Short Straddle

Introduction

Based on your research, you believe the stock you are interested in is going to trade around the same price for the next few months. You are looking to express your opinion that the stock’s volatility will decrease.

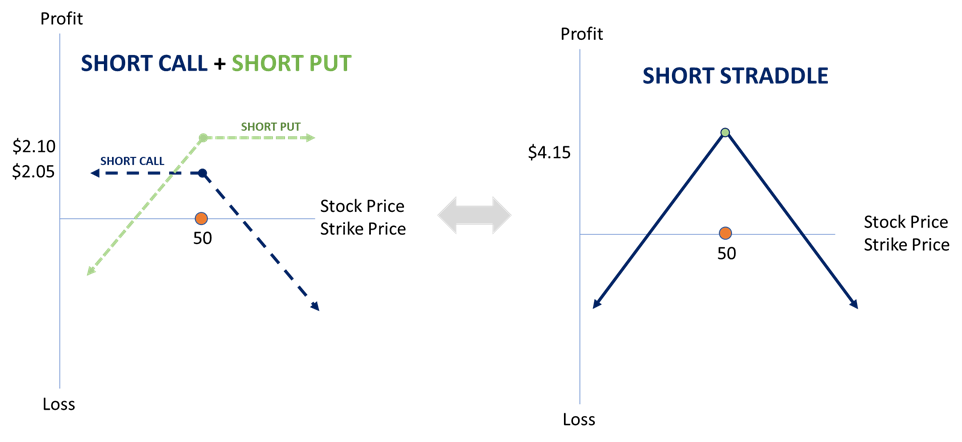

Utilizing your foundational knowledge of short call and short put positions, you decide to sell both a call and a put; the result is a short straddle position.

What exactly is a Short Straddle?

A short straddle consists of one short call and one short put. Both options must have the same underlying security, the same strike price, and the same expiration date for the strategy to be referred to as a straddle.

A short straddle is established for a net credit because you collect premiums from selling the options.

This strategy exposes you to the risks and benefits of short options. The short call has unlimited upside risk exposure while the short put has significant but capped risk exposure on the downside. The maximum gain for the short straddle is the total net premium collected for the call and the put.

Short Straddle Strategy: Additional Observations

A short straddle may be the strategy of choice when the forecast is for neutral, or range-bound, price action. Straddles are often sold between earnings reports and other publicized announcements that have the potential to cause sharp stock price fluctuations.

It is important to remember that the price of calls and puts – and therefore the price of straddles – contains the collective opinion of options market participants on how much the stock price will move prior to expiration. This means that sellers of straddles believe that the market consensus is “too high” and that the underlying security price will stay between the breakeven points.

“Selling a straddle” is intuitively appealing because you can collect two option premiums and the stock price must move quite a bit before you lose money. The reality is that the market is often “efficient,” which means that straddle prices are frequently an accurate gauge of how much a stock price is likely to move prior to expiration. Selling a straddle, like all trading decisions, is subjective and requires good timing for both entering the position and exiting or selling out of it.

The Straddle vs. Strangle Debate

Short straddles are often compared to short strangles, with traders frequently debating which strategy is “better.”

Short straddles involve selling a call and put with the same strike price and expiry on the same underlying asset. For example, sell a January 100 call and sell a January 100 put on XYZ stock. Short strangles, however, involve selling a call with a higher strike price and selling a put with a lower strike price. For example, sell a January 105 call and sell a January 95 put on XYZ stock.

Neither strategy is “better” in an absolute sense – each has unique trade-offs.

There is one advantage of a short straddle:

- The premiums received and maximum profit potential of one straddle (one call and one put) are greater than for one strangle.

There are three disadvantages of a short straddle:

- The breakeven points are closer together for a straddle than for a comparable strangle.

- There is a smaller chance that a straddle will attain its maximum profit potential if it is held to expiration.

- Short straddles are less sensitive to time decay than short strangles. Thus, when there is little or no stock price movement, a short straddle will experience a lower percentage profit over a given time period than a comparable strangle.

Example

- Sell 10 January XYZ 50 calls for $2.05

- Sell 10 January XYZ 50 puts for $2.10

In our example, assume stock XYZ is currently trading at $50. We sell 10 XYZ at-the-money calls for a total of $2,050 (10 x 100 multiplier x $2.05), less commissions and fees, and simultaneously sell 10 at-the-money XYZ puts for a total of $2,100 (10 x 100 multiplier x $2.10), less commissions and fees.

As a result of these two simultaneous trades, our account has a credit balance of approximately $4,150 (excluding commissions and fees).

Outcome 1: Profit

With a short straddle position, you are committing to volatility decreasing. This means your sentiment is neutral, believing that the stock price will not move far from the strike price.

Let’s assume we are correct in our sentiment, and the stock price hovers around the strike price. To calculate our profit at expiration on the position, use the following formula:

Profit = Net Profit/Loss from the Short Call + Net Profit/Loss from the Short Put

For the Short Call,

if S–K > 0, then the Loss = – (Current Stock Price – Strike Price) + Net Premium Received

= – Current Stock Price + Strike Price + Net Premium Received

if S–K < 0, then the Profit = Net Premium Received

For the Short Put,

if K–S > 0, then the Loss = – (Strike Price – Current Stock Price) + Net Premium Received

= – Strike Price + Current Stock Price + Net Premium Received

if K–S < 0, then the Profit = Net Premium Received

Max Profit = Total Net Premiums Received

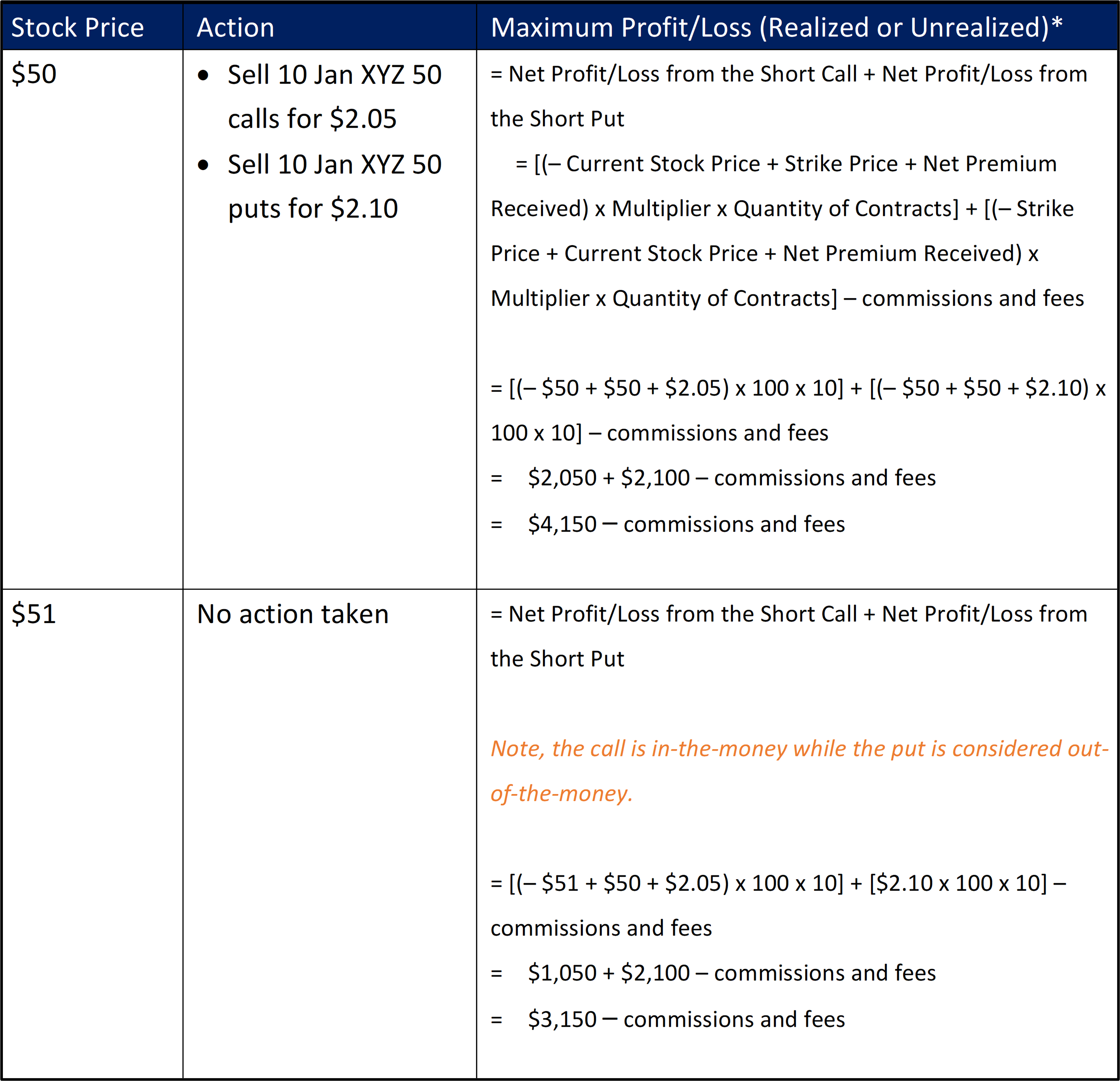

Example

Stock XYZ is trading at $50 and you establish a short straddle position.

- Sell 10 January XYZ 50 calls for $2.05

- Sell 10 January XYZ 50 puts for $2.10

A week later, stock XYZ is trading higher at $51.

*Unrealized profits/losses are those that potentially exist; realized profits/losses occur when you close out or trade out of the position.

Outcome 2: Loss

Let’s assume the market fluctuates wildly and we are incorrect about our forecast of volatility decreasing. To calculate our loss on the position, use the following formula:

Loss = Net Profit/Loss from the Short Call + Net Profit/Loss from the Short Put

For the Short Call,

if S–K > 0, then the Loss = – (Current Stock Price – Strike Price) + Net Premium Received

= – Current Stock Price + Strike Price + Net Premium Received

if S–K < 0, then the Profit = Net Premium Received

For the Short Put,

if K–S > 0, then the Loss = – (Strike Price – Current Stock Price) + Net Premium Received

= – Strike Price + Current Stock Price + Net Premium Received

if K–S < 0, then the Profit = Net Premium Received

Max Loss = Unlimited (upside); Significant though capped (downside)

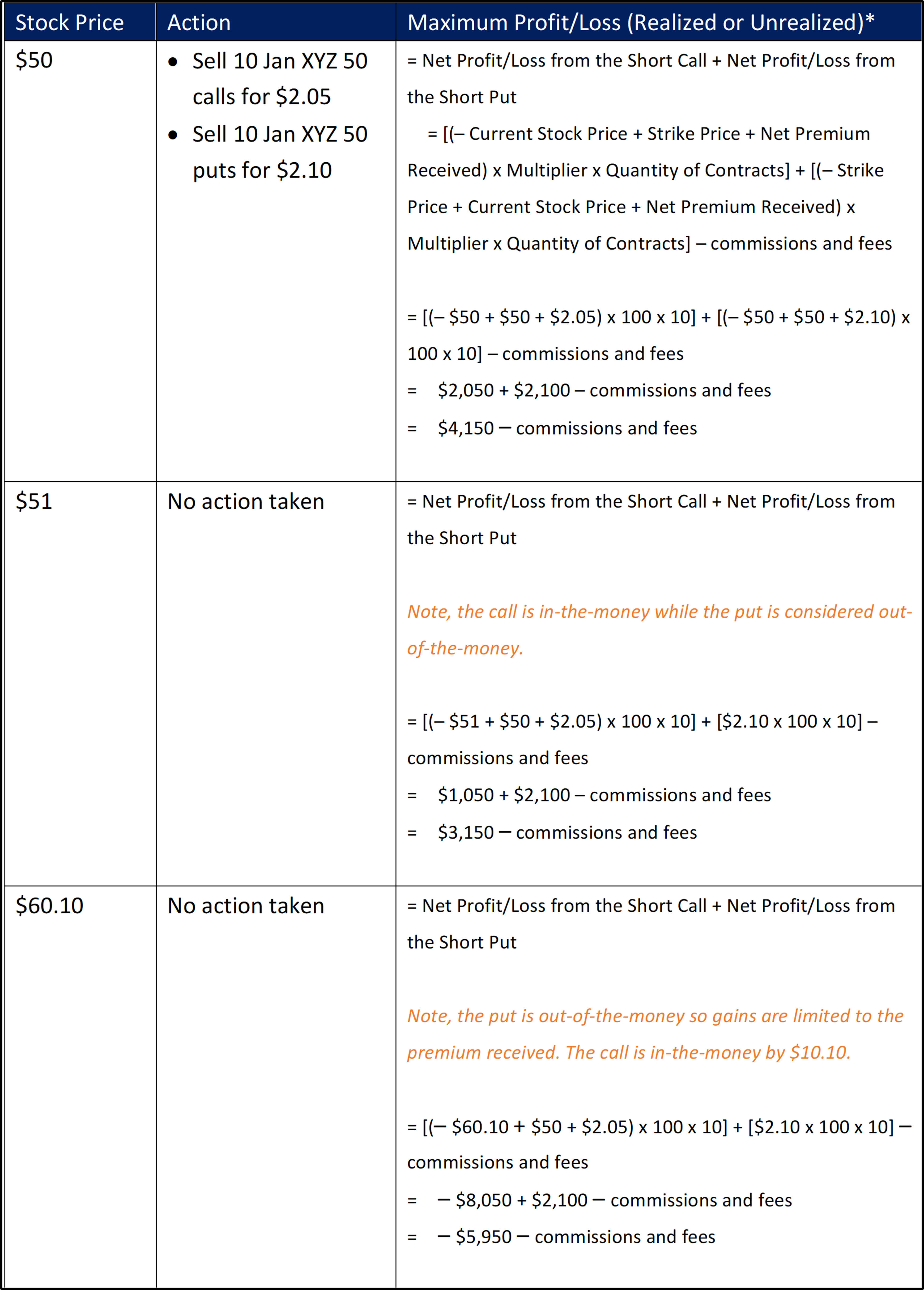

Example

Stock XYZ is trading at $50 and you establish a short straddle position.

Sell 10 January XYZ 50 calls for $2.05

Sell 10 January XYZ 50 puts for $2.10

A week later, stock XYZ is trading higher at $60.10.

*Unrealized profits/losses are those that potentially exist; realized profits/losses occur when you close out or trade out of the position.

Outcome 3: Breakeven

There are two potential breakeven points for the short straddle:

- Strike plus net premiums received

- Strike minus net premiums received

Upside Breakeven Price = Strike Price + Net Premiums Received

Downside Breakeven Price = Strike Price - Net Premiums Received

Example

Stock XYZ is trading at $50 and you establish a short straddle position.

- Sell 10 January XYZ 50 calls for $2.05

- Sell 10 January XYZ 50 puts for $2.10

- Fees and commissions = $20 total or $0.20 per share

Short Straddle Upside Breakeven Price = $50 + ($4.15 + $0.20) = $54.35

Short Straddle Downside Breakeven Price = $50 – ($4.15 + $0.20) = $45.65

At-A-Glance

Strategy

- Short Straddle

Alternative Name

- n/a

Pre-Requisite Strategy Knowledge

- Short Call

- Short Put

Legs of Trade

- 2 legs

Sentiment

Neutral; Volatility Decreasing

Example

- Short 10 Jan XYZ 50 calls

- Short 10 Jan XYZ 50 puts

Rule to Remember

- The strike price, underlying, and expirations must be the same for the call and the put

Max Potential Profit (GAIN)

- Total premiums received less transaction fees and commissions

Break-Even Points

At expiration, there are two potential breakeven points:

- Upside breakeven = Strike plus net premiums received for the straddle

- Downside breakeven = Strike minus net premiums received for the straddle

Max Potential Risk (LOSS)

- Unlimited upside risk; significant though limited downside risk is capped

Ideal Outcome

- XYZ price trades at or near the strike price

Early Assignment Risk

American options can be exercised on any business day, and the holder of a short option position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment must be considered when entering positions involving short options. Early assignment of options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned.

The short straddle strategy has early assignment risk.

Short calls that are assigned early are generally assigned on the day before the ex-dividend date. Therefore, if the stock price is above the strike price of the short straddle, an assessment must be made if early assignment is likely. If assignment is deemed likely and if a short stock position is not wanted, then appropriate action must be taken before assignment occurs (either buying the short call and keeping the short put open or closing the entire straddle).

Short puts that are assigned early are generally assigned on the ex-dividend date. Therefore, if the stock price is below the strike price of the short straddle, an assessment must be made if early assignment is likely. If assignment is deemed likely and if a long stock position is not wanted, then appropriate action must be taken before assignment occurs (either buying the short put and keeping the short call open or closing the entire straddle).

If early assignment of a stock option does occur, then stock is purchased (short put) or sold (short call). If no offsetting stock position exists, then a stock position is created. If the stock position is not wanted, it can be closed in the marketplace by taking appropriate action (selling or buying). Note, however, that the date of the closing stock transaction will be one day later than the date of the opening stock transaction (from assignment). This one-day difference will result in additional fees, including interest charges and commissions. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position.

Potential Position Created at Expiration:

There are three possible outcomes at expiration: the stock price can be at the strike price of a short straddle, above it, or below it.

- If the stock price is at the strike price of a short straddle at expiration, then both the call and the put expire worthless and no stock position is created.

- If the stock price is above the strike price at expiration, the put expires worthless, the short call is assigned, stock is sold at the strike price and a short stock position is created. If a short stock position is not wanted, the call must be closed (purchased) prior to expiration.

- If the stock price is below the strike price at expiration, the call expires worthless, the short put is assigned, stock is purchased at the strike price and a long stock position is created. If a long stock position is not wanted, the put must be closed (purchased) prior to expiration.

Note: options are automatically exercised at expiration if they are one cent ($0.01) in the money. Therefore, if the stock price is “close” to the strike price as expiration approaches, assignment of one option in a short straddle is highly likely. If the holder of a short straddle wants to avoid having a stock position, the short straddle must be closed (purchased) prior to expiration.

Charts

-Powered by The Options Institute

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal