Selling Cash-Secured Puts for Income: Put Your Idle Cash to Work!

Whether you realize it or not, you may already be a "put buyer" in a broad sense. The most common case is buying car insurance from an insurance company to protect against losses. In a cash-secured put strategy, you are acting in the role of the insurer—collecting premiums as income as a put seller, and taking on the risk of buying the underlying security if the price goes below the strike price.

Learn More: Introduction to Covered Calls and Cash Secured Puts

Here, we will explain how to generate additional income on the cash holdings with the cash-secured put strategy.

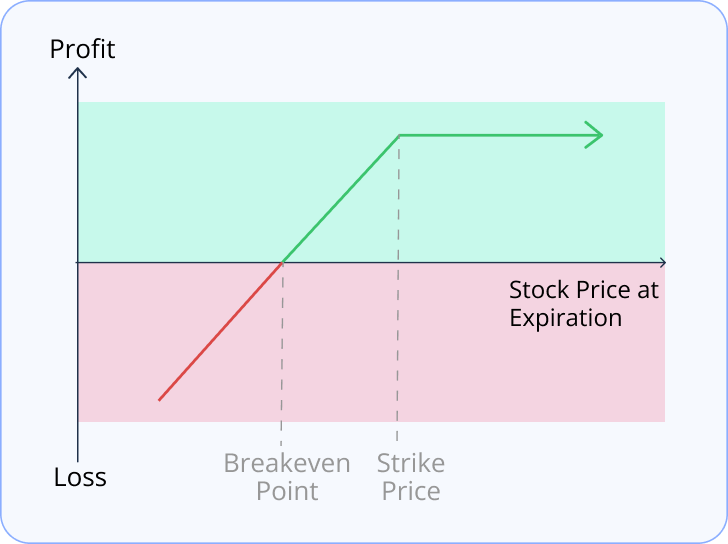

Risk and Reward Profile

When doing research on the cash-secured put strategy, you’ll likely see a graph like the one below, which shows the profit/loss analysis at the expiration date for a put contract. The chart provides a straightforward way to see how much money you might earn or lose. To help you better understand the strategy, let's explore the detailed risk and return profile in the example below.

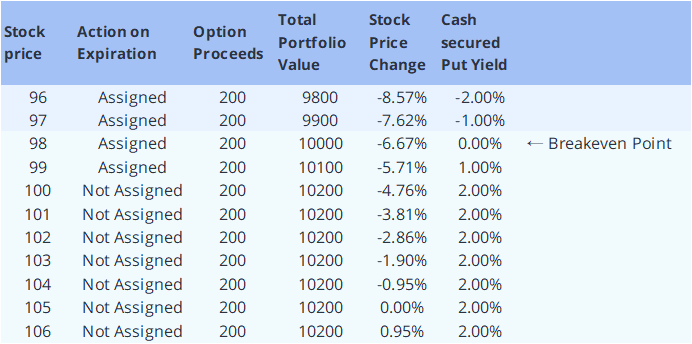

Suppose James holds $10,000 of unused cash and has no intention to invest in any asset until next month. After some research, he is slightly bullish on ABC stock, which is currently trading at $105. James decides to try using a cash-secured put strategy to generate returns on his idle cash. He sells one $100 16 Sep 22 Put contract at a premium of $2.00 with 26 days until expiration. His $10,000 cash balance is set aside as collateral. Here’s how his Portfolio is affected by the strategy at several different stock prices on the expiration date.

If the Put is not assigned, the portfolio value is calculated by taking the existing cash balance and adding the premium proceeds.

If it is assigned, James, as the put seller, will buy 100 ABC shares at the strike price of $100. The portfolio value would be calculated as the market value of 100 ABC shares plus the $200 premium received at the beginning.

Read More: Why Should Investors Consider Covered Calls and Cash Secured Puts?

Now, we have a much clearer picture of how the sold put contract works for James:

- Suppose James has no intention of owning ABC shares. In that case, the best scenario for him is that the put option expires worthless and is never assigned. In that case, he can keep the full premium of $200, an effective yield of 2% on his $10,000 cash in 26 days.

- If the put is assigned, he can still net a positive cash inflow as long as the stock price doesn't drop below the breakeven price. The breakeven price is calculated by strike price minus the premium (in our example, $100 - $2 = $98). A $1 reduction in the share price against a $2 premium still results in a $1 per share gain for James.

- Suppose the stock price is below the breakeven point before expiration. In that case, James will start losing money because the premium received can't offset the loss on the sold put. To avoid owning the ABC shares, James can exit his short put position before expiration by making a closing purchase. To do this, he would buy back the same contract he sold, likely realizing some loss due to paying a higher premium than he collected, but hopefully less than the loss he’d incur due to assignment.

More About the Strategy

So far, we’ve described the benefits of the Cash Secured Put Option Strategy —when the stock price is steady or increasing, it provides an active, income-generating alternative to letting your cash sit idle. In some cases, the premiums generated by this strategy can potentially exceed Dividend income from the stock itself. Some investors repeatedly sell cash-secured puts on the same underlying security, and over time they can collect premiums that even exceed the actual value of the stock.

But as with any strategy, investors should be aware of the downsides. When you are wrong about the stock price movement, you can suffer a potential loss on your principle. Moreover, option premiums can be taxed as ordinary (short-term) income if the put option is not exercised and expires worthless. It's best to consult with a tax advisor if you’re considering a new investment strategy.

After becoming more familiar with the cash-secured puts, you may find them useful as a stock acquisition strategy. With an appropriate selection of strike and expiration, investors can effectively buy stocks below their current trading price. In one famous story, Berkshire Hathaway founder Warren Buffet sold tens of thousands of put options on Coca-Cola, collecting millions of dollars in premiums, which effectively reduced the total amount he had to lay out to buy shares in the company.

See Also: Trading Cash Secured Put on Paper Trading

Next Steps

Explore our Seller Center, which features our new options screening tool, the Put Seller Tool.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal