Understanding Business Cycles

What Are Business Cycles?

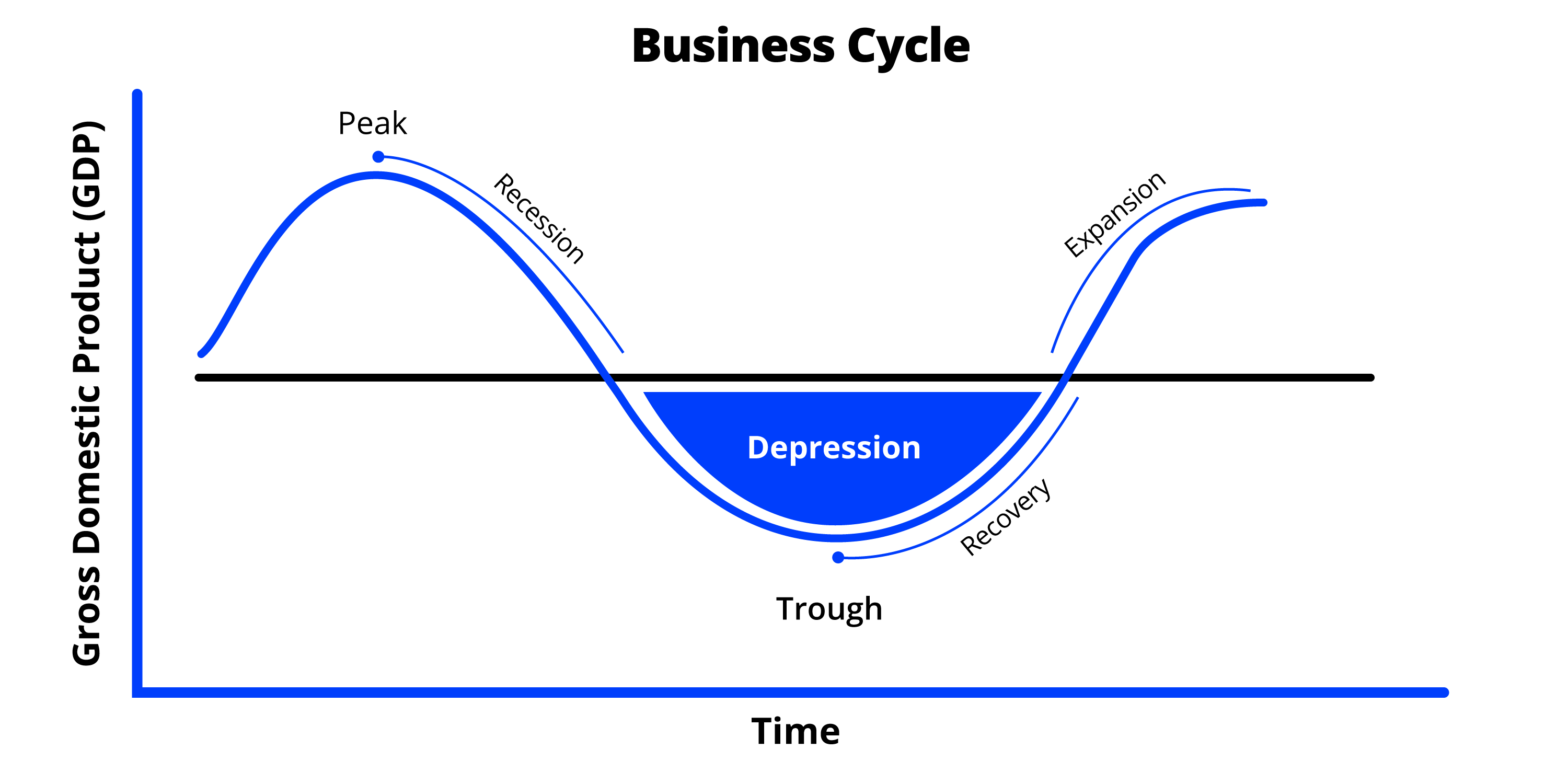

A business cycle refers to the cyclical nature of economic activity over time. It’s a periodic pattern of growth (expansion) and decline (contraction) in an economy, measured primarily by changes in Gross Domestic Product (GDP) and other key economic indicators like employment, industrial production, and consumer spending.

Business cycles can be caused by a variety of shocks, including financial market disruptions, international disturbances, technology shocks, energy price shocks, and actions taken by monetary policymakers.

Business cycles are inherent to market economies and typically consist of four distinct phases: expansion, peak, contraction, and trough.

The length of a business cycle is the time it takes to complete a single boom and contraction. The National Bureau of Economic Research (NBER) is an independent institution that dates the peaks and troughs of U.S. business cycles.

Phases of a Business Cycle

Expansion

This is the growth phase, characterized by:

· Increasing GDP.

· Rising employment and consumer spending.

· Higher business investments.

During this phase, confidence in the economy is high, and businesses expand operations to meet growing demand. Inflation may start to rise as the economy heats up.

Peak

The peak marks the high point of economic activity. Indicators such as production and employment reach their maximum levels. However, growth begins to slow as the economy reaches its capacity. Excess demand might lead to inflationary pressures.

Contraction

Also known as a recession, this phase is marked by:

· Declining GDP.

· Rising unemployment.

· Decreased consumer and business spending.

Businesses cut back on production and investments, while consumers tighten their spending due to economic and financial uncertainty. This phase can range from mild slowdowns to severe economic downturns.

Trough

The trough represents the lowest point of the cycle, where economic activity bottoms out. It will be followed by a recovery as conditions improve and the economy begins to grow again, leading back into the expansion phase.

What Causes Changes in Business Cycles?

Demand and Supply Fluctuations

Changes in consumer demand for goods and services can create imbalances, influencing production levels and employment rates.

Monetary Policy

Central banks influence economic activity by adjusting interest rates and controlling the money supply. Tight monetary policies (higher interest rates) can slow down an overheated economy, while loose policies (lower interest rates) can stimulate growth.

Fiscal Policy

Government spending and taxation directly impact economic activity. For example, increased public spending can drive growth, while higher taxes may slow it down.

Technological Innovations

Breakthroughs in technology can create booms in certain industries, leading to periods of rapid expansion. However, over-reliance on specific technologies can also create bubbles.

External Shocks

Events like oil price hikes, natural disasters, pandemics, or geopolitical tensions can disrupt economic stability and trigger recessions.

Business and Consumer Sentiment

Confidence in the economy influences spending and investment decisions. Fear or uncertainty can lead to reduced economic activity, while optimism fuels growth.

How Do Business Cycles Affect Stakeholders?

Businesses

During expansions, businesses experience higher sales and profits, prompting them to invest in new projects and hire employees. During recessions, businesses try to cut operational costs, reduce investments, and minimize their workforce.

Consumers

Economic growth leads to higher incomes, consumer spending, and more job opportunities. Recessions result in reduced purchasing power, job losses, and uncertainty.

Governments

Governments respond to business cycles by adjusting their monetary and fiscal policies. In times of contraction, they may increase public spending or cut taxes to stimulate growth. During expansions, they might implement policies to control inflation, such as raising interest rates to prevent further spending.

Investors

The stock market closely follows the business cycle. Expansions tend to drive up stock prices, while recessions often lead to declines. Understand where the market is at and use the information to determine what to do with your portfolio.

Can Business Cycles Impacts Be Managed?

While business cycles cannot be eliminated entirely, their impacts can often be mitigated through strategic action. Effective management of these cycles can help reduce economic instability and maintain long-term growth.

Monetary Policy Tools

Central banks, like the Federal Reserve, will adjust interest rates and quantitative easing to stabilize the economy.

Fiscal Stimulus

Governments can implement stimulus packages, increase public spending, or provide tax cuts to boost economic activity during economic downturns.

Regulations

Strong regulatory frameworks can prevent excessive risk-taking and speculative bubbles, reducing the likelihood of severe recessions.

Diversified Economies

Economies with diverse industries are less vulnerable to sector-specific shocks, which helps stabilize overall economic activity.

Understanding Business Cycles

Recognizing the stages of business cycles helps businesses, policymakers, and individual investors prepare for economic changes.

Businesses can align their strategies to the current cycle, such as ramping up production during expansions or holding onto cash during downturns.

Investors use cycles to identify different investment opportunities, shifting focus to growth assets in expansions and defensive ones during contractions.

Policymakers can implement timely measures to stimulate or cool down the economy, reducing the impact of extreme cycles.

The Bottom Line

Business cycles have important implications for the welfare of the population, government institutions, and private sector firms. Understanding their causes and impacts can help you navigate the ups and downs of economic activity effectively.

Head to Webull Learn to learn more about Stocks, ETFs, Options, and more! Webull is committed to helping improve your education to help you make more informed decisions.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal