3 TSX Dividend Stocks Yielding 3.6% To 7.2%

Over the last 7 days, the Canadian market has risen by 1.3%, contributing to a notable 23% climb over the past year, with earnings expected to grow by 15% annually. In this environment of robust growth, dividend stocks yielding between 3.6% and 7.2% can offer investors a blend of income and potential capital appreciation, making them an attractive option for those looking to capitalize on current market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.61% | ★★★★★★ |

| Labrador Iron Ore Royalty (TSX:LIF) | 7.78% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.09% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.33% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.09% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.58% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.26% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.11% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.33% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.06% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top TSX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

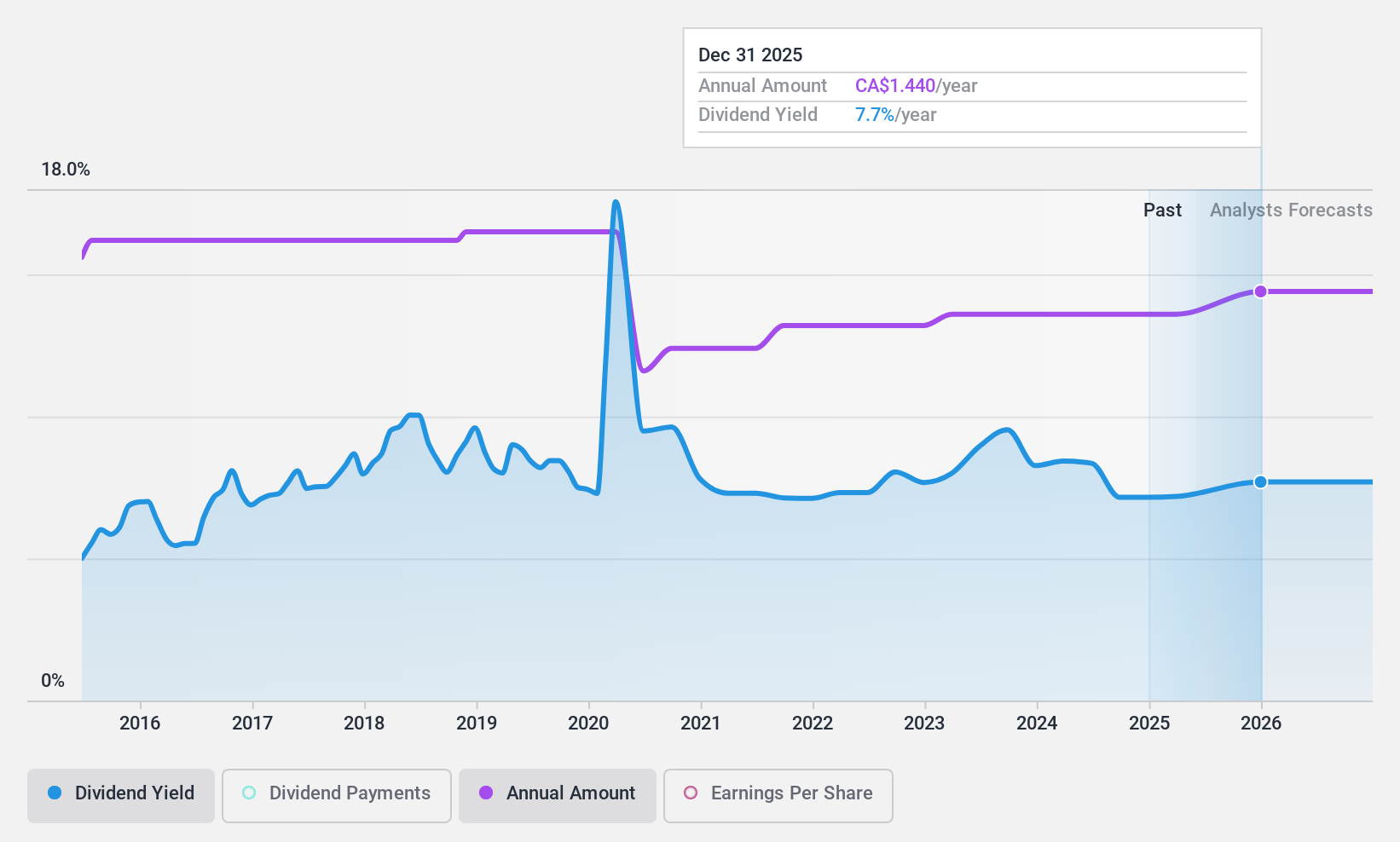

Alaris Equity Partners Income Trust (TSX:AD.UN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alaris Equity Partners Income Trust is a private equity firm focusing on management buyouts, growth capital, and mature investments in the lower and middle market sectors, with a market cap of CA$848.54 million.

Operations: Alaris Equity Partners Income Trust generates its revenue primarily from unclassified services, amounting to CA$215.71 million.

Dividend Yield: 7.3%

Alaris Equity Partners Income Trust offers a high dividend yield of 7.29%, ranking in the top 25% of Canadian dividend payers. Despite a volatile and unreliable dividend history over the past decade, its current dividends are well-covered by earnings (payout ratio: 29.5%) and cash flows (cash payout ratio: 72.6%). Although it trades at a good value relative to peers, future earnings are expected to decline significantly, which may impact long-term sustainability.

- Navigate through the intricacies of Alaris Equity Partners Income Trust with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Alaris Equity Partners Income Trust is priced lower than what may be justified by its financials.

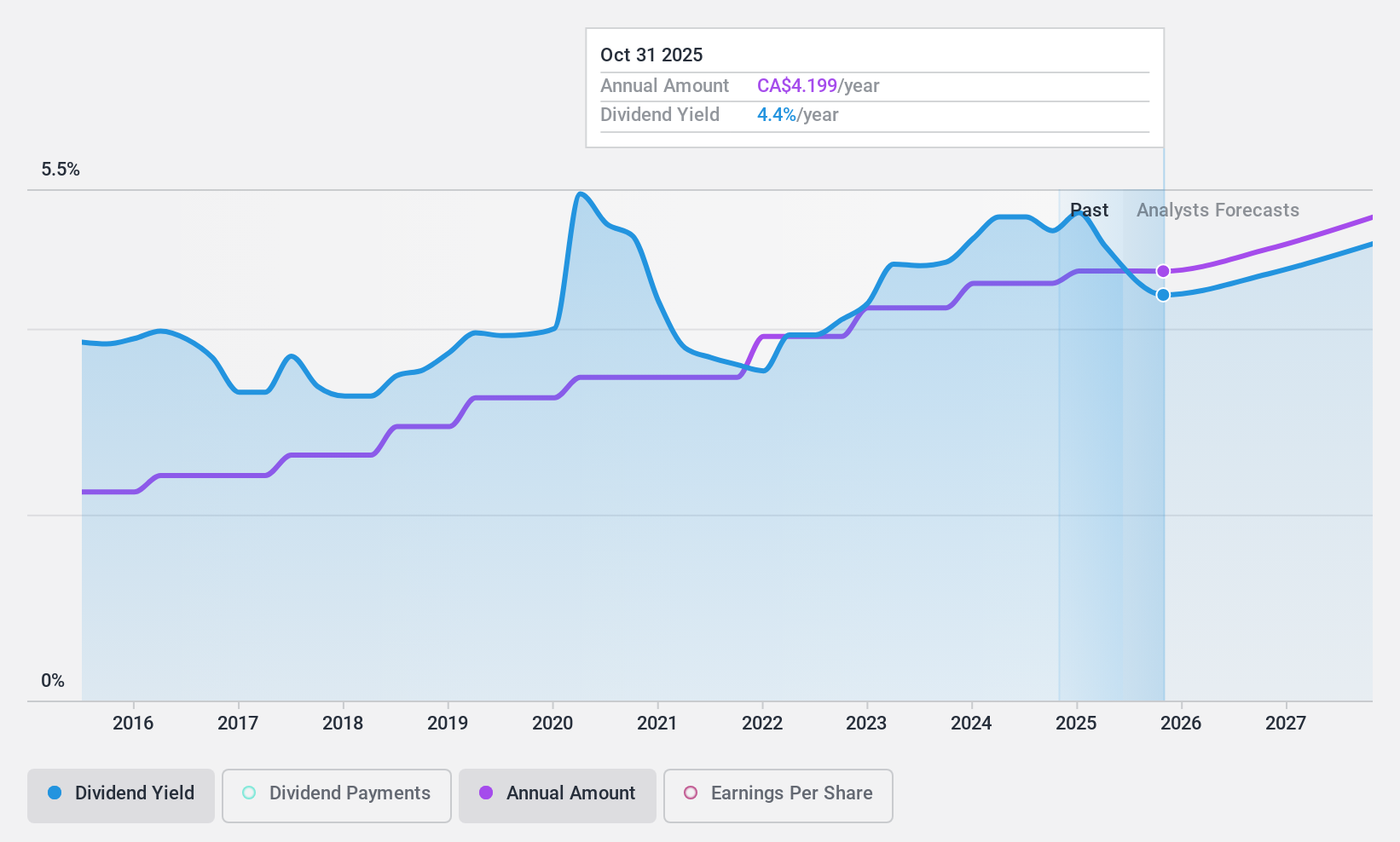

Toronto-Dominion Bank (TSX:TD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Toronto-Dominion Bank, along with its subsidiaries, offers a range of financial products and services across Canada, the United States, and internationally, with a market cap of CA$137.19 billion.

Operations: Toronto-Dominion Bank generates revenue through several segments, including Canadian Personal and Commercial Banking at CA$17.77 billion, U.S. Retail at CA$12.75 billion, Wealth Management and Insurance at CA$12.20 billion, Wholesale Banking at CA$6.76 billion, and Corporate operations contributing CA$1.19 billion.

Dividend Yield: 5.2%

Toronto-Dominion Bank's dividend yield of 5.2% is below the top quartile in Canada, and its payout ratio of 92.7% suggests dividends are not well covered by earnings. Despite stable and growing dividends over the past decade, recent financials show a net loss and reduced profit margins, raising concerns about sustainability. The bank's ongoing fixed-income offerings indicate efforts to manage capital but may not directly enhance dividend stability for investors.

- Delve into the full analysis dividend report here for a deeper understanding of Toronto-Dominion Bank.

- According our valuation report, there's an indication that Toronto-Dominion Bank's share price might be on the expensive side.

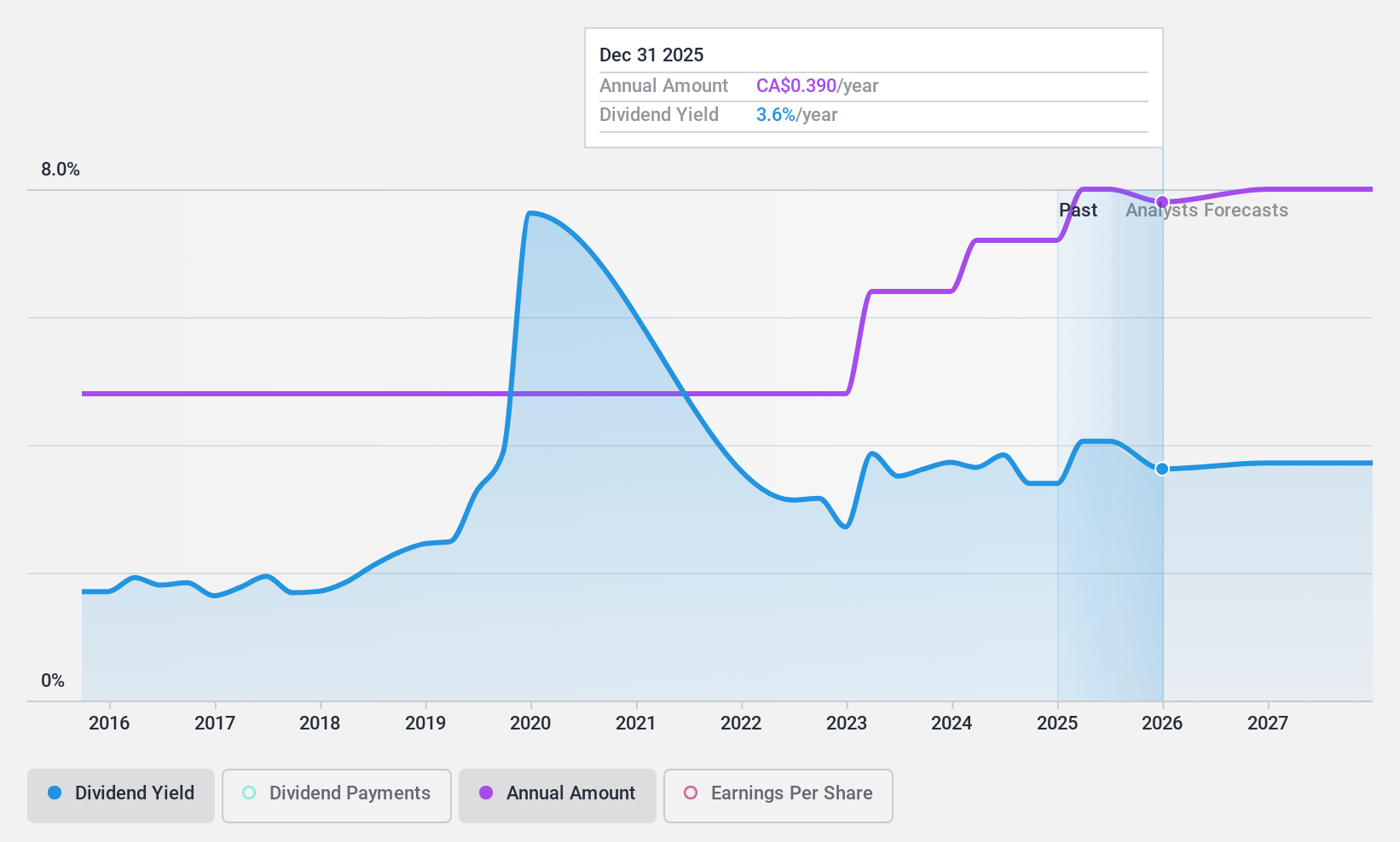

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company operating in Canada, the United States, and Australia with a market cap of CA$380.15 million.

Operations: Total Energy Services Inc.'s revenue is derived from four main segments: Well Servicing (CA$89.94 million), Contract Drilling Services (CA$299.62 million), Compression and Process Services (CA$393.38 million), and Rentals and Transportation Services (CA$80.86 million).

Dividend Yield: 3.6%

Total Energy Services declared a quarterly dividend of C$0.09, payable on October 15, 2024. Despite past volatility and an unreliable dividend history, the company maintains a low payout ratio of 32% and cash payout ratio of 24.7%, indicating dividends are well covered by earnings and cash flows. Recent earnings show improved net income at C$15.47 million for Q2 2024, supporting dividend sustainability even though the yield is below top-tier Canadian payers.

- Take a closer look at Total Energy Services' potential here in our dividend report.

- Our valuation report unveils the possibility Total Energy Services' shares may be trading at a discount.

Taking Advantage

- Get an in-depth perspective on all 30 Top TSX Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal