Scandinavian Medical Solutions (CPH:SMSMED) Takes On Some Risk With Its Use Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Scandinavian Medical Solutions A/S (CPH:SMSMED) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Scandinavian Medical Solutions

How Much Debt Does Scandinavian Medical Solutions Carry?

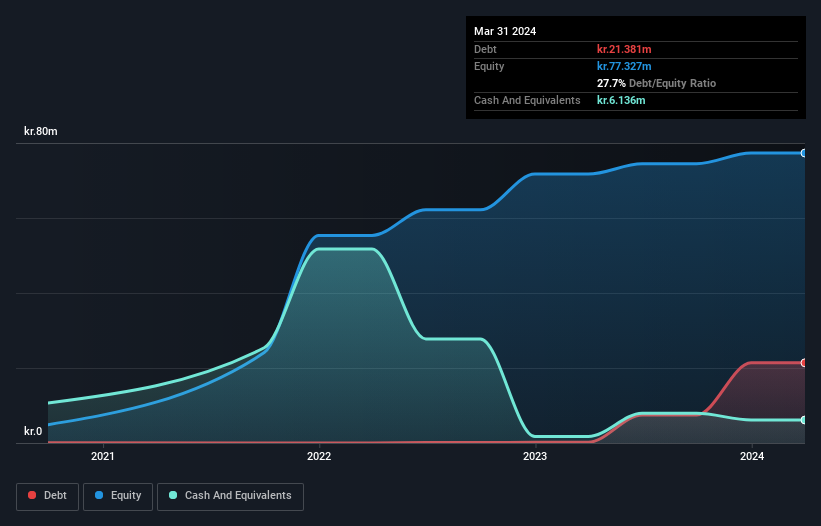

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Scandinavian Medical Solutions had kr.21.4m of debt, an increase on kr.195.2k, over one year. However, because it has a cash reserve of kr.6.14m, its net debt is less, at about kr.15.2m.

A Look At Scandinavian Medical Solutions' Liabilities

The latest balance sheet data shows that Scandinavian Medical Solutions had liabilities of kr.71.0m due within a year, and liabilities of kr.15.9m falling due after that. Offsetting these obligations, it had cash of kr.6.14m as well as receivables valued at kr.23.6m due within 12 months. So its liabilities total kr.57.2m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Scandinavian Medical Solutions is worth kr.184.3m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 1.0 and interest cover of 5.1 times, it seems to us that Scandinavian Medical Solutions is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Importantly, Scandinavian Medical Solutions's EBIT fell a jaw-dropping 60% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is Scandinavian Medical Solutions's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Scandinavian Medical Solutions burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Scandinavian Medical Solutions's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. We should also note that Healthcare industry companies like Scandinavian Medical Solutions commonly do use debt without problems. Overall, we think it's fair to say that Scandinavian Medical Solutions has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Scandinavian Medical Solutions is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal