What is Factor Investing?

Key Considerations in Factor Investing

The factors in factor investing are generally grouped into two categories: macro factors and style factors.

Macro Factors

These are broad economic forces that influence asset returns across various markets:

Economic Growth: Securities that perform well in growing economies.

Inflation: Assets like commodities or inflation-protected bonds that hedge against rising prices.

Interest Rates: Investments sensitive to changes in interest rates, such as bonds.

Volatility: Securities that provide stability during market turbulence, such as low-volatility stocks.

Style Factors

These are specific characteristics of individual securities and companies to consider:

Value: Stocks trading at a lower price relative to their fundamentals (e.g., low price-to-earnings or price-to-book ratios).

Size: Smaller companies, which often outperform larger ones over time.

Momentum: Stocks with strong recent performance thatwould tend to continue outperforming.

Quality: Companies with strong financial metrics, such as high profitability and low debt.

Low Volatility: Stocks that exhibit smaller price swings compared to the broader market.

How Factor Investing Works

Identify Relevant Factors: Investors choose factors based on their objectives, such as maximizing returns, reducing risk, or diversifying portfolios.

Screen Securities: Analyze assets to identify those that exhibit the desired attributes that you are looking for. You can research financial ratios to find value stocks or analyze past performance to identify momentum stocks.

Build Your Portfolio: Construct a portfolio that prioritizes exposure to the selected factors. Using factor-based ETFs can simplify this process, as well as provide diversification and professional management at a low cost.

Monitor and Rebalance: Regularly assess your portfolio to ensure it maintains targeted factor exposures as market conditions and asset characteristics change.

Benefits of Factor Investing

Potential for Outperformance: By focusing on factors that historically drive returns, investors can aim to outperform broad market indices.

Risk Management: Targeting factors like low volatility or quality can help reduce portfolio risk during market downturns.

Enhanced Diversification: Factor investing provides diversification beyond traditional asset classes, as factors often behave differently in varying market environments.

Evidence-Based Approach: Factor investing is supported by decades of academic research, lending credibility to its principles.

Risks of Factor Investing

Underperformance: Factors do not always outperform the markets, so there can be extended periods of underperformance that can test investors' patience.

Overcrowding: If many investors target the same factors, the competition may reduce their effectiveness.

Complexity: Identifying, analyzing, and combining factors requires significant expertise and data analysis, so this method is more suitable for investors who have the time and resources to give it the attention it needs.

Factor Timing: It’s challenging to predict when a particular factor will outperform, making the market timing aspect very difficult.

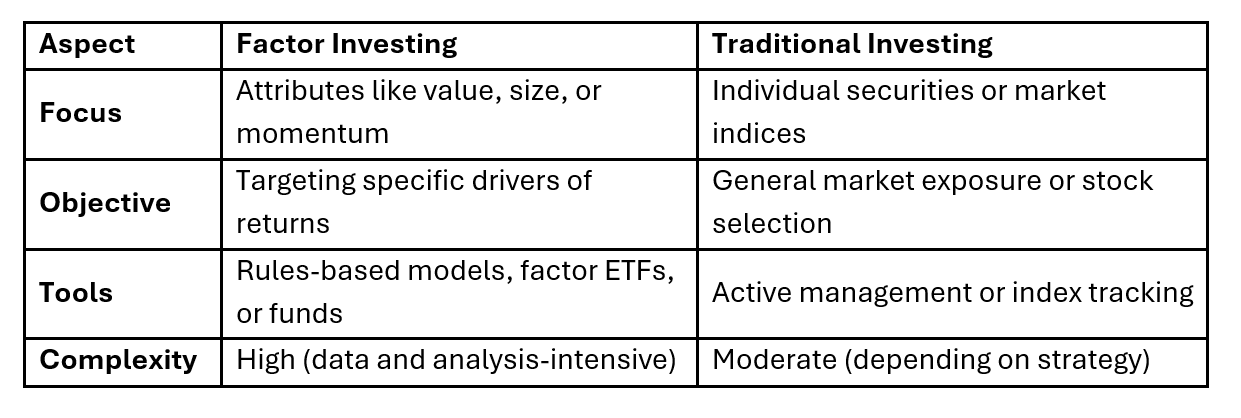

Factor Investing vs. Traditional Investing

Is Factor Investing Right for You?

Factor investing may not be suitable for those unfamiliar with complex financial strategies or investors who prefer simpler, traditional approaches. Factor investing is more suitable for:

Long-term investors who are seeking market-beating returns while remaining patient.

Risk-conscious investors looking to reduce portfolio volatility.

Experienced investors comfortable with quantitative strategies.

The Bottom Line

Factor investing bridges the gap between passive and active investing by leveraging data and research to target specific drivers of returns. While it requires a more detailed understanding of the market, its potential for positive risk-adjusted returns makes it an attractive strategy for those willing to dive deeper into analyzing individual stocks. With the right approach, factor investing can be part of building a robust, future-focused portfolio.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal