Weekly Hot Picks: The oil market is in a tight tug of war! The US index fell sharply in anticipation of interest rate cuts!

Market review

The US dollar index rose overall this week, but this month is likely to record its biggest monthly decline since November 2023. On Tuesday, the US index fell to its lowest point in more than a year, then the decline was reversed. On Wednesday, due to month-end buying and technical trading, the US index recorded its biggest increase since June 3, and continued to rise on Thursday and Friday due to good US economic data performance.

Spot gold showed an overall fluctuating trend this week. Among them, it fell more than 20 US dollars on Wednesday and narrowly held the 2,500 mark, ending with the strengthening of the US dollar and profits for traders. On Thursday, spot gold dived for a while after strong US economic data was released, but then there was a “deep V” rebound.

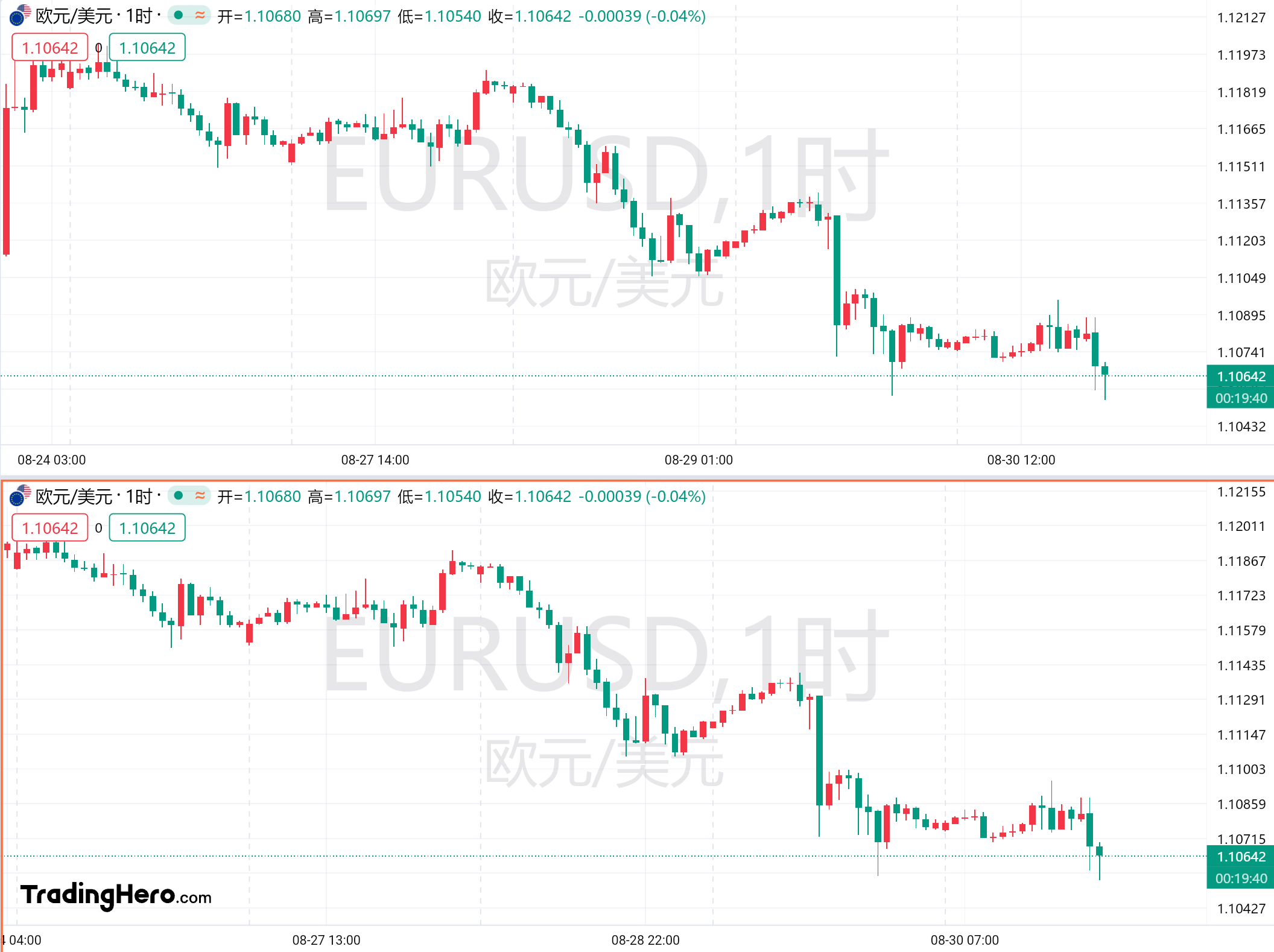

In terms of non-US currencies, the euro fell sharply against the US dollar, while the pound rose to a two-and-a-half-year high against the US dollar. At one point, the Australian dollar rose to its highest level against the US dollar during the year, and the New Zealand dollar was also close to its peak during the year, and the offshore renminbi surged to close to 7.07 against the US dollar.

International oil prices have fluctuated greatly. Oil prices fell at the beginning of the week due to market expectations of weak demand and oversupply. However, due to the political turmoil in Libya, production is at a standstill. Iraq also said it would reduce oil production in September, and both WTI crude oil and Brent crude oil rose sharply. However, before the US market on Friday, US and Burundian oil fell rapidly, both falling by more than 2% during the day. According to news, OPEC+ will gradually increase production as planned.

On the stock market side, Pinduoduo's stock price plummeted 28% in a single day, and fell more than 8% after Nvidia's earnings report. The pressure on technology stocks caused the NASDAQ to hit a two-week low; the strong performance of energy stocks boosted the Dow to a new high. European stocks surged, and the European Stoxx 600 Index hit a record intraday high.

Weekly calendar

1. The need for the Federal Reserve to cut interest rates by 50 basis points in September has decreased

Data on Friday showed that the US core PCE price index recorded an annual rate of 2.6% in July, maintaining a monthly rate of 0.2%, in line with expectations; the overall PCE recorded an annual rate of 2.5%, rising to 0.2% from 0.1% last month. Also, the monthly personal expenditure rate in July rose to 0.5% from 0.3% last month.

PCE's inflation performance is in line with expectations, and household spending remains stable, indicating that policymakers have so far been able to contain price pressure without causing much pain to consumers, that is, achieve a soft landing. Earlier data also showed that the revised annualized quarterly rate of US GDP for the second quarter was revised to 3%, indicating that the US economy is still resilient.

Most economists still believe that the Federal Reserve will refuse to cut interest rates by 50 basis points because the economy continues to grow strongly, and although inflation has slowed sharply, it is still above the 2% target. Atlanta Federal Reserve Chairman Bostic said this week that although inflation has declined, “there is still a big gap” from the Federal Reserve's 2% target.

San Francisco Federal Reserve Chairman Daly echoed Powell's view, saying that the time has come to cut interest rates, but it is still impossible to determine the exact path of monetary policy. It is too early to judge the September interest rate cut by 25 or 50 basis points; the inflation-adjusted neutral interest rate may reach 1%. Richmond Federal Reserve Chairman Barr said that there is still an upward risk of inflation, but as the labor market cools down, he supports interest rate cuts and hinted that the range is 25 basis points.

The minutes of the Federal Reserve's discounted rate meeting show that board members responsible for overseeing the Chicago and New York Federal Reserve voted in July to cut the discount rate by 25 basis points. In last month's vote, 10 of the 12 regional banks wanted to keep the discount rate at 5.5%, while the Chicago and New York Federal Reserve wanted to lower it to 5.25%.

2. Israel's Hamas temporary cease-fire for at least 9 days

Israel and Hamas have agreed to a temporary cease-fire to vaccinate children against polio (that is, the polio vaccine). The WHO says the cease-fire will have three vaccination regions, three times, each for three days, and the vaccination start date is September 1. The cease-fire will be from 6 a.m. to 3 p.m. The parties have agreed to extend the cease-fire in each region until the fourth day, if needed.

A senior WHO official also said that a second dose of the polio vaccine is required four weeks after the first dose. This could mean a longer cease-fire.

3. Eastern Libyan government halts oil production and exports

While OPEC+ is considering whether to start increasing production in October as originally planned, the authorities in eastern Libya shut down part of the oil production capacity and shut down all export terminals in the east due to two rival governments competing for central bank power. The agency estimates that the country stopped oil production of about 700,000 b/d, while oil production in July was about 1.18 million b/d. The analysis estimates that the scale of production stoppages may increase to 900,000 to 1 million b/d and continue for several weeks.

The country's central bank manages billions of dollars of oil revenue for two rival governments. Foreign media reported that the central bank governor had fled the country because he feared for his life safety.

Also, on Thursday evening, sources said that Iraq plans to cut oil production to 3.85 million to 3.9 million b/d in September to make up for the total 1.4 million b/d excess OPEC+ quota for the January-July period. Iraq also cancelled 1 million barrels of spot shipments in August to reduce exports.

4. The US Department of Labor admits a mistake in data disclosure!

On Wednesday, a US Department of Labor spokesperson said that the US government was unable to release key non-agricultural revised data in a timely manner last week due to a technical failure. At the same time, he acknowledged that staff provided these data to callers before the official announcement. In the future, the Bureau of Labor Statistics, which is supervised by the Ministry of Labor, will publish data through multiple platforms, including social media, to ensure that the data is available at the time of publication.

On August 21, local time, the Bureau of Labor Statistics released a preliminary benchmark revision for non-agricultural data delayed by more than half an hour, forcing staff to manually upload the data. The spokesperson said that due to a lack of communication within the bureau on how to respond to public inquiries, the problem became more complicated. After the 10-point ban passed, some employees provided information to those requesting data over the phone.

5. Central Bank: Buying 400 billion yuan of special treasury bonds from tier-1 traders

On August 29, 2024, the People's Bank of China carried out an open market cash buyout transaction using quantitative tenders to purchase 400 billion yuan of special treasury bonds from first-level open market traders. It should be noted that this central bank operation is in the “Open Market Business Transactions” section and is not an “open market treasury bond trading business” that is hotly discussed in the market.

6. Ministry of Housing and Construction's official media voiced: Housing pensions are not real estate tax, public accounts do not require ordinary people to pay

Recently, the topic of housing pensions has attracted widespread public attention. “Construction Magazine” published a press review article on its WeChat account on August 26, saying that the housing pension system has been seriously misinterpreted. Currently, 22 cities including Shanghai are piloting it. Personal accounts already have funds for special housing maintenance through payment. The focus of the pilot project is on the government to set up public accounts, and there is no need for ordinary people to pay money.

7. Rumor has it that relevant parties are considering further lowering interest rates on existing mortgages

On Friday afternoon, the real estate sector surged. According to market rumors, relevant parties are considering further lowering interest rates on stock mortgages to allow stock mortgages totaling 38 trillion yuan to seek remortgages. Stock mortgage customers can renegotiate mortgage interest rates with banks without having to wait until January next year. Residents can also directly transfer existing mortgage loans to other banks and sign contracts according to the latest interest rates. This will be the first time this operation known as a “mortgage transfer” will be permitted.

As of now, these rumors have not been officially confirmed, and it is unclear whether the New Deal will apply to all housing.

8. Russia launches large-scale missile and drone attacks on Ukraine

Russia launched large-scale missile and drone attacks on Ukraine this week. Huge explosions were heard in Udo and emergency power outages were implemented throughout the country. The water supply in parts of Kyiv was affected. The Ukrainian air force commander said that Russia's air strike on Ukraine on Monday was the largest since the Russian-Ukrainian conflict.

Zelensky said that Ukraine is preparing to respond to Russian attacks. Ukraine has also decided to further strengthen its forces on the eastern front in the Pokrovsk direction. Ukraine is reported to have achieved partial success in Russia's Kursk region. The situation on the Pokrovsk front line is grim, and Russia is trying to disrupt Ukraine's supply lines. Ukraine continues to advance in Russia's Kursk region and has now taken control of 100 settlements.

US Central Intelligence Agency Deputy Director Cohen said that the Ukrainian military plans to keep part of the occupied Russian territory for a period of time, and Putin will launch a counterattack, but it is expected that this will be a difficult battle for the Russian army, and Putin will have to deal with domestic challenges due to the loss of Russian territory.

9. Nvidia's revenue guidelines are difficult to adjust; at one point, it plummeted 8% after the market

The earnings report released by Nvidia this week showed that the second-quarter results were better than expected, but the revenue guidance fell short of the most optimistic market expectations, causing the market to worry that its explosive growth momentum is weakening. Its revenue for the third fiscal quarter is expected to reach around US$32.5 billion. Although analysts' average expectations were US$31.9 billion, the highest forecast was US$37.9 billion.

The company also said it is working to resolve production barriers for the highly anticipated next generation of Blackwell chips, and Nvidia acknowledged production issues and said it was making changes to increase its production. Meanwhile, the company said it expects the product to bring in “billions of dollars” in revenue in the fourth quarter.

10. After Pinduoduo's earnings report, the market value evaporated by 55 billion US dollars in a single day

The second-quarter earnings report released by Pinduoduo this week fell short of expectations, and executives were pessimistic about domestic e-commerce competition and global prospects, causing the company's stock price to plummet by more than 28%, the biggest one-day decline since listing in the US in 2018, and the market value evaporated by nearly 55 billion US dollars.

Chen Lei, co-CEO of the company, said he sees many new challenges in the future, including changes in consumer demand, increased competition, and uncertainty in the global environment. He also said that Pinduoduo will enter a new stage of high-quality development, requiring increased investment, and profitability will also be affected.

11. Iran's retaliation is late but it will arrive. The US says it will defend Israel

Iran's Deputy Defense Minister said that Israel has committed an unforgivable crime. As far as the present is concerned, the Israeli regime must continue to be in the midst of mental anxiety and panic. What is certain is that Iran's response will be unpredictable. The chief of general staff of Iran's armed forces also said that there will definitely be a planned response to the assassination of Hania.

A US Department of Defense spokesman said the threat of attacks on Israel by Iran and its proxies still exists. US National Security Council spokesman Kirby said that Iran is “ready to launch an attack on Israel at any time”; if Iran launches an attack, the US will defend Israel.

12. Berkshire Hathaway Joins 'Trillion-Dollar Club'

On Wednesday, Buffett's Berkshire Hathaway surpassed $1 trillion in market capitalization and joined the “trillion dollar club” made up of six other companies: Apple, Nvidia, Microsoft, Google, Amazon, and Meta. Berkshire Hathaway is the only non-tech company among them.

13. National Health Insurance Administration: Financial allowances and individual contribution standards increased by 30 yuan and 20 yuan respectively over the previous year

The National Health Insurance Administration, the Ministry of Finance, and the State Administration of Taxation issued a notice on completing the work related to basic medical insurance for urban and rural residents in 2024, making it clear that in 2024, all levels of finance will continue to increase subsidies for residents' health insurance contributions. At the same time, the increase in individual residents' contributions will be reduced appropriately. Financial allowances and individual payment standards will increase by 30 yuan and 20 yuan respectively over the previous year, and not less than 670 yuan and 400 yuan per person per year, respectively. This is the first time since 2016 that the new personal payment standard has fallen below the financial subsidy standard.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal