Navigating Changing Interest Rates

Certain fixed-income products, particularly ETFs with multi-sector investment strategies, are designed not just to weather changes in interest rates, but to perform well in various market conditions. Webull can provide the resources to help you choose investments that align with your needs, ensuring you maintain your standard of living even in a changing rate environment.

How Interest Rates Affect Bond Prices

Historically, interest rates and bond prices have an inverse relationship—when interest rates change, bond prices move in the opposite direction. If rates are fluctuating, it may be a good time to reassess your fixed-income investments to ensure they are positioned to effectively handle a shifting rate environment.

As interest rates rise and fall, longer-term bonds (which typically offer higher yields) tend to experience greater price fluctuations, while shorter-term bonds (with lower yields) tend to be less volatile.

Focusing on Duration

Duration measures the expected percentage change in a bond's price in response to a 1% change in interest rates. The longer a bond's duration, the more sensitive it is to changes in interest rates.

Two key factors influence a bond's duration:

Coupon rate: Bonds with higher coupon rates typically have a lower duration. If two similar bonds have different coupon rates, the one with the higher coupon will recoup its initial cost faster than the one with the lower yield.

Time to maturity: Bonds with longer maturities are more sensitive to interest rate changes. For instance, a bond maturing in one year will recover its cost sooner than one maturing in 10 years. Consequently, bonds with shorter maturities have lower duration and carry less price risk.

How Much Can Interest Rate Changes Impact My Investments?

If a bond has a duration of 10 years and interest rates increase by 1%, then that bond's price would be expected to decline by approximately 10%. If interest rates were to decline by 1%, the bond's price would be expected to increase approximately 10%. To reduce price fluctuations, investors often shorten their duration exposure to limit sensitivity to rate changes. However, if your portfolio meets your income needs and aligns with your risk tolerance, adjustments may not be necessary.

Strategies in Different Rate Environments

Rising Interest Rates

When interest rates rise, bond investors can earn more interest on newly purchased bonds, but the market value of their existing bonds will decrease. If interest rates increase gradually over several years, the impact may be less noticeable, as the higher interest payments can help balance out the decline in the bond's value. However, when rates rise quickly, the decrease in the bond's principal value tends to outweigh the additional interest income, making the effect more painful for investors.

Buying bonds when interest rates are at or near their peak can be a potential strategy for capital appreciation, as the market value of existing bonds is likely to rise when rates decrease. Alternatively, you might consider investing in an actively managed bond ETF, allowing professional money managers to handle navigating shifting interest rates.

Another approach is to combine short- to medium-term bonds with other types of bond ETFs, like floating-rate debt (such as bank loans) and ETFs that invest in Treasury Inflation-Protected Securities (TIPS). Both bond types have adjustable interest rates, which are less sensitive to rising interest rates than fixed rate vehicles.

For investors who still maintain a larger stock allocation within their portfolios, there are areas of focus. Dividend-paying stocks are compelling for investors seeking income in times of rising interest rates. Companies that regularly pay dividends tend to have stable cash flow and strong financial health. Investors can focus on companies with a track record of increasing dividends over time, as they offer the potential for both steady income and capital appreciation.

Companies with solid quality and fundamentals can also be a focus during a rising rate environment. Companies that have strong balance sheets, a solid growth outlook, and competitive advantages within their industry are generally more stable in uncertain economic conditions. Speculative investments, or companies with high levels of debt would be more exposed to interest rate volatility and economic challenges.

Falling Interest Rates

For those seeking opportunities, rate cuts could benefit actively managed investment-grade bond ETFs and provide continued potential for those looking for attractive yields on individual bonds. Bond prices and yields move in opposite directions, so when interest rates decrease, the price of existing bonds generally rises, rewarding investors. However, for investors with the resources to build diversified portfolios of individual bonds, it’s important to note that a series of gradual rate cuts could eventually reduce the yields of available bonds.

If economic data deteriorates, the Federal Reserve may opt for more aggressive rate cuts to stave off a potential recession. In this case, US Treasury bonds could become an attractive strategy for navigating a slowdown.

Despite rising government debt, US Treasuries remain among the least risky investment options, and investors are likely to continue turning to them in times of economic uncertainty. In times of economic contraction, Treasuries have historically performed well. Some believe Treasuries could outperform corporate bonds—and stocks—during a recession.

If the economy avoids a recession, Treasuries may not outperform other bonds or stocks, but they could still offer a low-risk option to access attractive yields.

Historically, rate cuts have generally been positive for the stock market, regardless of whether the economy is in a recession. Although stocks often underperform leading up to the first rate cut during a recession, they tend to outperform in the 12 months following the initial rate reduction, in both recessionary and non-recessionary conditions.

Rate cuts might provide an even greater boost to small-cap companies. Smaller businesses typically carry more debt than larger ones, meaning they have been hit harder by higher interest rates and may benefit more from rate relief. Additionally, small and mid-sized companies have been out of favor with investors, leading to a significant valuation gap between large-cap and smaller companies, a gap that has rarely been so wide. Rate cuts could act as a catalyst for smaller companies to regain investor interest.

Bond Ladders

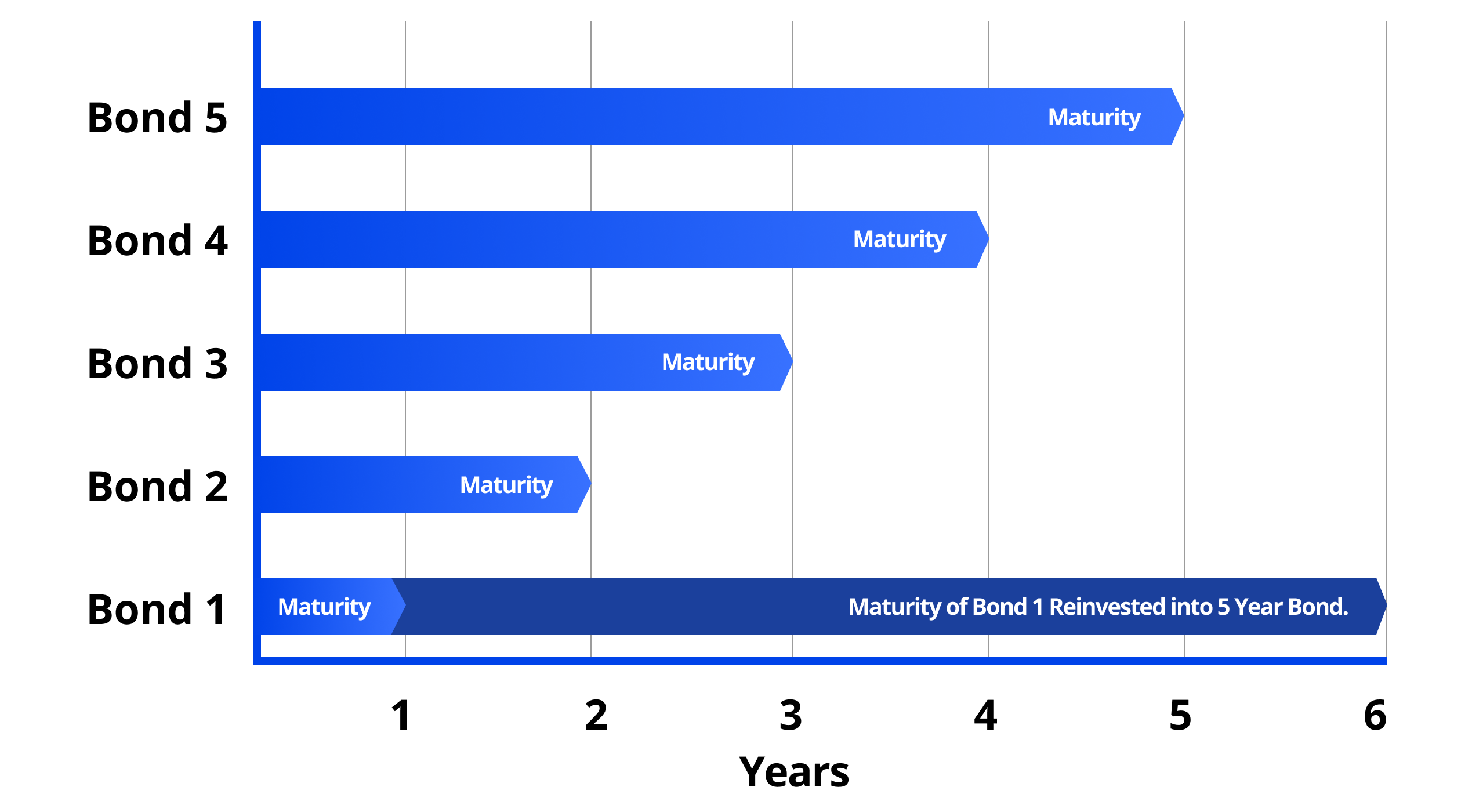

One popular & effective strategy to mitigate interest rate risk is by investing in a bond ladder, which is a portfolio of individual bonds or bond ETFs with maturities spread out evenly into "rungs". "For example, a 1–5-year bond ladder would typically be invested 20% each into bonds maturing in 1, 2, 3, 4, and 5 years from now.

If you don't know which way interest rates are headed or don't want to speculate either way, this is a great strategy because after the 1st bond comes due, you'll now have bonds maturing between 1-4 years left, so you reinvest the money that came due in a new 5 year bond in order to keep the ladder intact.

So, if interest rates go up, you will have some money coming due soon so you can take advantage of the higher rates. If rates go down, you will be happy you have those longer-term bonds in the portfolio whose market value increased.

Bond ladders can be constructed with any time frame you see fit. The example above uses 1-5 years, but other examples might be a 1-10-, 5-15-, or 3–7-year ladder. The shorter the average maturity is, the better off you will be if rates go up. The longer the average maturity is, the better off you will be if rates go down. The more maturities you have, the more diversified your portfolio would be.

Stay Informed and Adjust

It is important to regularly review your investment portfolio. If economic conditions, or your financial goals change, you can make the necessary adjustments to your portfolio allocation. As interest rates fluctuate, certain asset classes may outperform others, so rebalancing your portfolio might be necessary to maintain the appropriate allocation that aligns with your long-term objectives.

Financial markets can be volatile during periods of rising interest rates, so stay informed about new economic developments and market trends. However, it’s equally important to avoid reacting impulsively to short-term market fluctuations. Keep a long-term perspective on your investments and try to remain calm during market turbulence. Avoid panic selling or making drastic changes to your portfolio in response to short-term market movements, as this can harm your overall financial strategy.

Head to Webull Learn to continue your education on Stocks, ETFs, Bonds and more! Webull is committed to improving your financial education so you can make informed decisions in your portfolio.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal