GDP and the Stock Market

What is Gross Domestic Product?

Gross Domestic Product (GDP) is a measure of the total economic output of a country. It is measured each quarter and each year.

For example, the advanced GDP estimate for the last quarter and the previous year is released at the end of January. Second and third estimates usually follow in the months right after the advanced estimate.

Click to go to the economics calendar on Webull.

There are several different measures of GDP that can be used to assess a country's economic performance.

- Nominal GDP reflects the total value of goods and services produced in a country, using current market prices.

- Real GDP adjusts for inflation, so it provides a more accurate representation of the volume of goods and services produced over time.

- GDP per capita divides the total value of goods and services produced in a country by the total population, providing an indication of the average income or standard of living in a country.

The GDP is represented as a percentage. It shows the rate of change from the previous quarter or year. For example, the real GDP for the 3rdquarter of 2022 is 3.2%, meaning that it has increased at an annual rate of 3.2% compared to the 2nd quarter. The real GPD for year 2021 is 5.7%, meaning that it has increased by 5.7% compared to year 2020.

GDP and the stock market

The release of GDP data is highly anticipated by investors, policymakers, and the general public. A strong GDP may lead to an increase in investor confidence, which can result in a rise in stock prices. On the other hand, a weak, or even negative GDP may lead to a decrease in investor confidence and a decline in stock prices.

Importantly, two consecutive negative GDP is often considered an indicator of future recessions. However, other factors, such as the unemployment rate, must be taken into consideration as well.

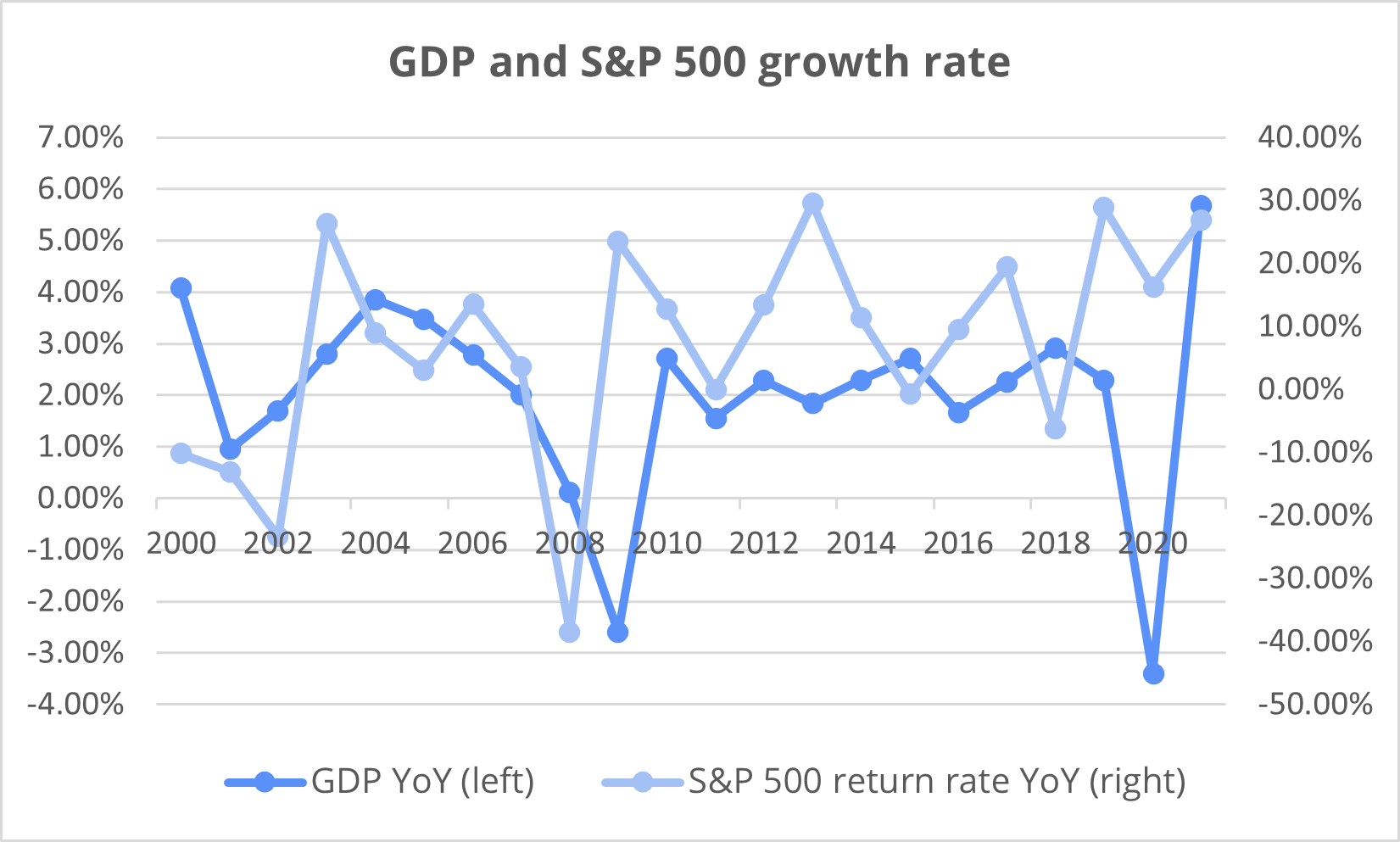

The chart below shows the annual GDP and S&P500 index return rate from 2000 to 2021. In general, the two parameters go hand in hand despite a few divergences.

GDP can also have significant implications for monetary and fiscal policy, which in turn affect the stock market. In a time of rising inflation, a weak GDP may cause policymakers to slow the tapering pace. On the other hand, a strong GDP accompanied by rising inflation may lead to interest rates hike. Therefore, during times of inflation, the impact of GDP release on the stock market can be mixed.

How do investors adjust investments according to GDP releases?

To a great extent, GDP gives implications about where the stock market is heading next.

In response to strong GDP releases, stock investors may consider increasing their positions in sectors that are expected to benefit from economic growth, such as technology or consumer discretionary.

On the other hand, in response to a weak, or even negative GDP, investors may consider shifting their investments to defensive sectors, such as utilities or healthcare, which tend to perform well during economic downturns. They may also choose to take advantage of market declines to buy quality stocks at a discount.

It’s worth noting that like other economic indicators, the GDP estimate is given before the official figure comes out. If the release beats the estimate and the market outlook is positive, it’s possible that major indexes may go up.

The bottom line

GDP measures the overall health of the economy and implies where the stock market is heading. A strong GDP indicates a strong economy and may imply a positive market outlook. A weak or negative GDP indicates slow economic growth and may be a warning of recession.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal