Retail Sales

What are Retail Sales?

Retail sales are a way to measure the demand for finished goods by consumers. The Retail Sales Index (RSI) calculates how many durable and non-durable goods have been purchased over a certain period of time.

The RSI is a monthly report put out by the U.S. Census Bureau based on data samples that are used to predict sale patterns across the country. To prevent data from being skewed, the Census Bureau releases two reports each month, one that covers all food service and retail sales, and one that omits vehicle and gas sales. This is due to the high price of vehicles—which are often bought seasonally—and the volatility of gas prices, which may not give an accurate depiction of average retail sales.

Each report notes the percentage change of sales from the previous month, as well as the YoY difference in order to account for seasonal sale patterns.

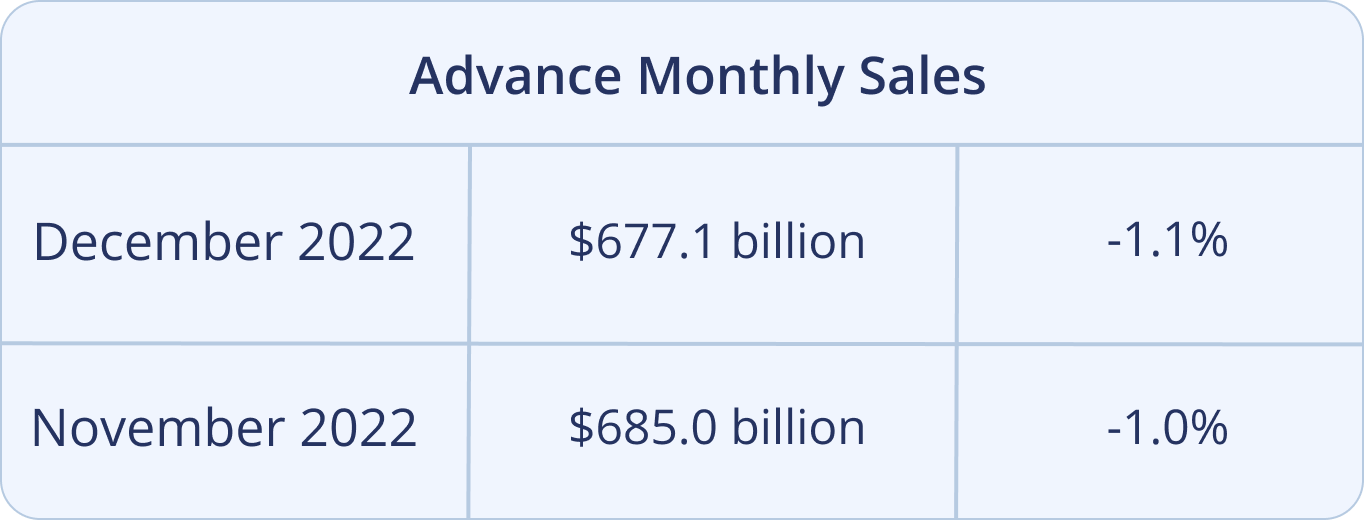

For example, food service and retail sales in December 2022 were down 1.1% from November 2022, but up 6.0% from December 2021. Overall, sales in 2022 were up 9.2% from that of 2021.

Impact of Retail Sales on the Market

Retail sales reports are valuable because they reveal a lot about the economy. Consumer spending habits generally indicate the direction of the economy, whether it is expanding or contracting. The more money that consumers spend, the better it is for company shareholders because they have higher earnings, and high retail sales correspond to favorable movement in equity markets.

Consumer spending also indicates if there is inflationary pressure, which causes fluctuations in inflation due to supply and demand. Additionally, the results from the retail sales report hold significant weight when the Federal Reserve is making decisions.

If there are more retail sales and inflation is increasing, the Fed will generally tighten monetary policy and increase interest rates to lower inflation. If sales are floundering and inflation is low, the Fed will lower interest rates in an attempt to stimulate the economy. Adjusting the economy based on retail sales is crucial, because consumer spending accounts for around two-thirds of the United States’ GDP.

Overall, the RSI indicates:

- The general state of the economy

- Trends in the unemployment rate

- Consumer confidence

- Consumer demand

- Manufacturing activity

- Corporate earnings

How Should Investors React?

If retail sales tell us about corporate earnings, they also indicate stock prices. When consumer spending is high and corporations are earning more, stock prices are likely to rise.

The retail sales index is a useful tool due to the data being merely weeks old. It provides timely data on the current performance of retailers, which can help inform investing decisions.

Individual retailers often release their own sales reports as well, which can create volatility in their stock prices. Whenever there is an upcoming event, such as an earnings release, there is more uncertainty in the market. Uncertainty leads to volatility, which can inform your investment strategy, and may lead to profitable trades.

Another factor in sales data is seasonality. Fourth quarter months, October-December, usually have the highest sales due to holiday shopping.

Retail sales typically correlate with stock prices—higher sales mean higher company earnings and stock prices, which can be a profitable time to invest. However, this historical correlation is not a given, and does not guarantee a return on investments. In general, higher retail sales are good for all investors, apart from bondholders.

The Bottom Line

Regardless of your trading strategy, the retail sales index provides useful data that can help you analyze the current state of the economy, as well as specific companies and stocks. Understanding when the economy is expanding or contracting and how this indicates different inflation rates is important for being an informed investor. When retail sales are high, the economy is strong, the GDP grows, and shareholders and investors are likely to see a rise in share prices.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal