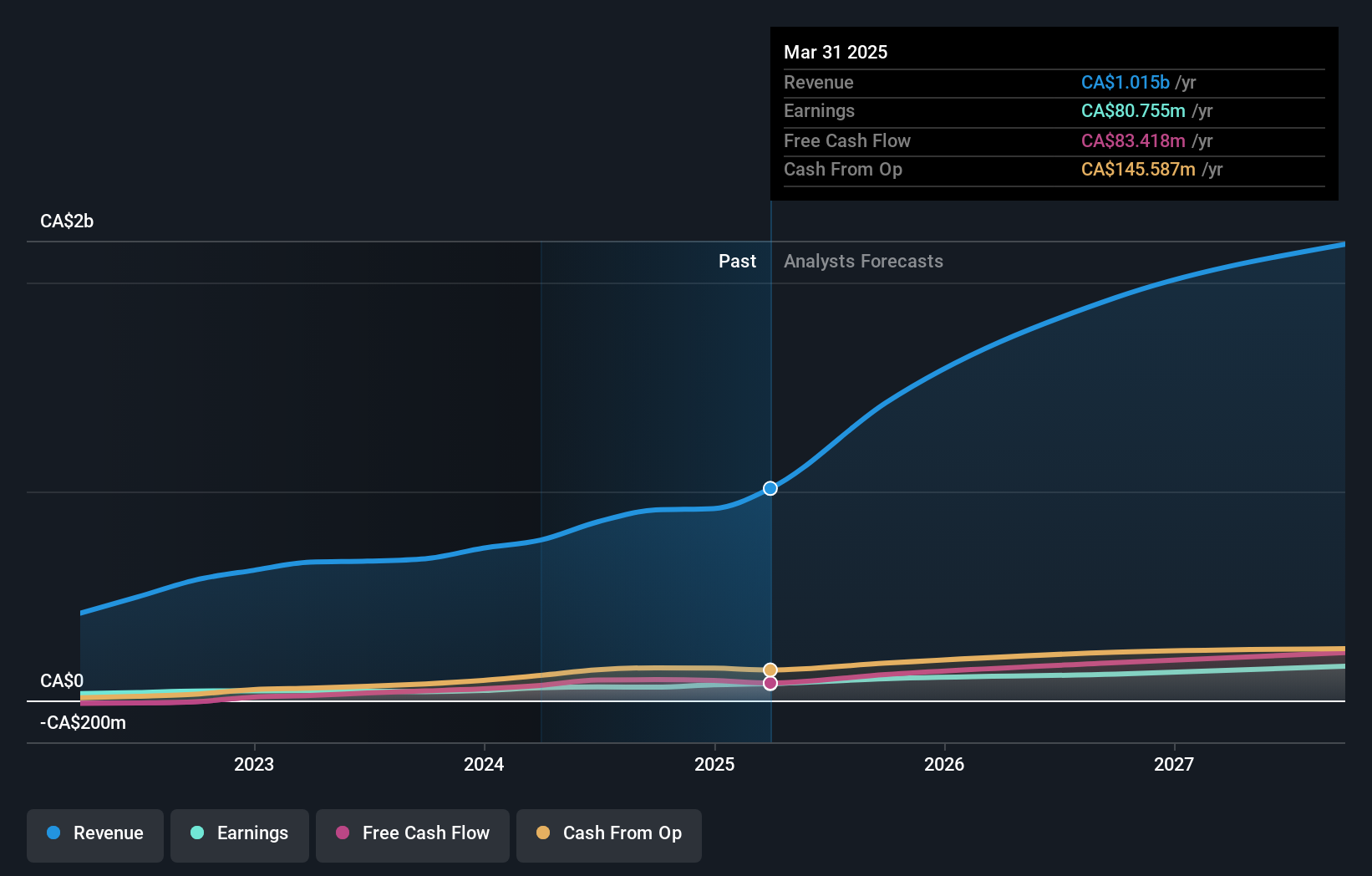

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services to the energy, agriculture, mining, transportation, and other markets in Canada and the United States, with a market cap of CA$1.98 billion.

Operations: TerraVest Industries generates revenue primarily from its HVAC and Containment Equipment segment (CA$292.90 million), followed by Compressed Gas Equipment (CA$243.77 million) and Service (CA$201.78 million). The company also earns from Processing Equipment, contributing CA$117.58 million to its overall revenue structure.

TerraVest Industries, a nimble player in Canada's industrial sector, showcases robust financial health with earnings growing by 43.6% last year, outpacing the energy services industry. The company trades at 21.8% below its estimated fair value and has reduced its debt to equity ratio from 117.9% to 49.4% over five years, though it still carries high debt levels with a net debt to equity ratio of 42.3%. Recent inclusion in the S&P Global BMI Index underscores its potential for broader recognition and growth prospects within the market landscape.

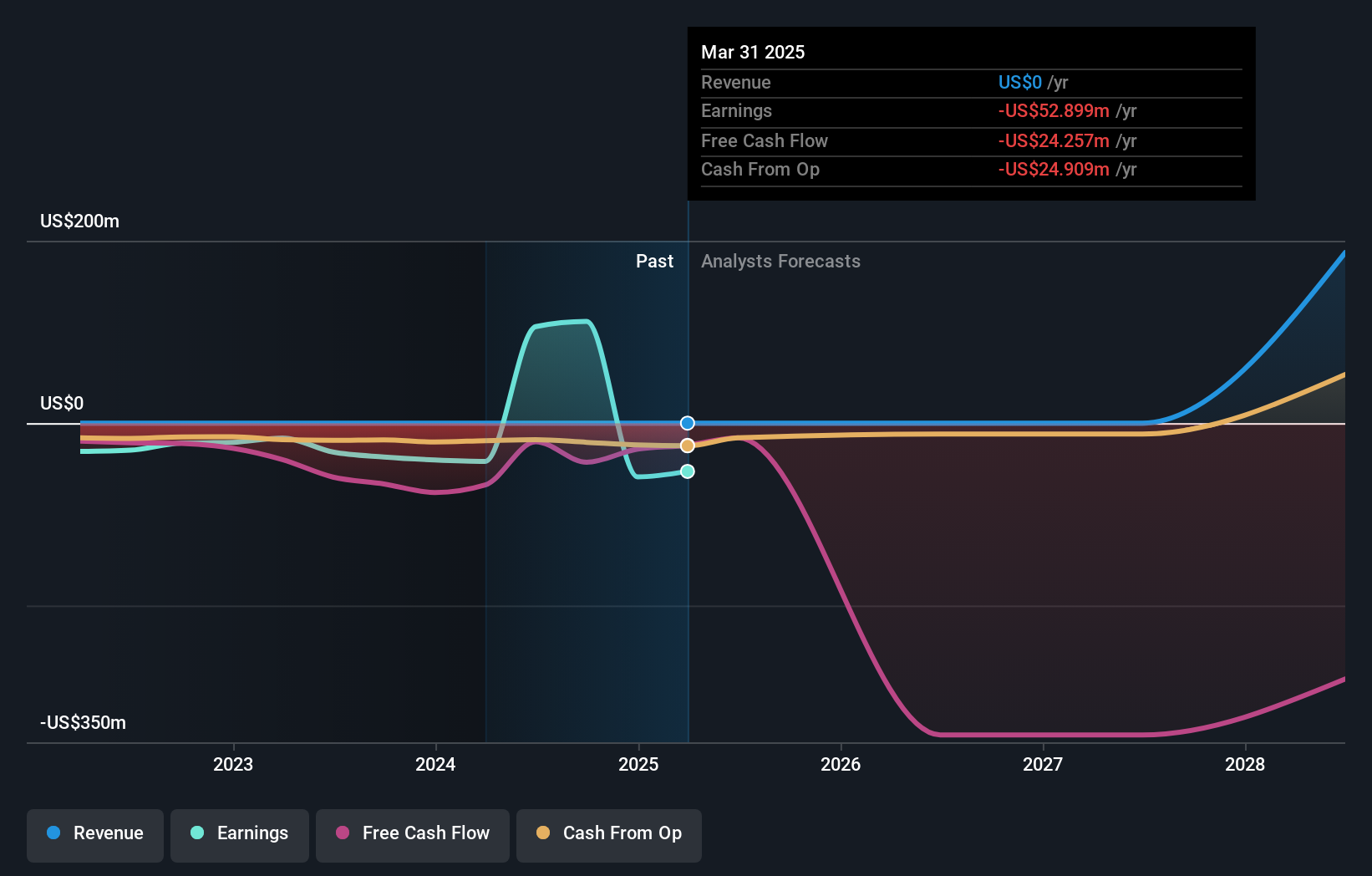

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Lithium Ltd. is engaged in the exploration, development, and processing of lithium brine properties in the United States with a market cap of CA$609.12 million.

Operations: Standard Lithium Ltd. currently does not report any revenue segments, focusing its efforts on exploration and development activities in the lithium brine sector.

Standard Lithium, a nimble player in the lithium sector, recently reported a net income of CAD 147 million for the year ending June 2024, contrasting with a CAD 42 million loss previously. The company’s price-to-earnings ratio stands at an attractive 4.1x compared to the Canadian market average of 15.7x, highlighting its value potential. Despite significant insider selling and shareholder dilution over the past year, Standard Lithium remains debt-free and is poised for growth with strategic partnerships like Equinor's involvement in its Arkansas project.

- Click to explore a detailed breakdown of our findings in Standard Lithium's health report.

Assess Standard Lithium's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 48 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal