Build a Bond Ladder to Create an Income Stream

Staggered maturities provide several benefits, such as managing different types of risk such as changing interest rates or stock volatility. Bond ladders also allow investors the benefit of creating a steady stream of income that can be reinvested in several ways or used for living expenses.

How to Build Your Bond Ladder

There are several ways to build a bond ladder that suits your individual needs. The total amount you plan to invest, the staggering or spacing of maturities, and the types of bonds are all primary considerations when creating a bond ladder.

The first step in creating a bond ladder is to create the “rungs” of the ladder. Take the total amount of dollars you plan on investing and divide by the total number of years you wish to commit to the ladder. The greater number of rungs there are, the more diversified the portfolio will be, which can lower risks such as default.

The next step is to determine the spacing of the rungs, which is determined by span of time of the maturities of the bonds. The maturities can range anywhere from months to years. If you select bonds with longer maturities, the average return should be higher since bond yields generally increase over longer time periods. However, this also generates higher reinvestment risk and lower access to funds.

Read: How Bonds Work

The last step is to select which “materials” to use to construct your ladder. Investors can build their bond ladders with different types of bonds. Each type of bond has its own benefits and risks. Investors can tailor their investment to maximize returns and advantages based on their individual needs, including tax considerations and risk tolerance. Here is a brief overview of how different types of bonds can be utilized within the strategy:

Municipal Bonds: These bonds are issued by state and local governments and are often free from federal income tax and, in some cases, state and local taxes. They can be attractive to investors in higher tax brackets looking to reduce their taxable income.

U.S. Treasuries: Bonds issued by the U.S. government come with a full faith and credit guarantee, making them one of the safest investment options in terms of default risk. They are suitable for investors prioritizing the preservation of capital.

Investment-Grade Corporate Bonds: These are bonds issued by corporations with a credit rating considered "investment grade" (BBB-/Baa3 or higher). They typically offer higher yields than municipal and Treasury bonds, compensating investors for the increased credit risk.

By incorporating a mix of these bonds into a laddered portfolio, investors can achieve a balance between risk and return, while potentially benefiting from different tax treatments. This strategy can also help manage interest rate risk, as maturing bonds can be reinvested at prevailing interest rates, which is particularly beneficial in a rising interest rate environment. However, diversification among bond types does not eliminate risks entirely, as bond prices can fluctuate and there is still potential for loss of principal.

Read Also: Introduction to Bonds

Important Considerations

Before building a bond ladder, it is important to consider following some guidelines:

Your Investment Amount: Determine whether you have enough assets in your portfolio to spread across several bonds for a ladder while also maintaining proper diversification and meeting your current cash needs. If you do not have enough to allocate to individual bonds, ETFs (Exchange Traded Funds) or CDs may be another option.

High Quality Bonds: When selecting bonds for your bond ladder, it is prudent to use higher quality bonds. Lower quality, or high yield bonds have greater risk of default and could disrupt the steady flow of income as well as the predictable value outcome at maturity.

Noncallable Bonds: It is also important to remember to avoid bonds with a call feature, as these can be redeemed by the issuer at any time, which exposes your ladder to call risk.

Hold Your Bonds Until Maturity: It is important to hold all the bonds in the ladder to their respective maturities. Doing this eliminates market timing and maximizes the benefits of regular income from the ladder. Selling bonds early also creates increased interest rate risk as the selling prices of bonds could be driven down if current interest rates are on the rise.

Reinvestment Strategy: Have a plan for reinvesting the proceeds from maturing bonds. Typically, you could reinvest in a new bond at the longest maturity of your ladder to maintain its structure. Decide whether you will reinvest the interest payments or use them as income.

Monitor and Adapt to Changing Conditions: Regularly review your bond ladder to ensure it still meets your goals and that the individual bonds or ETFs are performing as expected. Be sure to monitor changes in interest rates and other economic conditions to determine whether to continue reinvesting in your bond ladder.

Read More: Selecting the Right Bond For You

Example

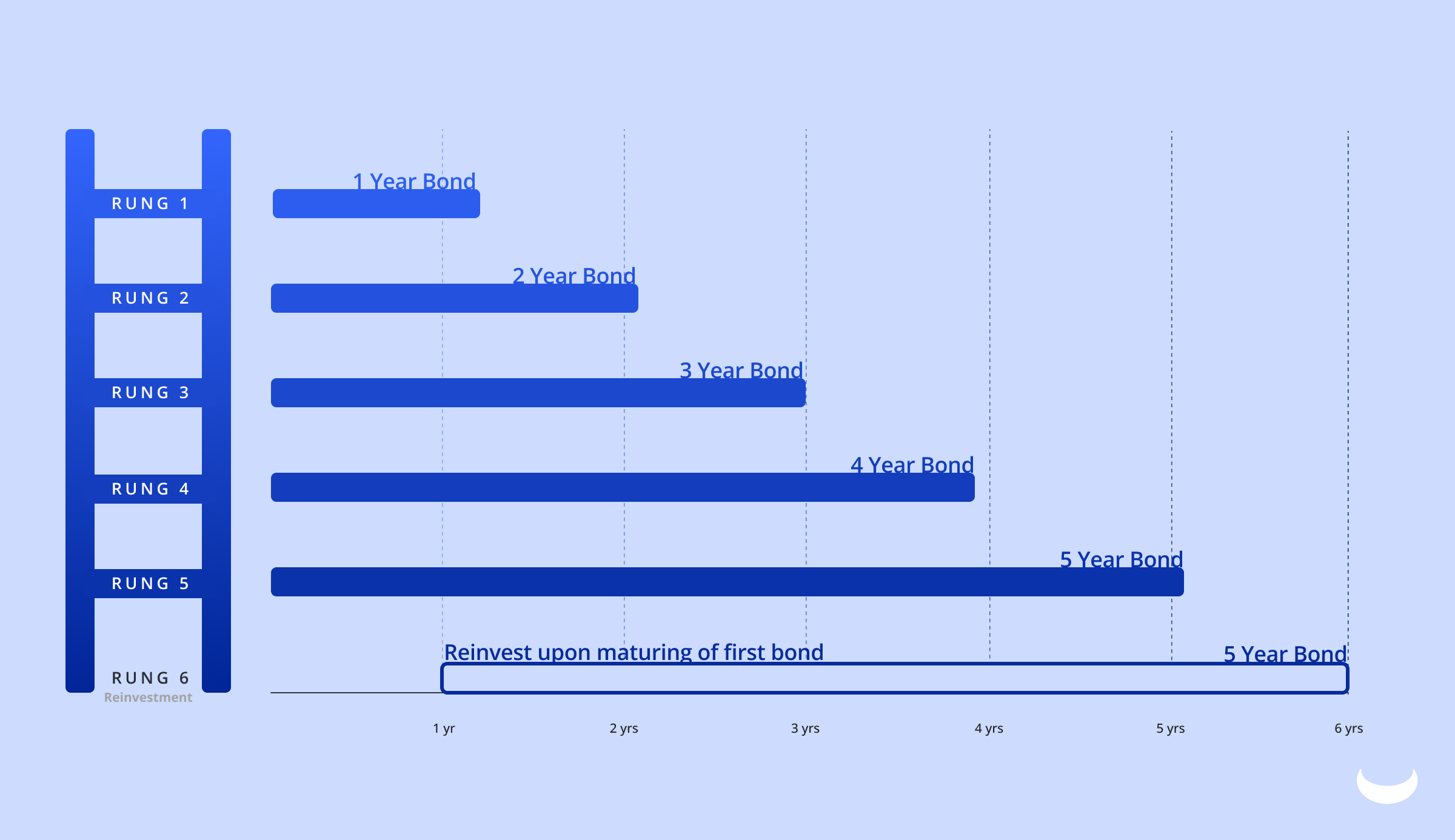

Suppose an investor wants to invest $50,000 into a bond ladder strategy. The investor decides to build a 5-year ladder with bonds maturing each year. The investor would divide the total investment into equal amounts for bonds with different maturities. Here's what it could look like:

- Year 1: $10,000 in a 1% yield bond maturing in 1 year

- Year 2: $10,000 in a 2% yield bond maturing in 2 years

- Year 3: $10,000 in a 3% yield bond maturing in 3 years

- Year 4: $10,000 in a 3.5% yield bond maturing in 4 years

- Year 5: $10,000 in a 4% yield bond maturing in 5 years

Ladder average annual yield: 2.7%

Each bond pays interest, typically semi-annually or annually, providing the investor with a regular income. As each bond matures, the investor can either take the principal and interest as a payout or reinvest the funds into a new bond at the long end of the ladder, maintaining the staggered structure. If interest rates have risen, the investor may be able to purchase a new bond with a higher yield, potentially increasing their income.

For instance, when the 1-year bond matures, the investor could reinvest the principal from the matured bond into a new 5-year bond. The ladder then always remains intact with five rungs and continues to deliver periodic income.

See Also: How Bond Prices, Rates, and Yields are Related

Bonds At Webull

Webull will soon offer Treasury Bonds, Bills, and Notes backed by the U.S. government, which are time-tested investments.

You can start investing with a minimum investment of $1,000. But before investing, visit Webull Learn for valuable information on investing in Stocks, ETFs, and Options. Webull is committed to providing resources to help you make informed decisions to build and diversify your investments. Stay tuned for more updates on bonds at Webull and take your investment journey to the next level.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal