Cash Management Vs. Money Market Funds Vs. Treasuries

Managing cash in your brokerage account is a key piece of the investment puzzle, often overlooked but important for your financial success.

Cash Management, U.S. Treasuries, and Money Market Funds (MMFs) are in the spotlight. Each offers a different way to handle your cash, whether you're after security, yield, or quick access to your funds.

Let's simplify these concepts and learn how they could fit into your financial picture.

Cash Management

At Webull, Cash Management is a place to earn interest on uninvested cash you're not currently using, and lets you earn 3.75% APY on any idle cash.

Benefits:

- Earn Interest: The 3.75% APY can get you more compared to many other accounts.

- Keep All Your Earnings: There are no fees for enrolling in the cash management feature and no minimum amount. Every cent of interest you earn stays with you.

- Peace of Mind: The uninvested cash in your brokerage account that is swept to the program banks is then eligible for protection under FDIC insurance.

- Ease of Use: Cash Management uses the settled cash in your account, you just set it and forget it and it will work for you.

Risks:

- No Investment Choices: Cash Management has no investment choices like the other options do since it is simply interest earned on idle cash.

- Changing Rates: The current interest rate could change since rates change over time with the economy.

U.S. Treasuries

U.S. Treasuries can be a good choice if you don’t need access to cash quickly. In simple terms, they are like loans you give to the U.S. government, and in return, they promise to pay you back with interest over time.

Benefits:

- Steady Income: Interest is paid regularly, which can be a reliable source of income.

- More Choices: Treasuries have different lengths of maturity which can offer investors more diversity, with Bills ranging from 4-52 weeks, Notes ranging from 2-10 years, and Bonds with choices of 20 or 30 years.

- Safety First: U.S. Treasuries are known for being secure since they're backed by the government.

- Lock Yield: With treasuries, you can lock in your interest rate percent, so if interest rates go south you will still earn the same amount of interest.

Risks:

- Not Risk-Free: Like all investments, there's risk, though it's typically lower than other investments and is considered minimal.

- Price Fluctuation: If you decide to sell your Treasuries before maturity, their value could be more or less than what you paid, depending on interest rate changes.

- Liquidity Risk: While Treasuries are generally liquid, during times of financial stress, it might become harder to quickly sell them at fair market value. This can limit your ability to access funds in an emergency.

Read More: Introduction to Bonds

Money Market Funds (MMFs)

When you find yourself with a cash surplus, consider letting Money Market Funds (MMFs) work for you. These funds invest your money into short-term debt securities, which is like issuing a short-term IOU to reliable entities.

Benefits:

- Liquidity on Demand: Get to your funds when needed, affording you the benefit of liquidity.

- Pursuit of Price Consistency: MMFs strive to maintain a fixed net asset value (NAV), offering a less volatile experience compared to the equity market.

- Above-average Yield Potential: Expect yields that tend to edge out traditional savings accounts, though generally lower than riskier investments like stocks or bonds.

- More Choices: Offers a diverse range of investment options within a single fund, allowing for greater flexibility in terms of asset allocation.

Risks:

- Lack of FDIC Protection: MMFs don't come with the same insurance backing as bank deposits, adding an element of risk.

- Variable Earnings: Interest rates can fluctuate with the market, leading to variable income from your investment.

- Some Risk Involved: Traditionally stable, MMFs are not immune to market stress and can depreciate under certain economic pressures.

See More: What Are Money Market Funds?

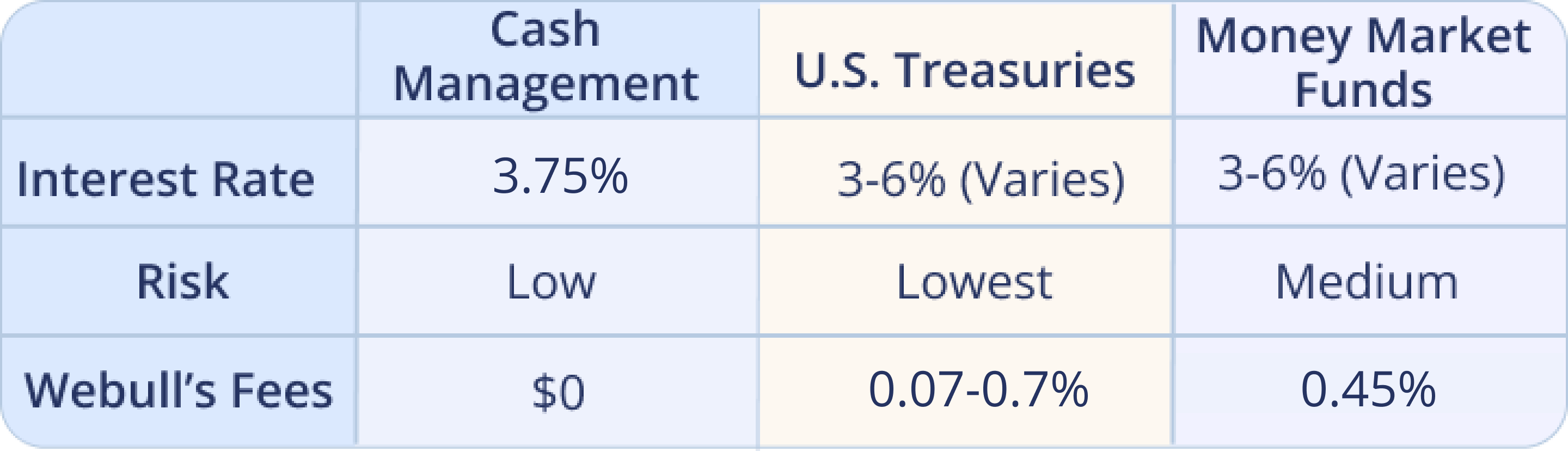

Comparing Cash Management, Treasuries, and Money Market Funds

Cash Management, Treasury securities (Treasuries), and Money Market Funds (MMFs) are all ways to handle your cash, each with its own features. Cash Management works like a bank accounts with extra perks. Treasuries are loans to the U.S. government and available in different time lengths, from a few days to 30 years. MMFs are pools of money invested in short-term debts, designed to keep their value steady.

*All of the information is based on data from December 20th 2024

Cash Management is great for storing cash and keeping things simple and safe. Treasuries are best when you can put away money for a set time and want safety. MMFs are a good mix of getting your cash when needed and getting a little more money back. These are some options you can use to manage your cash well, making sure it's safe, available when needed, and earning a little extra.

The Bottom Line

Cash Management, Treasury securities, and Money Market Funds offer advantages ranging from high liquidity and ease of access with cash management to Treasuries' predictable returns and the competitive yields of MMFs. The key is choosing the right mix that aligns with your personal investment goals, whether accessibility, security, or growth.

Investors looking to learn more about Stocks, Options, Bonds, and ETFs, should consider exploring the Webull Learn Center further, to read more to help their investing strategies and trading techniques.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal