P&L of a Long Put

Outcome 1: Profit

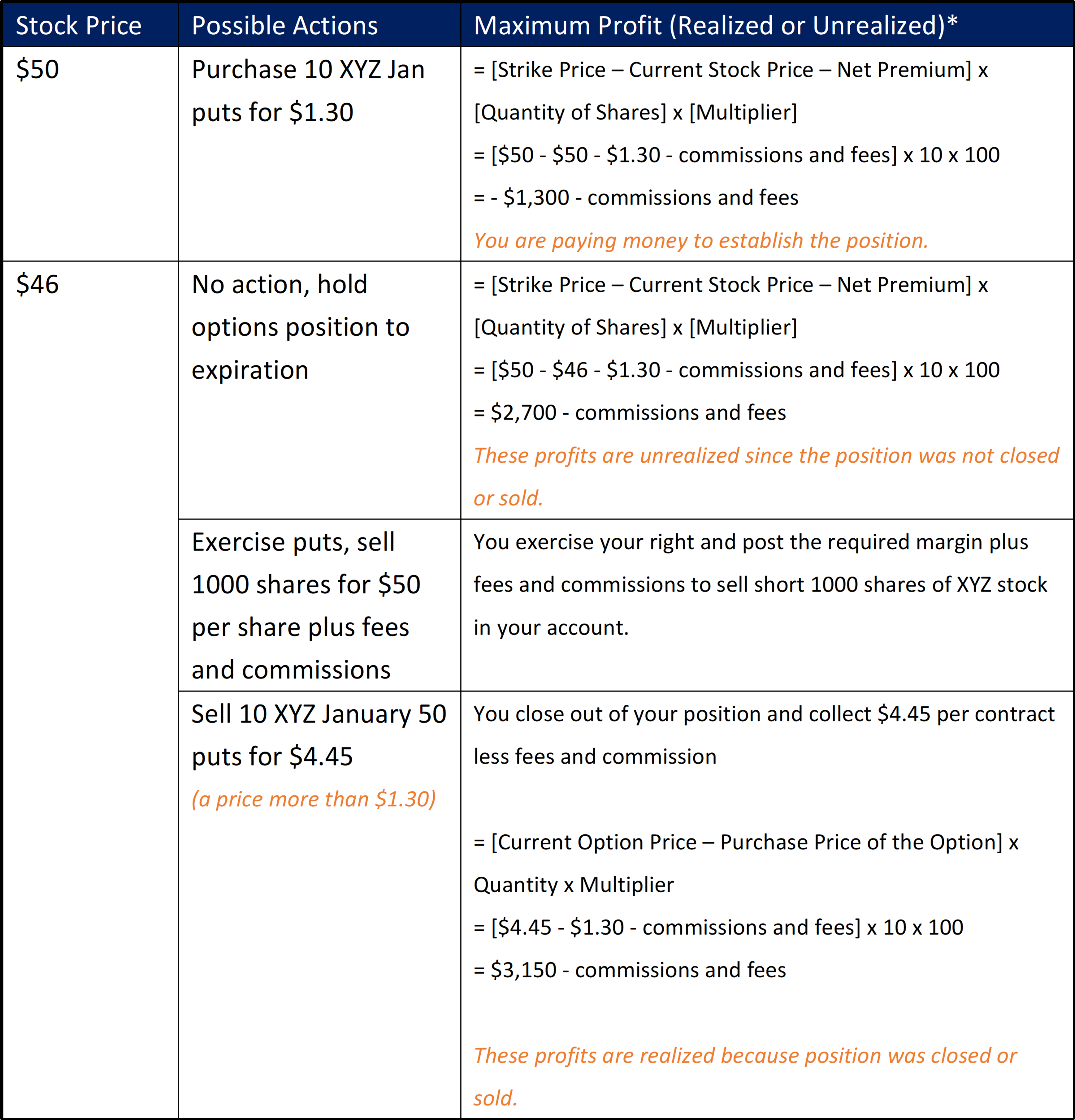

With a long put position, you are committing to a bearish stock sentiment, believing that the stock will decrease in value and decline in price. There is significant, but limited, profit potential. Let’s now assume we are correct in our sentiment and the stock price declines.

To calculate our profit on the position when we purchased our contracts without borrowing funds, we use the following formula:

Profit = Strike Price – Current Stock Price – Net Premium Paid

Example

Stock XYZ is trading at $50 and you purchase 10 XYZ Jan 50 puts for $1.30.

A week later, stock XYZ is trading lower at $46.

*Unrealized profits are those that potentially exist; realized profits occur when you close out or trade out of the position.

Our maximum profit is significant but limited. Remember, the price of XYZ stock cannot trade below $0. Therefore, the maximum profit is defined as:

Max Profit = (Strike Price - Net Premium Paid) x Quantity of Contracts x Contract Multiplier

In our example, the maximum profit potential is $48,700 less fees and commissions [($50 - $1.30) x 10 x 100 = $48,700].

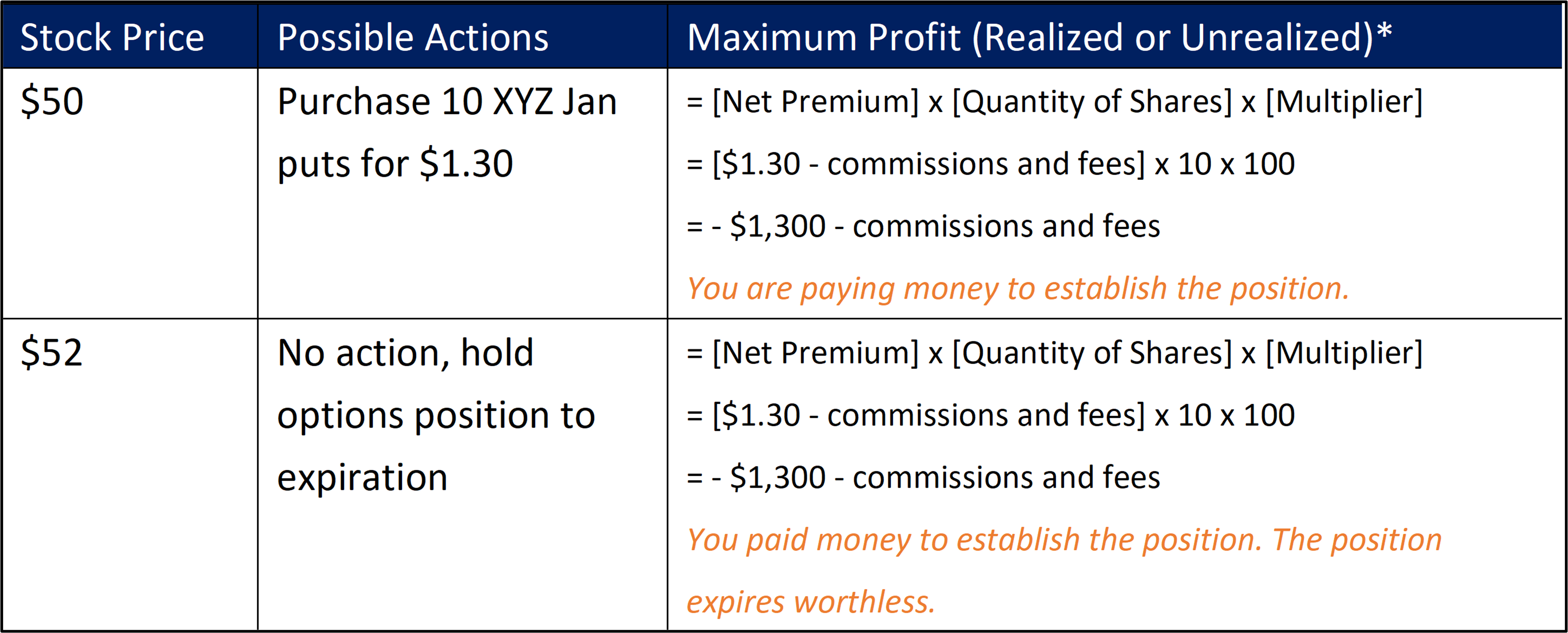

Outcome 2: Loss

With a long put position, you have paid money (net premium) to establish an options position that gives you access to the stock’s significant, but limited, downside profit potential. This means that your potential losses (or upside risk exposure if the stock rises in price) are known and limited to the net premium paid.

Max Loss = Net Premium Paid

Example

Stock XYZ is trading at $50 and you purchase 10 XYZ Jan 50 puts for $1.30.

At expiration, stock XYZ is trading higher at $52.

*Unrealized profits are those that potentially exist; realized profits occur when you close out or trade out of the position.

Our maximum loss is capped and known.

Outcome 3: Breakeven

The breakeven price for a long put strategy occurs when the stock is trading at a price equal to the strike price less the net premium paid.

In our example, the breakeven stock price equals $48.70 ($50 - $1.30 = $48.70, not including fees and commissions).

-Powered by The Options Institute

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal