How Do You Trade an Earnings Report?

How does earnings season generate trading opportunities?

Earnings season is the time when most public companies announce quarterly earnings. It usually starts two weeks following the end of each quarter.

Earnings can rapidly change market sentiment, causing volatile price swings within a short period of time. This is a time when short-term investors take advantage of the drastic price movements to make profits. Long-term investors may reevaluate and adjust their portfolios based on an analysis of the earnings.

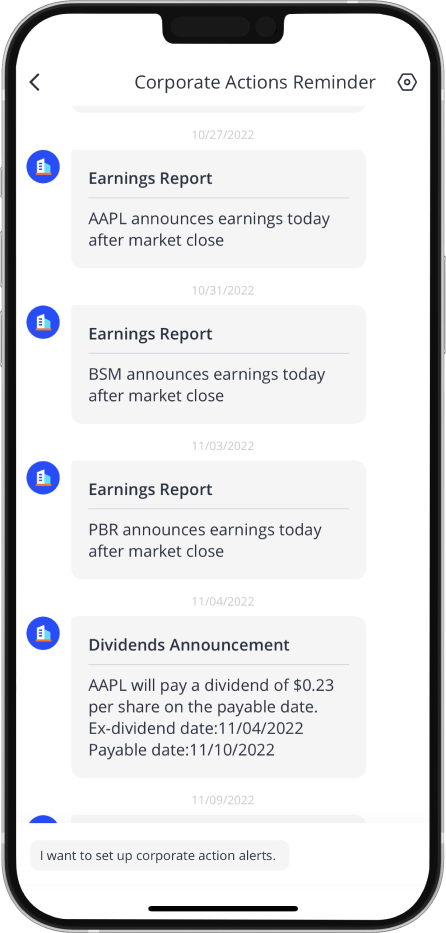

To trade the earnings, investors must first know when the earnings announcement is scheduled. Tap here to see the earnings calendar on the Webull App. Or, enable the Corporate Actions Reminder in the message center to receive alerts.

*Note: Earnings announcement dates are subject to change. A company may change its earnings announcement date anytime.

Trading earnings over the short term

1. Choose what stocks to trade

Hundreds of companies release their earnings during earnings season, but not all of them will experience drastic price movements. Investors can refer to previous price movements following each earnings release to choose which stocks to trade. (Learn about the Webull earnings calendar)

2. Do your research

One common way for investors to prepare for the earnings season is knowing what is expected of the stock they’ll be trading. If the actual EPS and revenue beat estimates, the price is likely to rise. On the contrary, if the numbers miss estimates, the price will probably fall.

3. Make a forecast on the price direction and enter a trade

Based on the information you gathered, you need to forecast whether the earnings will be lower or higher than the estimate, and thus determine the direction of your trade.

If you expect earnings to beat expectations, you can buy the shares before the earnings are announced.

4. Protect your trade

Since your prediction could be either right or wrong, you need to protect your trade to lock in profits and limit losses.

During extended hours trading, only limit orders can be executed.

Let’s say you expect Stock A to beat estimates and jump to $260 following the announcement. You buy 10 shares at $240 per share beforehand and place a limit order to sell the shares at $260. Since a limit order cannot protect you from losses, you set a price alert. If the price tumbles $5 instead, you’ll receive the alert immediately.

Trading earnings over the long term

As a long-term investor, you may not be as concerned with short-term fluctuations in the market as short-term investors would be. Instead, you may be more focused on the long-term prospects of the companies you have invested in.

1. Compare the actual earnings with your expectations

If you’re holding a stock for the long term, you may expect stable growth in its earnings. For example, you may expect a 25% YoY increase in total revenue. If the company's earnings are significantly worse than expected, you need to find the reasons behind the disappointing results. If you find that the company's long-term prospects have changed, you may consider slowly scaling out.

On the other hand, if the earnings are above your expectations, you may consider slowly increasing your existing position size.

2. Compare the actual EPS with that of others in the industry

The performance of individual companies is impacted by the overall market. In a bearish market, the growth rates of most companies tend to slow down. So, it might not be sufficient to decide based solely on the growth rate.

You can also compare the EPS of different companies in the same industry to measure the profitability. The higher the ranking, the better the profitability.

If the earnings have fallen far below your expectations and the company ranks low in profitability, you might choose a time to trim or exit the position.

Investors can see the TTM EPS (12-M trailing EPS) rank of a company by clicking Company>Financials on Webull.

The Bottom Line

Short-term investors can make profits from earnings announcements if they’re right about where the price is heading. However, they must understand the risks involved and protect their trade.

Long-term investors can analyze earnings to evaluate the health of their portfolio and make adjustments where needed. But, they should avoid over-correcting investments impacted by short-term price fluctuations.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal