Exit Options Positions with Option Alerts

Key Takeaways

- Option alerts are a powerful tool to help you track price movements

- Learn how to apply option alerts in a low liquidity position.

- A flexible way to use option alerts: find trading ideas by monitoring contract prices.

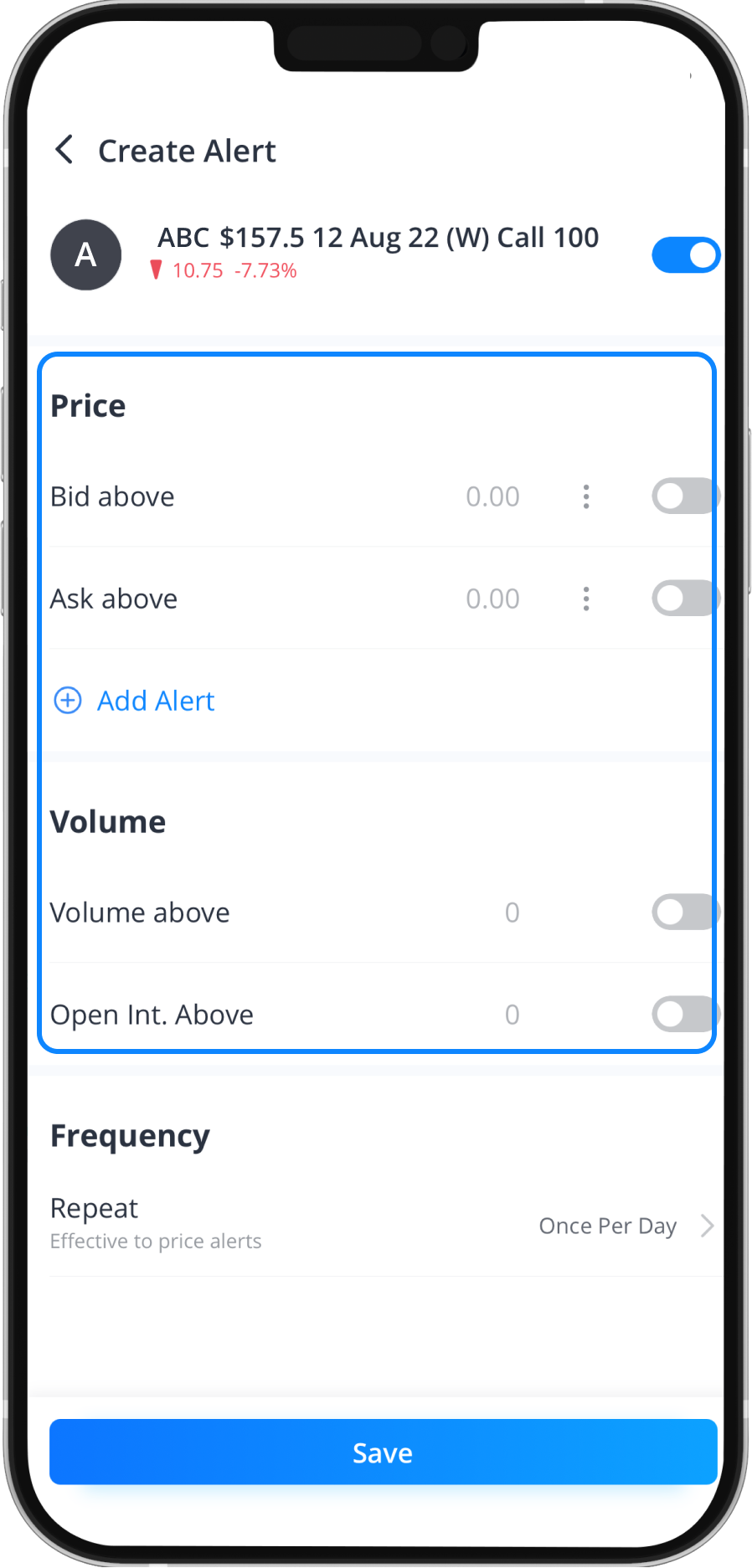

- Webull provides two types of alerts for option contracts—price alertsand volume alerts.

An Efficient Way to Exit Positions

Webull supports several order types, such as the TP/SL order, stop loss, and stop-limit order, which can be used to execute your exit strategy. To use these effectively, finding your exit point is critical. Options alerts are an easy and practical tool to help you track price movements in relation to your exit point. Having constructed orders to protect your options positions, target alerts can let you know when the execution of those orders is near.

Suppose you bought one call option contract of AAPL at $110, with a premium of $9.70. The contract is currently trading at $9.50. You’ve placed a stop-loss order at $7.50, and you want to set some alerts to notify yourself if the contract price continues to fall. You can set three price alerts: bid price below $9, bid price below $8.5, and bid price below $8. Now you will be notified if the contract bid price falls to any of the prices you’ve set.

Based on these option alerts, you can observe the speed and severity of price changes for a contract. Option alerts can be used to take targeted trading actions to protect your account, such as setting a TP/SL order to close your positions to secure gains or protect from further losses.

Applying Option Alerts in a Low Liquidity Position

Option traders need to be able to monitor trends in volatile markets, especially when holding low-liquidity option positions. In such cases, keeping a close eye on changes in the bid price can help you protect your positions.

Suppose a contract you own is currently trading below the price you paid, and is so thinly traded that your odds of exiting at a favorable price are slimmer than you’d like. You may only have a small window to execute the trade if the price reaches your exit point. You could set alerts to monitor changes to the contract price. Any price change would impact your position, but alerts allowyou to see when the changes are trending towards your exit point. You can monitor these specific market changes and respond promptly, without being glued to your screen.

Find Trading Ideas with Option Alerts

Along with exit strategies, alerts can also be helpful for investors who want to open positions. If you are considering opening a position, trysetting an alert for to notify you when a contract you are interested in meets the optimal conditions for you.

The Types of Alerts You Can Set on Webull

Webull now provides two types of option contract alerts—price alerts and volume alerts.

- Price Alerts

You can receive alerts when the bid or ask price of a contract is below or above a certain price, based on your settings.

*Please note that if you don't subscribe to OPRA (Real Time Options) Market Data, the alert still can be triggered based on the real-time price, but you can only view the delayed options quotes when you check the options quotes.

- Volume Alerts

You can receive alerts when the contract's volume or open interest is higher than the number you set.

If you have created alerts before, tap here to manage your alerts.

Bottom Line

Building an alert strategy is an efficient way to help you exit positions at the right time. Share your exit strategy in the comments below!

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal