Holding Options Positions Until the Last Minute

When holding options positions, you may have personally experienced how volatile they can be. In the final days leading up to expiration, their value can change drastically in either direction. Sometimes this effect can be beneficial, but sometimes it can quickly wipe out gains or increase losses.

Since the options market moves fast, flexible and prompt position management is key to a successful trade. Some basic understanding of Greeks will help you understand what happens to your position as expiration approaches.

Theta Risk

Each option contract has an ending date, when its time value reaches zero. Every day between the issuing of the option and it’s expiration, the time value is lower than the day before. This is called “time decay,” and it makes all options depreciating assets, regardless of their intrinsic value. Time decay works against option buyers, and in favor of option sellers.

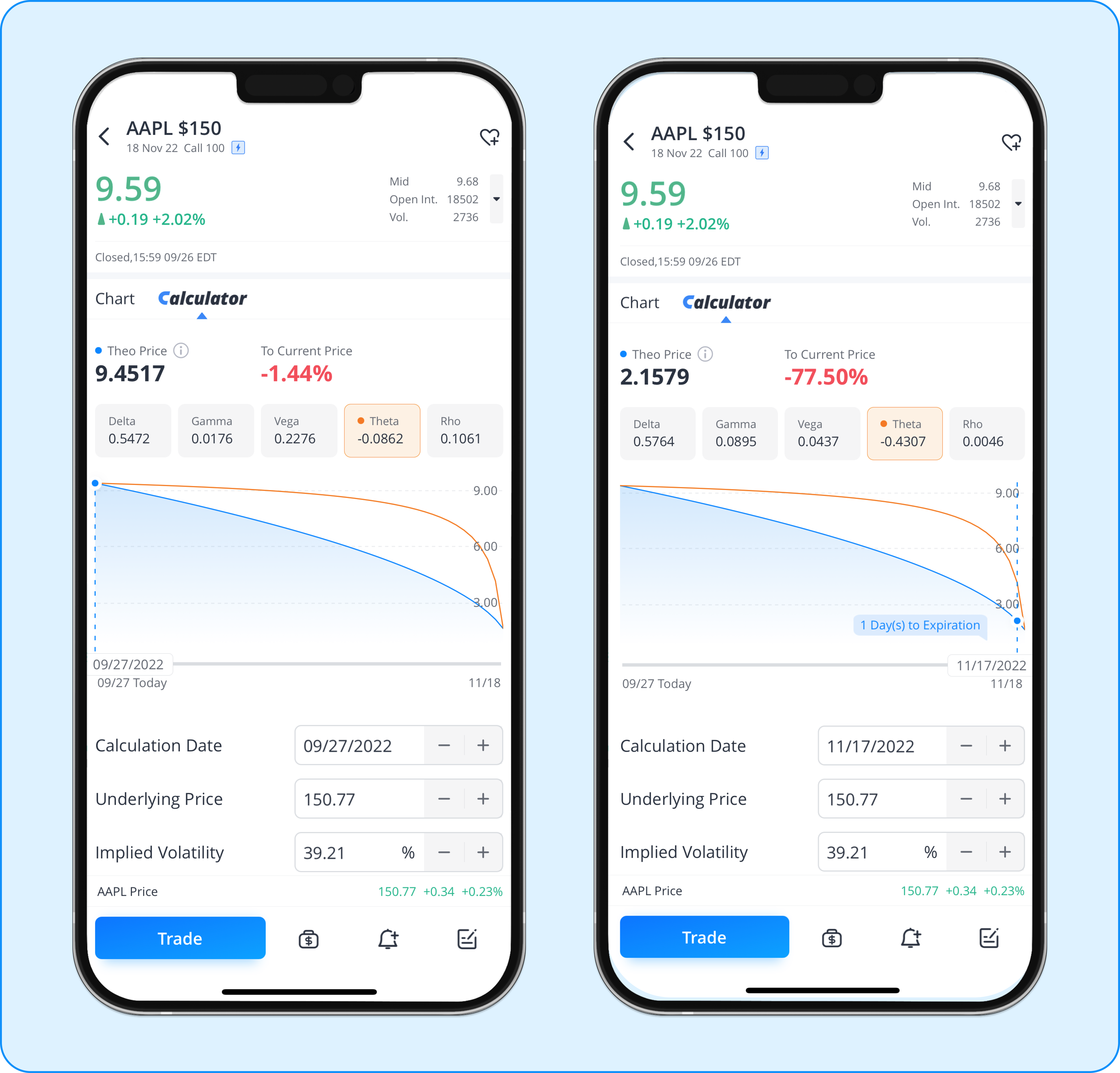

The Greek letter ‘Theta’ is used to denote the theoretical rate of time decay, or the decrease in the value of an option as time passes. When you assess an options contract through the options chain, the theta value displayed tells you the approximate rate of change in the option's value as one day passes. The options calculator can show how theta reacts as expiration approaches.

Example: The AAPL $150 18 Nov 22 Call is currently in ATM status with 52 days until the expiration

The rate of decay speeds up as an option gets closer to expiration, with the absolute theta value increasing. This is denoted by the orange curve on the graphs above. You can see how steep the curve becomes on the right tail. If you decide to hold a long option position to expiration, you need to judge whether you can bear the accelerating loss of the option's time value. If you don't want to take the high theta risk, you may choose to realize your gains/losses and exit the current long position by a closing sale or a rolling-out order.

By contrast, the best scenario for options sellers is for their sold options to expire worthless, letting them keep the entire premium. But this doesn't mean the seller should do nothing about their short options. There is another kind of risk that options sellers should be mindful of as expiration nears, called Gamma risk.

Gamma Risk

Gamma refers to the rate of change in an option's Delta value relative to a change in the underlying security price. Delta itself already refers to a rate of change, specifically the change in the price of an option relative to the change in the value of its underlying security. For instance, if an option has a Delta of .25 and the value of the underlying security increases by $1 per share, the premium on the option in question will increase by 25 cents. But Delta is not static, and the next dollar increase in the underlying may increase the premium by 30 cents, or 35 cents, instead of 25. This difference in Delta from one $1 increase to the next is the value described by Gamma, and like the other values we’ve explored, it too is time-sensitive.

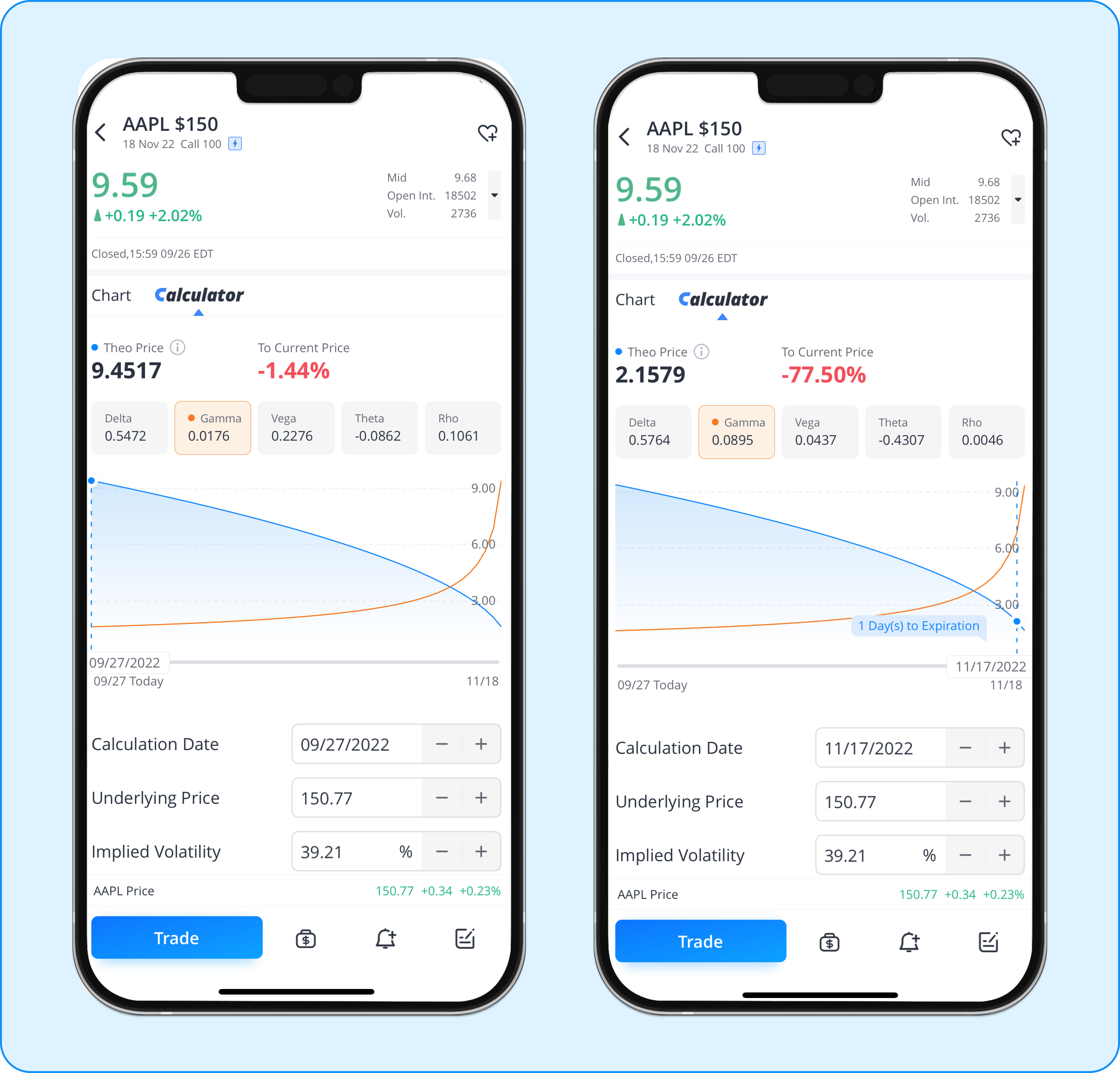

Let's see the gamma change as the AAPL $150 18 Nov 22 Call approaches expiration.

All other things being equal, gamma at expiration is over five times greater than on 09/27.

- Higher Gamma values indicate that the Delta could change dramatically with even tiny price changes in the underlying security, which ultimately lead to dramatic price swings.

- In such cases, a short option position can rapidly move from profit into loss as the option price surges.

- Closing options positions before expiration can effectively help options sellers avoid major losses and reduce the potential high gamma risk.

For options buyers, the higher gamma works in their favor, as higher gamma means that options gain value at a faster rate and lose value at a slower rate. For this reason, some investors use a strategy of consistently betting on near-term ATM options to take advantage of high gamma value.

Bottom Line

Time is a key factor in managing your options positions. Changes in Theta and Gamma will affect your portfolio as expiration nears, and understanding how will make you a smarter, safer investor.

Want to put your newfound knowledge to the test? Try out paper trading on our latest mobile version>>>

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal