How Bond Prices, Rates, and Yields are Related

Bond Prices When Interest Rates Rise or Fall

If an investor plans to hold a purchased bond until maturity, interest rate risk will not be as much of a factor. However, if the investor wants to sell the bond on the secondary market before it reaches maturity, the price bond investors are willing to pay can rely on the current rate environment. If rates go up, newly issued bonds will have higher coupon rates than those already on the market, making the existing bonds less attractive and can drive prices down. If rates go down, bonds that have already been issued will have more attractive coupon rates and could lead investors to pay a premium price.

Example: An investor purchased a 10-year corporate bond with a face value of $1,000 and a coupon rate of 3% when prevailing interest rates were at 3%. However, after a few years, the Federal Reserve decides to raise interest rates due to a strong economy, causing new bonds with similar risk profiles to offer a higher coupon rate of 5%.

As a result, investors in the market now demand a higher yield to compensate for the increased interest rate environment. Since the older bond with a 3% coupon rate is now less attractive compared to the newer bonds offering a 5% coupon rate, its price in the secondary market begins to drop.

The investor, needing to sell the bond before maturity, finds that potential buyers are only willing to pay $900 for the bond to achieve a yield closer to the new market rate of 5%. This results in a loss of $100 for the investor, who initially purchased the bond at face value.

Bond Yield

Simply put, the bond yield is the return an investor can expect from a bond being held. The yield is generally expressed as an annual percentage and represents the annual interest income as a percentage of the bond’s current market price. If an investment has a yield of 5%, that means it averages a 5% yield each year. The higher price that is paid for a bond, the lower the yield will be.

There are multiple ways to calculate yield but yield to maturity is what investors will often use when purchasing a bond. The calculation of a bond’s yield to maturity considers several factors, including coupon rate, price, years remaining until maturity, and the difference between the face value of the bond and the price that was paid to purchase it.

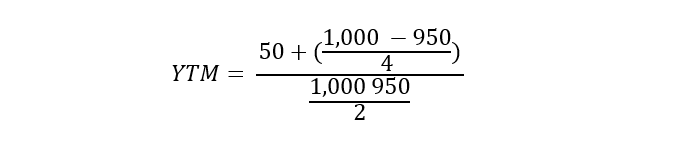

Example: Let's consider a $1,000 par value bond with 4 years to maturity, a 5% annual coupon rate, and currently sells for $950 in the market.

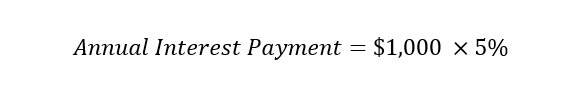

Step 1: Calculate the annual interest payment

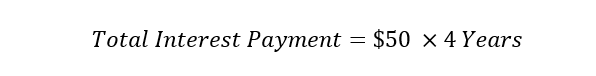

Step 2: Calculate the total interest payments over the life of the bond

Step 3: Calculate the total cash flows at the end of the bond's life

Total cash flows = $1,000 + $200 = $1,200

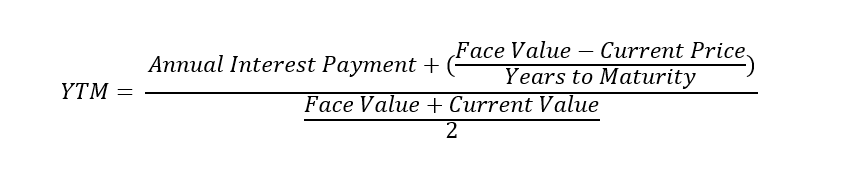

Step 4: Calculate the yield to maturity using the current market price

Yield to Maturity = (Annual interest payment + ((Face value - Current price) / number of years to maturity)) / ((Face value + Current price) / 2)

Note that two bonds could have the same yield to maturity and face value but have different coupon rates.

Other yet less common methods of calculating the yield of bonds include current yield, yield to worst, and yield to call.

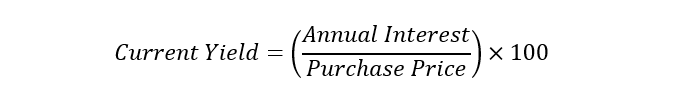

Current yield is the simplest calculation, simply taking the annual interest of the bond and dividing by purchase price and multiplying by 100.

While a quick and simple calculation, this is not as accurate as yield to maturity.

Yield to worst represents the yield an investor would receive in worst-case scenarios. It varies depending on the terms of the security, or if there are call features. Yield to worst will always be lower than yield to maturity.

Yield to call uses the same formula as yield to maturity, but only calculates the yield until the call date, rather than to maturity.

Explore Bond Investment Opportunities with Webull

Are you seeking a more stable way to grow your investments? Webull is here to help! Soon, you'll be able to invest in U.S. Treasury Bonds, Bills, and Notes through Webull.

Starting with as little as $1,000, you can begin your journey into bond investing. Be sure to visit Webull Learn to access resources on Stocks, ETFs, and Options. Webull is dedicated to giving you the knowledge to make informed and strategic investment decisions. Keep an eye out for upcoming updates and elevate your investment strategy with Webull.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal