Collar (Long Stock + Long Lower Strike Put + Short Higher Strike Call)

Introduction

You previously purchased stock and are seeking a cost-effective way to protect your long position against significant losses by giving up some of your potential upside gains.

What exactly is a Collar?

A collar position is created by buying (or owning) stock and by simultaneously buying a put and selling a call on a share-for-share basis. Typically, the call and the put are out-of-the money.

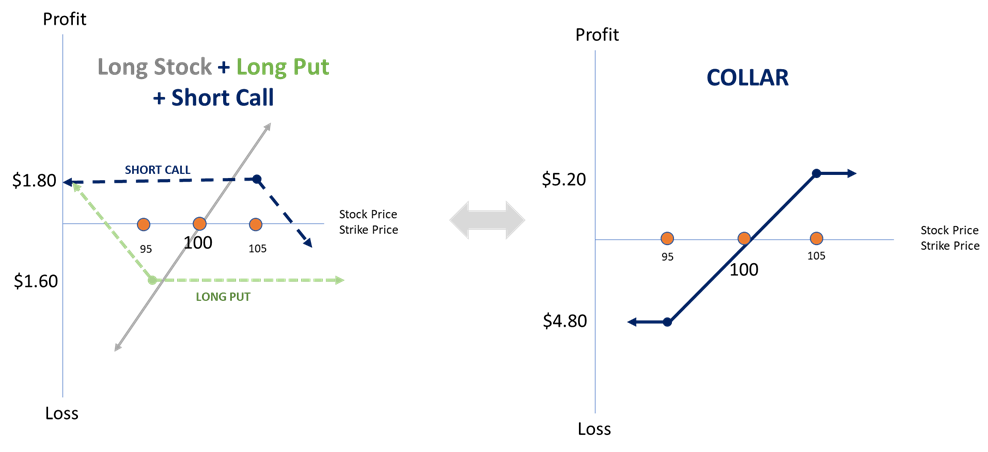

If the stock price declines, the purchased put provides protection below the strike price until the expiration date. If the stock price rises, profit potential is limited to the strike price of the covered call less commissions.

Example

Buy 100 shares of XYZ for $100 per share

Buy 1 XYZ January 95 put for $1.60

Sell 1 XYZ January 105 call at $1.80

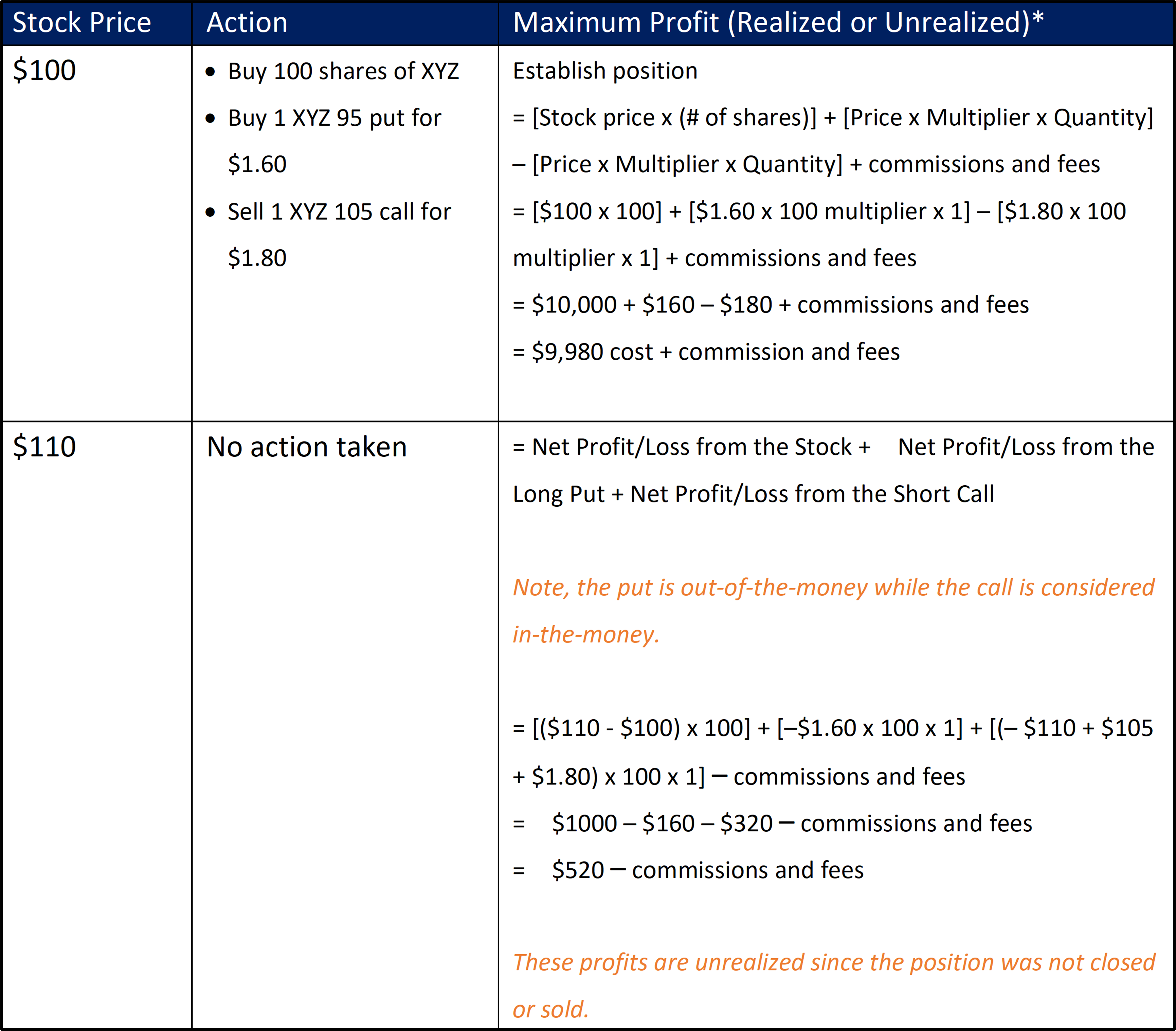

In our example, assume stock XYZ is currently trading at $100. We purchase 100 XYZ shares for a total of $10,000 (100 x $100), plus transaction fees and commissions. We buy 1 XYZ January 95 put for a total of $160 (1 x 100 multiplier x $1.60), less commissions and fees, and simultaneously sell 1 XYZ January 105 call for a total of $180 (1 x 100 multiplier x $1.80), less commissions and fees.

In this example, the options collar position (long put + short call) is established for a net credit of $20 ($180 - $160 = $20).

Additional Observations

Use of a collar requires a clear statement of investment goals, forecasts, and follow-up actions:

- If a collar is established when shares are initially acquired, then the goal may be to limit risk and to generate upside profit potential at the same time.

The forecast must be “neutral to bullish”, though the covered call limits upside profit potential beyond the strike price of the call.

If the stock price is above the strike price of the call, the investor should determine whether they will purchase the call to close out their short call position (thereby leaving the long stock position intact) or hold the short call position until it is assigned and the stock is sold. There is no “right” or “wrong” choice; it is, however, a decision that an investor must be prepared to make.

- If a collar is established against previously purchased stock when the short-term forecast is bearish and the long-term forecast is bullish, then it may be assumed that the stock is considered a long-term holding.

In this case, if the stock price is below the strike price of the put at expiration, then the investor will likely close their long put position by selling it. The stock position remains intact and may be held by the investor, who anticipates a rise in the stock price. However, if the short-term bearish forecast does not materialize, then the covered call must be repurchased to close the short call position and eliminate the possibility of assignment. It is advisable that the investor think through the possibility of a rise in stock price in advance and that they know their risk appetite for losses and the corresponding stock price level at which they may decide to repurchase the call.

- If a collar is established when a stock is near its “target selling price,” it can be assumed that, if the call is in-the-money at expiration, the investor will take no action and let the call be assigned so that the stock is sold.

However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the put. Will the put be sold and the stock held in case of a rally back to the target selling price, or will the put be exercised and the stock be sold? Again, there is no “right” or “wrong” answer to this question, but it is recommended that an investor think through the possibilities in advance.

Outcome 1: Profit

With a collar position, potential profit is limited because of the short call.

To calculate our profit on the position that was established for a credit, use the following formula:

Profit = Net Profit/Loss on Long Stock + Net Profit/Loss on Long Put + Net Profit/Loss on Short Call

For the Long Stock,

Profit = Current Price – Original Purchase Price

For the Long Put,

if K – S < 0, then the Loss = Net Premium Paid

if K – S > 0, then the Profit = Strike Price – Current Stock Price – Net Premium Paid

For the Short Call,

if S – K > 0, then the Loss = – (Current Stock Price – Strike Price) + Net Premium Received

= – Current Stock Price + Strike Price + Net Premium Received

if S – K < 0, then the Profit = Net Premium Received

Example

Stock XYZ is trading at $100 and you establish a collar for a net credit of $0.20 per share of stock (excluding transaction fees and commissions).

- Buy 100 shares of XYZ for $100 per share

- Buy 1 XYZ January 95 put for $1.60

- Sell 1 XYZ January 105 call at $1.80

A week later, stock XYZ is trading higher at $110.

*Unrealized profits are those that potentially exist; realized profits occur when you close out or trade out of the position.

Outcome 2: Loss

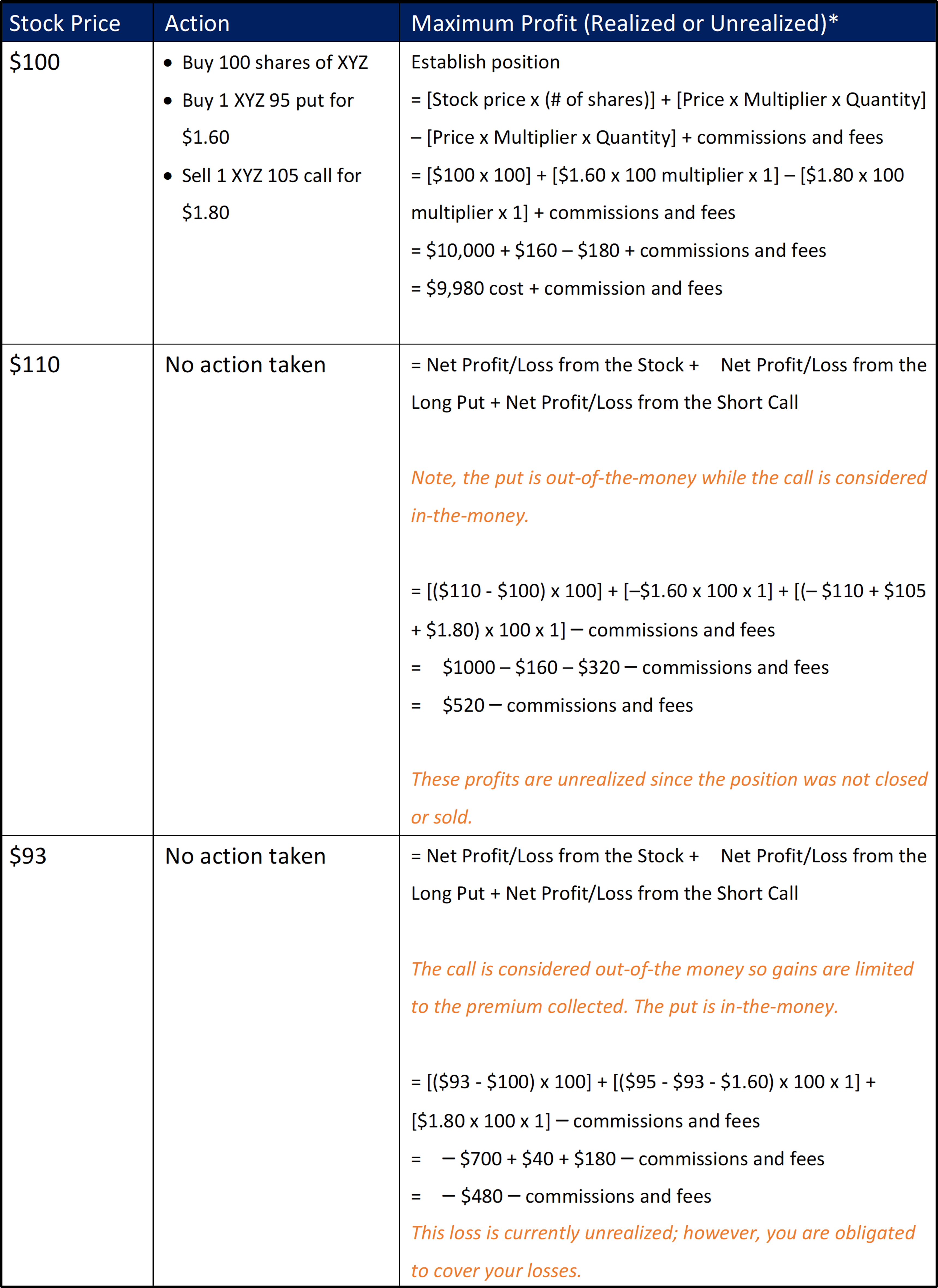

Let’s assume we are incorrect in our sentiment, and the stock price declines. To calculate our loss on the position, use the following formula:

Loss = Net Profit/Loss on Long Stock + Net Profit/Loss on Long Put + Net Profit/Loss on Short Call

For the Long Stock,

Profit = Current Price – Original Purchase Price

For the Long Put,

if K – S < 0, then the Loss = Net Premium Paid

if K – S > 0, then the Profit = Strike Price – Current Stock Price – Net Premium Paid

For the Short Call,

if S – K > 0, then the Loss = – (Current Stock Price – Strike Price) + Net Premium Received

= – Current Stock Price + Strike Price + Net Premium Received

if S – K < 0, then the Profit = Net Premium Received

Max Loss = The maximum loss is realized if the stock price is at or below the strike price of the put at expiration. Remember, the stock price cannot trade below $0. The maximum loss in our example is therefore $100 – $95 – ($1.80 – $1.60) = $4.80 per share plus commissions and fees.

Example

Stock XYZ experiences unexpected news and is now trading lower at $93.

*Unrealized profits are those that potentially exist; realized profits /losses occur when you close out or trade out of the position.

Outcome 3: Breakeven

The breakeven price calculated on a per-share basis for a collar is equal to the original stock price minus the total net premium received.

Breakeven Price = Purchase Price of Stock – Total Net Premium Received

Example

Stock XYZ is trading at $100 and you establish a collar position, receiving $0.20 per share.

· Buy 100 shares of XYZ for $100 per share

· Buy 1 XYZ January 95 put for $1.60

· Sell 1 XYZ January 105 call for $1.80

Breakeven Price (per share) = $100 – ($1.80 – $1.60) = $100 – $0.20 = $99.80

At-A-Glance

Strategy

Collar

Alternative Name

Protective Collar

Pre-Requisite Strategy Knowledge

Long Stock

Long Put

Short Call

Legs of Trade

2 legs

Sentiment

Bullish

Example

- Long 100 shares of XYZ for $100 per share

- Long 1 XYZ January 95 put for $1.60

- Short 1 XYZ January 105 call at $1.80

Rule to Remember

The strike price of the put must be less than the strike price of the call option with the same underlying and expirations

Max Potential Profit (GAIN)

Limited:

- If traded for a credit, strike price of the call + total net premium received – original purchase price of stock

- If traded for a debit, strike price of the call – total net premium paid – original purchase price of stock

Break-Even Point

- If traded for a credit, original purchase price of stock – total net premium received

- If traded for a debit, original purchase price of stock + total net premium paid

Max Potential Risk (LOSS)

Limited:

- If traded for a credit, original purchase price of stock price – strike price of the put – total net premium received

- If traded for a debit, original purchase price stock price – strike price of the put – total net premium paid

Ideal Outcome

XYZ price increases to the strike price of the call

Early Assignment Risk

Early assignment risk applies to short options positions only.

Equity options in the United States can be exercised on any business day, and the holder of a short stock options position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment must be considered when entering positions involving short options. Early assignment of stock options is generally related to dividends.

The holder (long position) of a stock option controls when the option will be exercised, while the seller (short position) has no control over when they will be required to fulfill the obligation.

While the long put (lower strike) in a collar position has no risk of early assignment, the short call (higher strike) does have such risk.

Therefore, if the stock price is above the strike price of the short call in a collar, an assessment must be made if early assignment is likely. If assignment is deemed likely and if the investor does not want to sell the stock, then appropriate action must be taken. Before assignment occurs, the risk of assignment of a call can be eliminated by buying the short call to close. If early assignment of a short call does occur, stock is sold.

Charts

-Powered by The Options Institute

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal