Open an Options Position Using Stop Orders

Introduction

Options trading is volatile, and trading opportunities can vanish in a flash, so it’s important to monitor changes in the market. Stop-limit and stop-market orders can help you when monitoring price trends, and let you place orders automatically when the price target is reached.

Key Takeaways

- How do stop limit orders work for options buyers?

- How do stop market orders work for options buyers?

What are Stop Market and Stop Limit Orders?

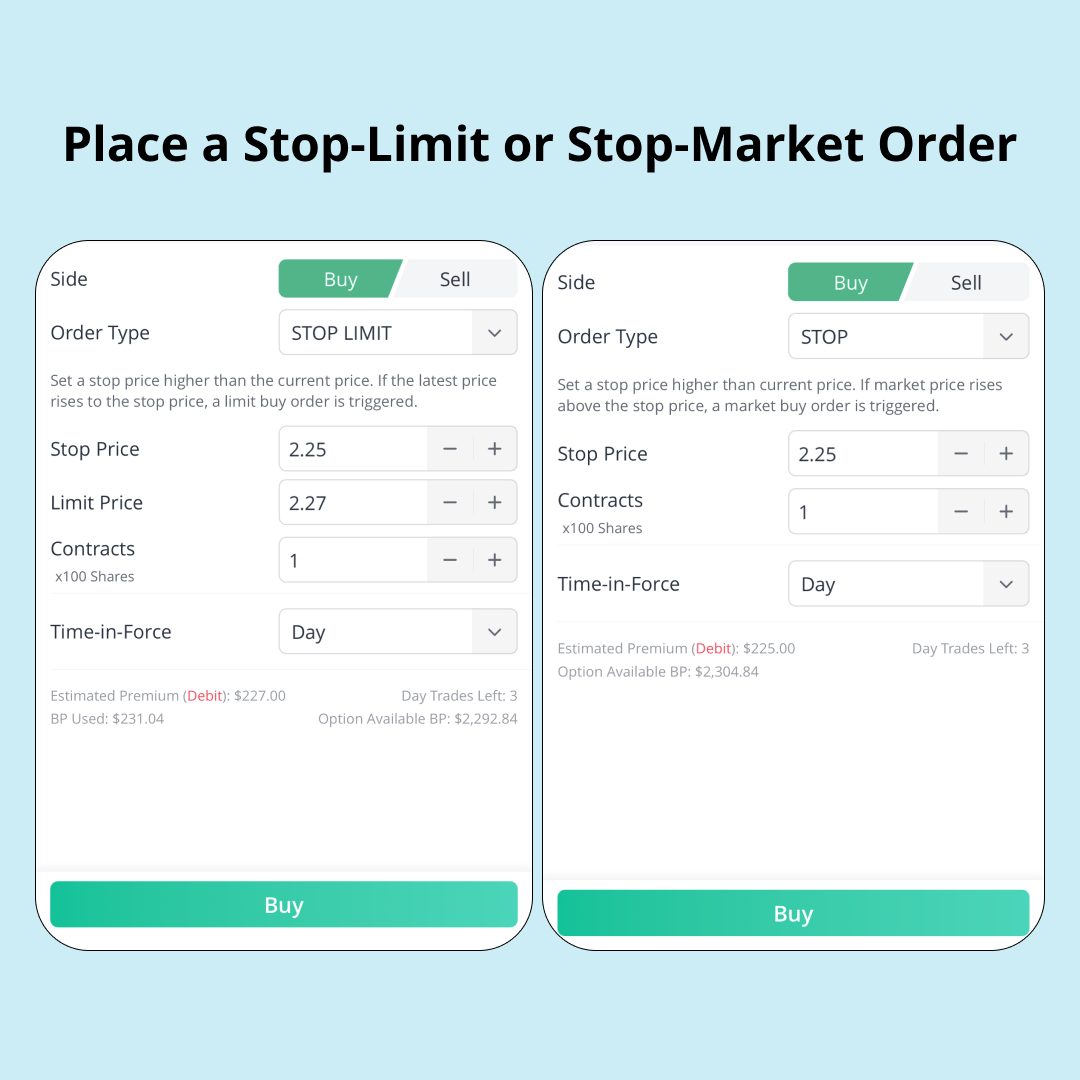

- Stop limit order

Stop limit orders allow you to enter two prices: a stop price and a limit price. The order is triggered when the contract has traded at or through the stop price, and then becomes a limit order which will trigger at the limit price, if and when that price is reached.

- Stop market order

A stop market order, also called stop order or stop-loss order, is like a stop limit order, except that the order is changed to a market order upon being triggered.

Trading Scenarios

Suppose you are bullish about XYZ stock, which is currently moving sideways. You plan to bet on a future upside movement of XYZ by opening a call position. However, an early long call position will lose value due to the time decay effect, which may outweigh any benefit of holding the position if the stock price doesn't move upward. In a case like this, the stop limit order type can be helpful, allowing you to open an option position at an acceptable price of your choosing.

Example:

The XYZ $150 25 Nov 22 Call is currently trading at $2.00 with ten days until the expiration date.

- How does the stop limit order work for opening an options position?

Suppose you want to buy the XYZ call contract when the price has reached $4.00, and you are willing to pay $6.00 at most. You can place a buy order as a stop limit order, with a stop price of $4.00 and a limit price of $6.00. Your order will be triggered only when the contract price hits $4.00 or above, and will filled at $6.00 or below.

The stop limit order protects you from missing trading opportunities and allows you to buy a contract in an acceptable price range.

- How does the stop market order work for opening an options position?

You set the stop price at $4.00. The stop order will be triggered when the contract price reaches $4.00 and becomes a market order, which executes automatically at the best available price. The specific price of a market order cannot be guaranteed.

If you want the order to be filled quickly when the price reaches $4.00, the stop order is more suitable than the stop limit order, although it entails the risk of filling at a worse price.

Want to Take the Next Step?

Stop limit and stop market orders help you monitor contract price trends, and place your trades in a timely fashion, as long as the target price is reached. Click here to learn how to use the two orders to protect your current options positions!

Disclaimer Regarding Buy/Sell Limit, Stop Loss, Sell Stop, and Stop Limit Orders:

Due to fast-moving markets, market volatility, and illiquid markets, take profit and stop loss orders may not execute in it's entirety or at all. In these instances, the stock price may skip over the set price and leave the order unexecuted or may execute at prices which are substantially different than expected.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal