Shenzhen Quanxinhao (SZSE:000007) adds CN¥149m to market cap in the past 7 days, though investors from five years ago are still down 43%

It's nice to see the Shenzhen Quanxinhao Co., Ltd. (SZSE:000007) share price up 10% in a week. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 43% in that time, significantly under-performing the market.

While the last five years has been tough for Shenzhen Quanxinhao shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Shenzhen Quanxinhao

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Shenzhen Quanxinhao moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 38% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

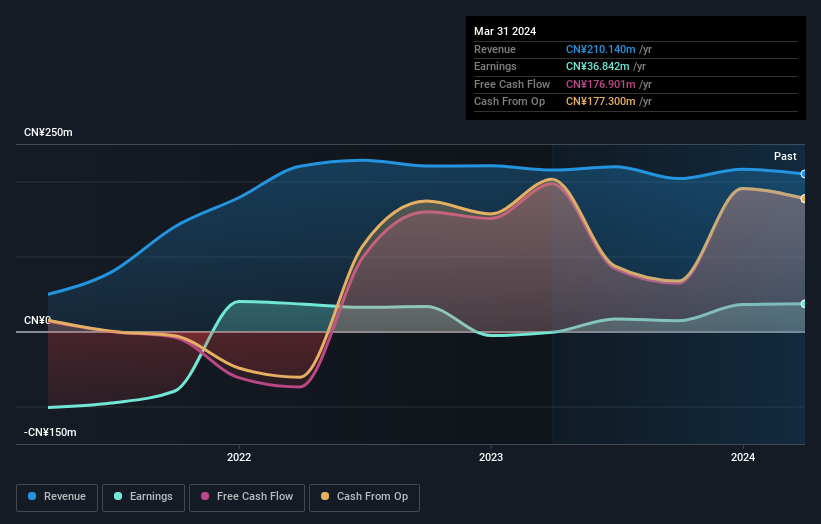

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Shenzhen Quanxinhao's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's never nice to take a loss, Shenzhen Quanxinhao shareholders can take comfort that their trailing twelve month loss of 7.6% wasn't as bad as the market loss of around 11%. What is more upsetting is the 7% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. Is Shenzhen Quanxinhao cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal