How to Trade Sports Events

Trading sports event contracts involves buying or selling contracts based on market-determined probabilities of specific sports-related outcomes. Prices fluctuate based on supply and demand and reflect how market participants collectively assess the likelihood of an event.

Sports event contracts allow participants to trade on clearly defined outcomes, rather than wagering against a bookmaker. Contract prices may change over time as new information becomes available and as market conditions evolve.

This guide provides an overview of how to trade sports event contracts, including:

- Understanding the structure of an Event Contract

- Selecting an available contract based on the underlying outcome

- Placing orders and monitoring open positions

- Closing or holding a position through contract settlement

Trading in Event Contracts involves risk and may not be suitable for all investors. Please review all applicable disclosures before trading.

1. What You’re Really Trading

Sports Event Contracts are Cleared Swap contracts and function in the same manner as other cleared Event Contract markets.

Each Sports Event Contract has a defined settlement structure:

- The contract settles at $1.00 if the specified event outcome occurs.

- The contract settles at $0.00 if the specified event outcome does not occur.

The trading price (for example, $0.42) represents the market-determined value of the $1.00 settlement outcome at that time.

Prices fluctuate based on supply and demand and reflect the market’s collective assessment of the likelihood of the underlying event outcome.

Participants are trading market-implied probabilities, which may change as market conditions evolve or new information becomes available. Trading does not guarantee profit and involves risk.

2. Choose a Contract

Once you understand what sports event contracts represent, the next step is choosing which type of contract best matches your view.

Different contracts answer different questions—and attract different trading strategies.

2.1 Single-Game Contracts

Single-game contracts focus on the outcome of one match. They are often the most intuitive place to start.

Game Winner

Question being traded: Will Team A win the game?

Common use cases:

- You have a strong directional view on the winner

- You want a clean, binary decision

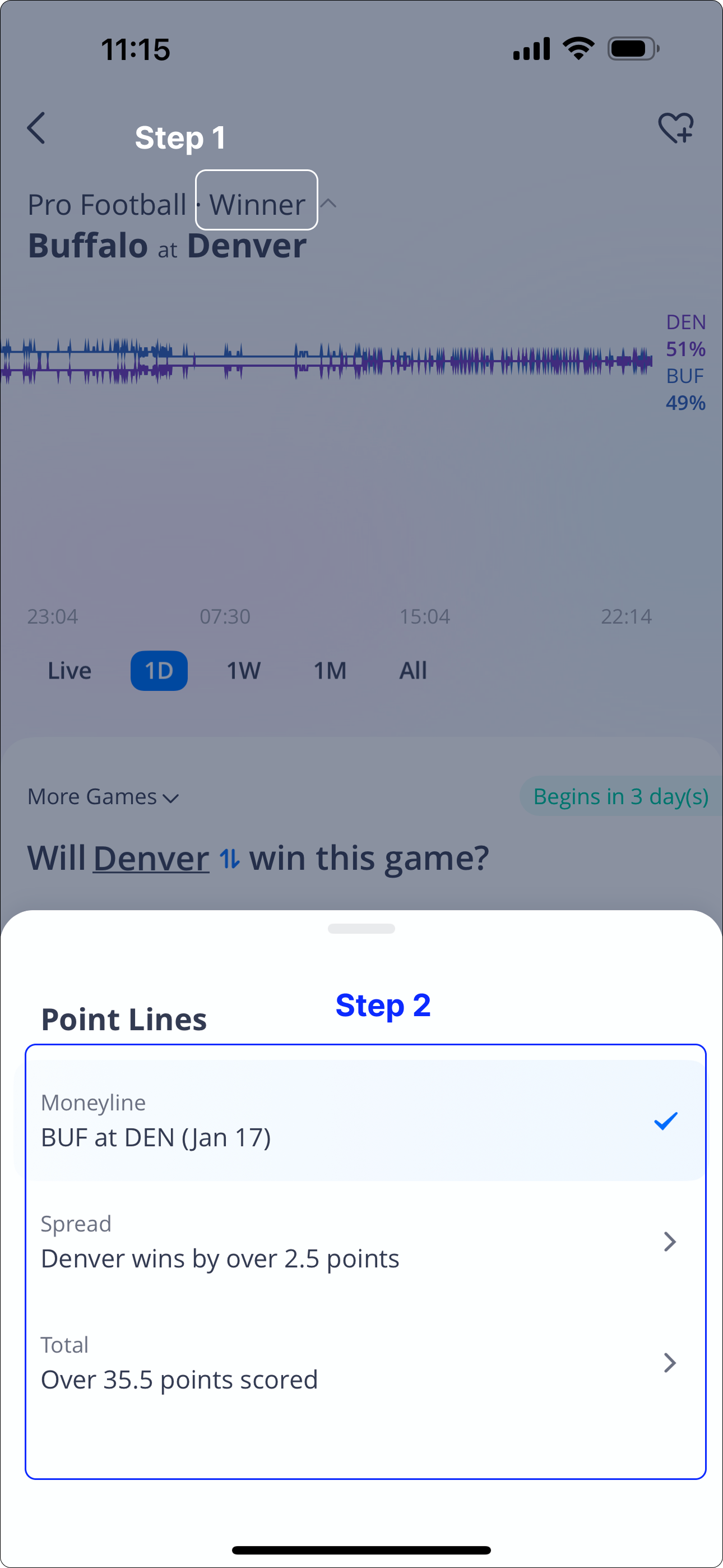

Spread: Winning by More Than Expected

Question being traded:Will Team A win by more than X points?

The spread reflects the market’s expectation of the score difference.

- Favorite: negative spread (e.g. -6.5)

- Underdog: positive spread (e.g. +6.5)

Key idea:

You’re not predicting who wins—you’re trading whether the actual result exceeds market expectations.

Total: How Many Points Are Scored

Question being traded:Will the total points scored be over X?

- Independent of which team wins

- Often influenced by pace, weather, injuries, and play style

Common use case:

Trading information such as weather changes or late injury news.

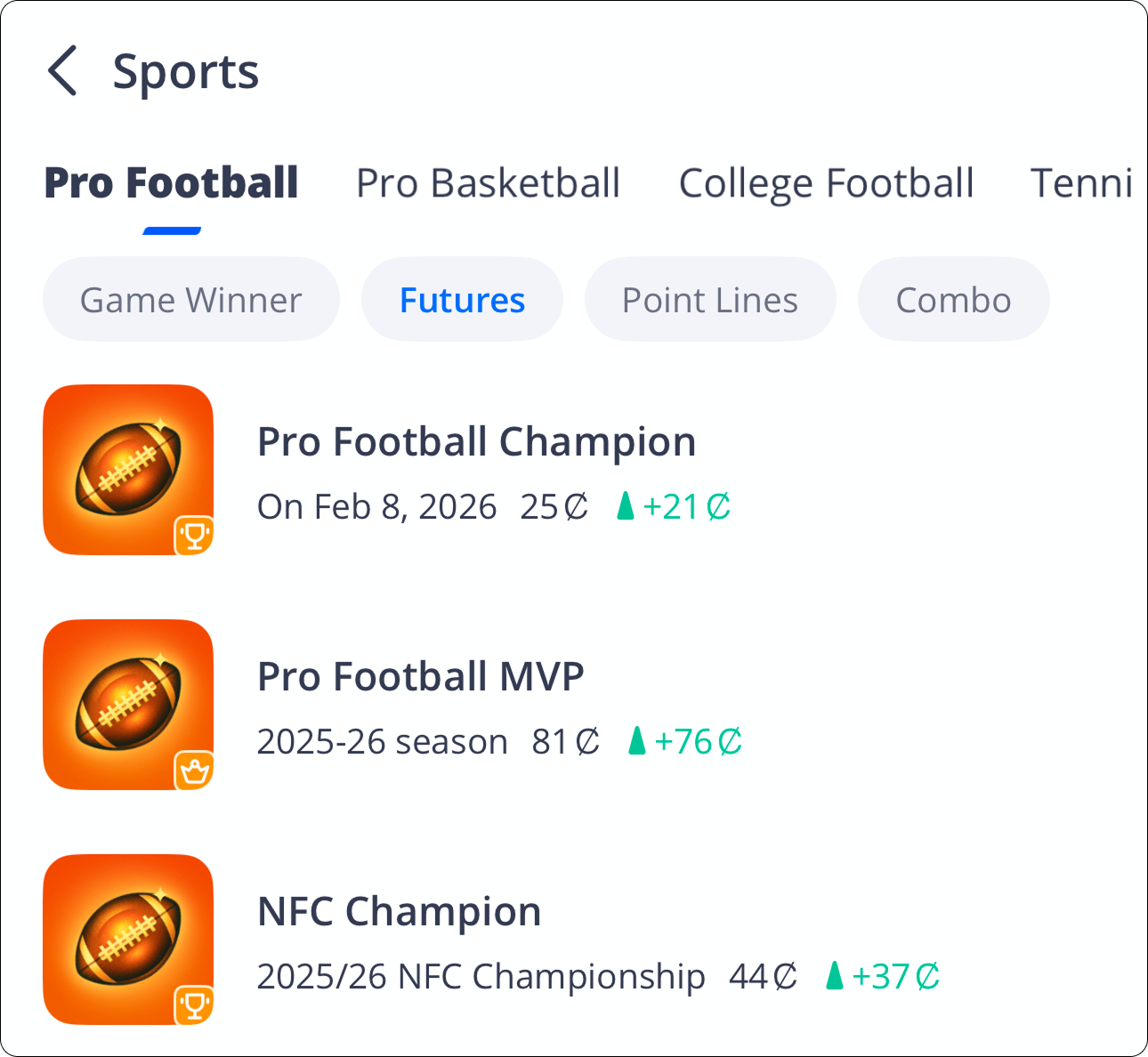

2.2 Tournament & Major Event Contracts

For large competitions (e.g. the Super Bowl, World Cup, NBA Playoffs), markets extend beyond individual games.

These contracts often trade days or weeks before the final outcome, creating more opportunities to enter and exit positions.

Championship Winner: Who Wins It All

Question being traded:

Will Team A win the Super Bowl?

- Each team has its own Yes / No contract

- Prices move as teams advance, get eliminated, or face new information

How traders use it:

- Take early positions before expectations are fully priced in

- Adjust or exit positions as probabilities change round by round

This type of contract is best understood as longer-horizon expectation trading, not a single-game decision.

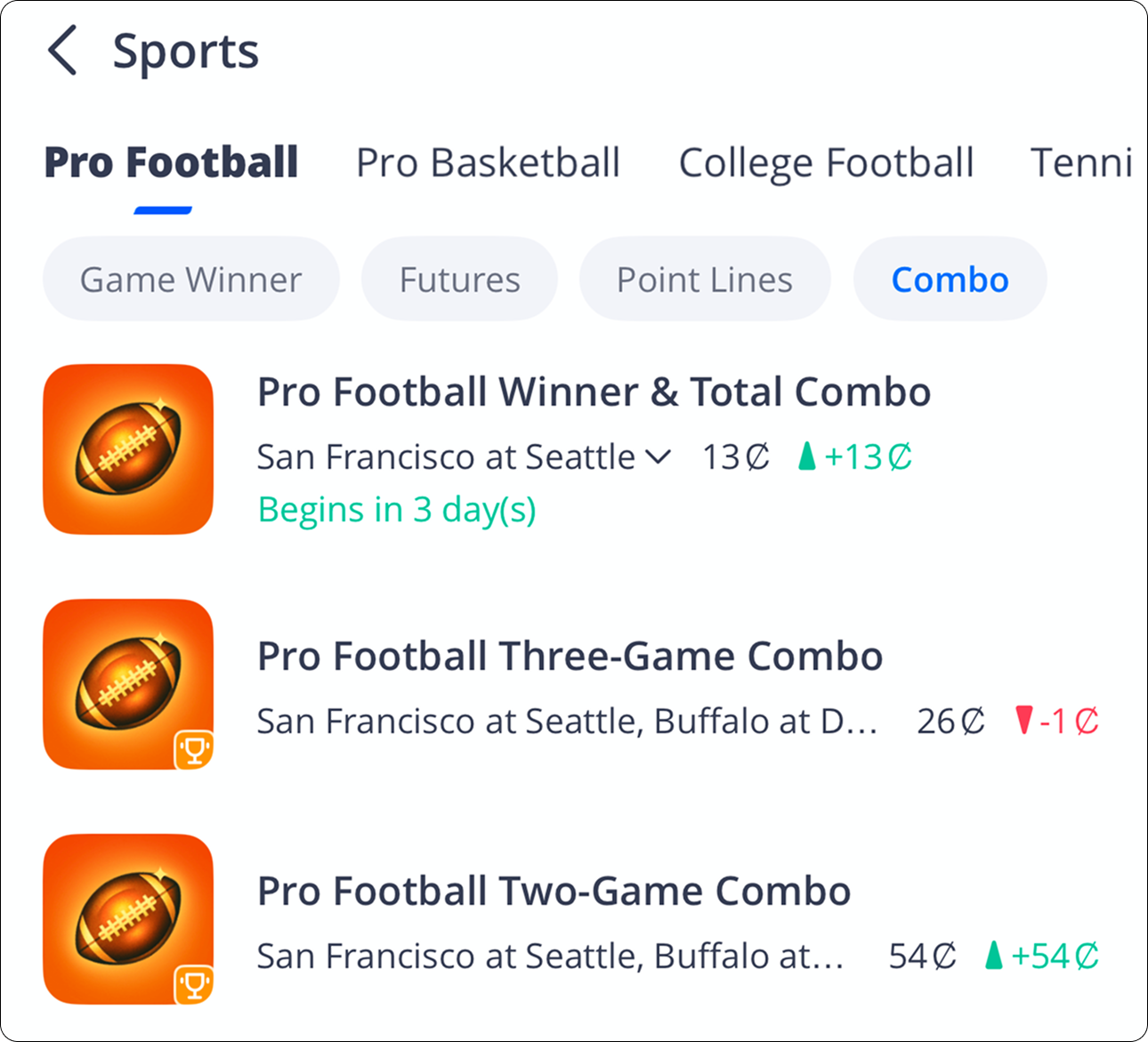

2.3 Combo: Trading Multiple Outcomes Together

Combo contracts allow traders to combine multiple conditions into a single trade.

Questions being traded (examples):

- Will Team A win and total points be under 39.5?

- Will Team B win and Team C win?

A Combo contract only settles at $100 if all conditions are met.

Trader mindset:

You’re not trading a single result—you’re trading whether a specific combination of outcomes will occur.

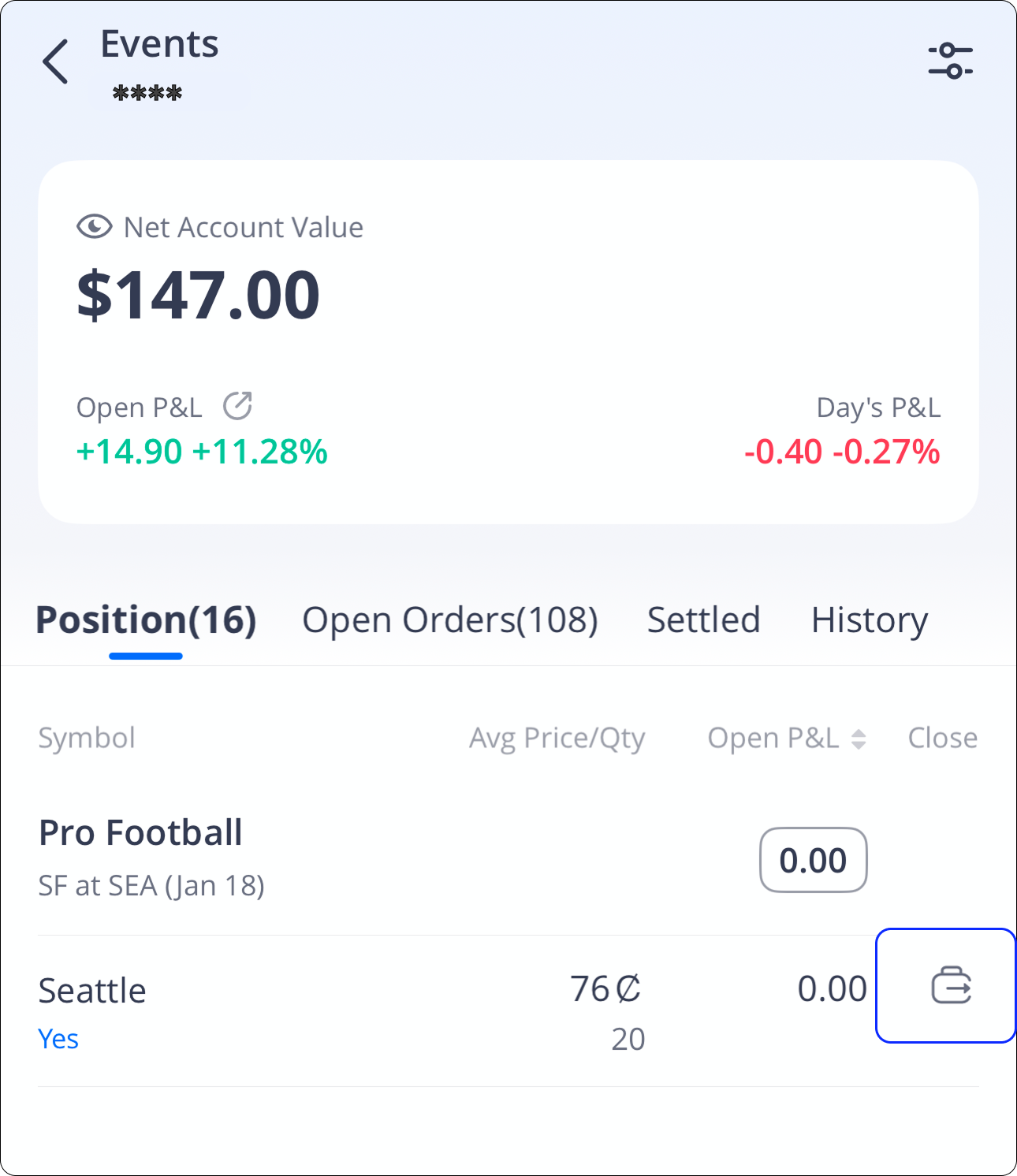

3. How to Manage Your Position

After choosing a contract, trading success depends on understanding price movement and position management.

3.1 How Prices Move

Prices change as market expectations evolve.

Common drivers include:

- New information (injuries, weather, lineup changes)

- Shifts in market sentiment

- Large orders entering the market

Remember that prices reflect tradable beliefs, not guaranteed probabilities.

This creates opportunities when you believe:

- The market is overreacting

- The market hasn’t fully priced in new information

3.2 Managing Your Position: Hold or Sell

When you buy a sports event contract, you are not required to wait until the event ends.

You have two ways to manage your position:

Hold to settlement

- If the event happens, the contract settles at $1

- If it doesn’t, you lose your initial investment

- This approach is often used when you have strong conviction

Sell before settlement

- You can sell your position at any time while the market is open

- If prices move in your favor, you may realize gains before the event finishes

- Selling early can also help manage risk if expectations change

Conclusion

Sports Event Contract trading reflects the interaction of market expectations, publicly available information, and participant behavior. Prices are determined by supply and demand and may change as new information becomes available or as market conditions evolve.

Whether evaluating a single game or a broader championship market, participants are assessing the same fundamental consideration:

how the market is currently valuing a specific, clearly defined outcome.

Understanding how Event Contract prices are formed can help participants better interpret market movements. Trading Event Contracts involves risk and does not guarantee any particular result.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal