Naked Options

A naked option strategy involves selling an option without holding the full amount of the deliverable as collateral. This is different from the normal covered options strategies tradable at level 1 on Webull, which require the seller to hold the full share position for covered calls, or the full cash amount for cash-secured puts .

These strategies are very risky, exposing the investor to potentially substantial losses while offering limited profit potential. The maximum profit possibility from selling a naked option is the premium collected and is realized when the option expires worthless. Given this risk profile, naked options are considered advanced strategies, and they will not be suitable for all options traders.

Naked Call

A naked call is when an investor sells call options without owning the underlying security, as he or she would with a covered call . Investors writing naked calls expect the stock price to remain the same or decrease. This way, the call options sold are less likely to be exercised, and the seller will keep the premium.

The maximum profit from writing a naked call is limited to the premium received. The potential losses, however, are theoretically unlimited. If the price of the underlying security rises significantly, the investor may be forced to buy the stock at the higher market price and sell it at the lower, agreed-upon strike price, resulting in substantial losses.

Example

Stock XYZ is currently trading at $100 per share. An investor writes a naked call option with a strike price of $105 expiring one month from today and receives a premium of $5 per share.

If the price of XYZ remains below $105 at expiration, the call option expires worthless, and the investor keeps the $5 premium as profit.

If the price of XYZ rises above $105 at expiration, the call option may be exercised, and the investor is obligated to buy the stock at the higher market price to sell it at $105.

Naked put

A naked put is when an investor sells put options without holding the amount of the cash deliverable. Investors writing naked puts anticipate that the price of the underlying asset will either remain stable or increase. This way, the put options they sold are less likely to be exercised.

Just like writing a naked call, the maximum profit from writing a naked put is limited to the premium received. The maximum loss is, however, limited to the strike price minus the premium received, which occurs when the price drops to zero. Just like naked calls, this makes these strategies risky and only suitable for certain traders.

Example

Stock XYZ is currently trading at $100 per share. In this case, an investor writes a naked put option with a strike price of $95 expiring one month from today and receives a premium of $5 per share.

If the price of XYZ remains above $95 at expiration, the put option expires worthless, and the investor keeps the $5 premium as profit.

If the price of XYZ falls below $95 at expiration, the put option may be exercised, and the investor is obligated to buy the stock at the strike price.

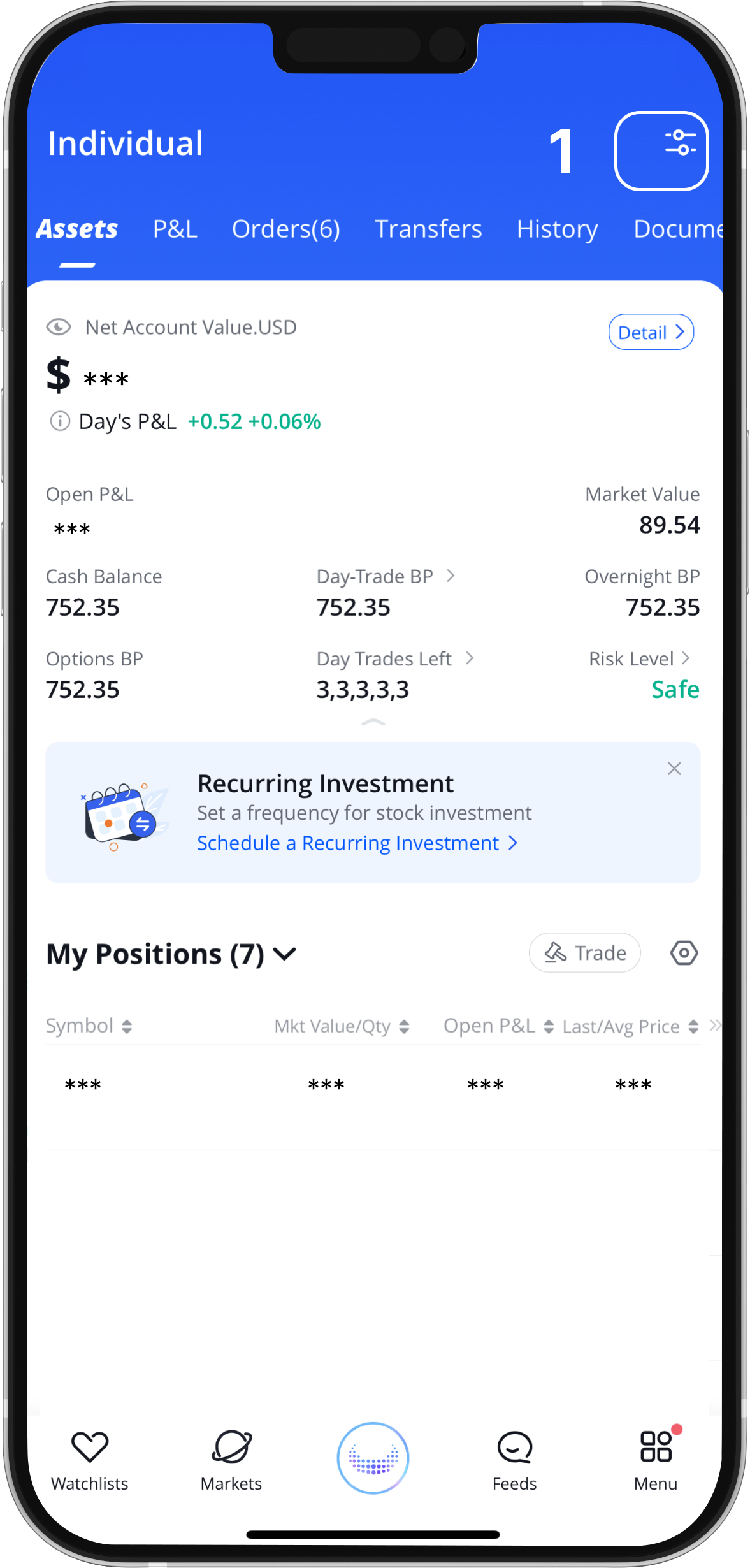

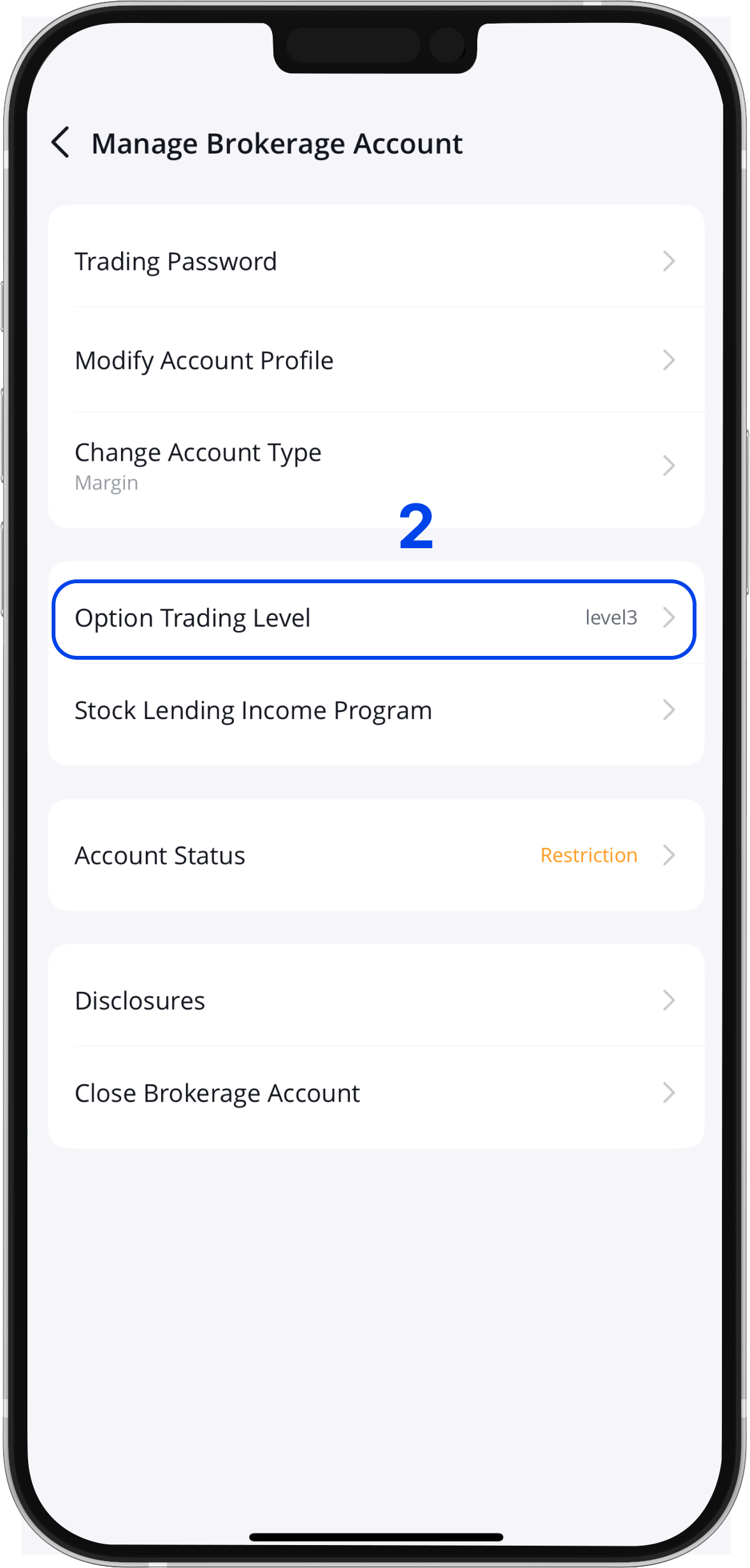

Trading naked options on Webull

Naked option strategies are now available on Webull. Here are a few things to take note of before you start.

1. Requirements for Writing Naked Calls and Puts:

To participate, you must apply and be approved for Level 4 in a margin account. Level 4 approval is not guaranteed for all applicants, as these are especially risky strategies, and are not suitable for all investors.

Writing naked calls requires a minimum net asset value of $10,000 in your account.

If you found this helpful read about Margin Trading .

2. Tradable Assets with Naked Calls and Puts:

For now, you can employ naked options strategies on S&P 500 stocks only. Index/ETF options will be supported at a later phase.

3. Available Strategies:

Currently, trading is limited to naked calls and puts. Strategies like short straddles and strangles are not yet available.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal