How do Long-term Investors Pick Stocks in a Bear Market?

As the S&P 500 went down nearly 25% from its peak, we have to face the fact that we are in a bear market. The bad news is that we cannot determine when exactly a bear market will end, but the good news is that it can offer you one of the most profitable times to buy. Even strong stocks have declined by 40% or more, which presents a unique opportunity to invest in quality stocks at discounted prices.

Blindly looking for diamonds in the rough is not efficient. Here's how you can find favorable stocks to help survive a market downturn.

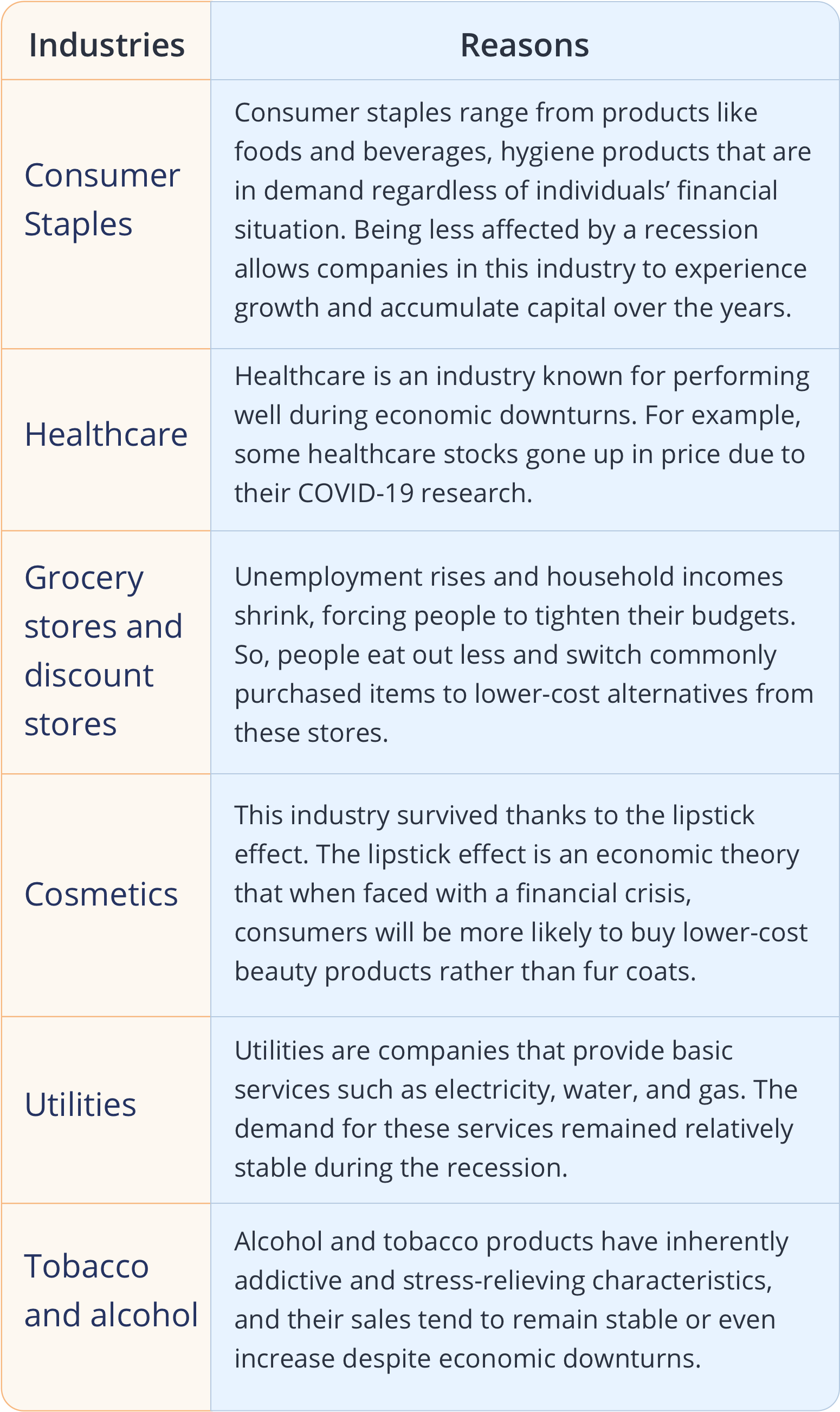

Watch Historically Recession-resistant Industries

Like Warren Buffett said, only when the tide goes out do you discover who's been swimming naked. Some industries are relatively less sensitive to the ups and downs of the economic cycle and changes in interest rates. They provide investors with recession-proof stocks to hold during economic turbulence.

The table below shows examples of recession-resistant industries and the reasons why they are relatively immune to the downturn.

Consider Undervalued Stocks

If you're shopping and see a $100 product on sale for $80, it can be considered undervalued. Similarly, an undervalued stock is trading for less than it is worth.

You can buy low because the majority are neglecting the undervalued stock. Then you can sell high if the price increases when the value goes up. Below are three key indicators to identify such undervalued stocks.

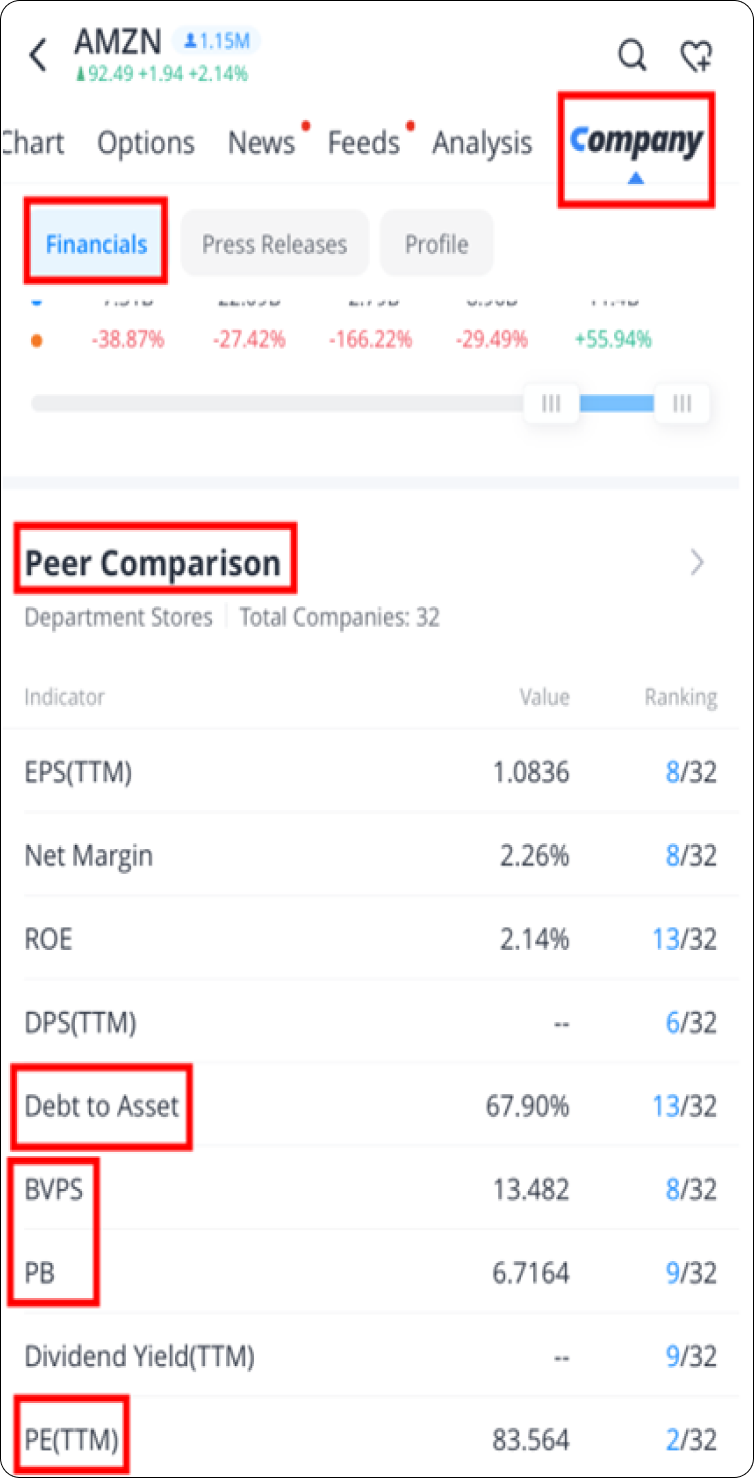

- Price-to-earnings ratio indicates how much money you need to spend to make a $1 profit, which is calculated by dividing the price per share by the earnings per share. If a company in a particular industry has a P/E ratio of 20 with its major competitors at 25, the company stock may be undervalued.

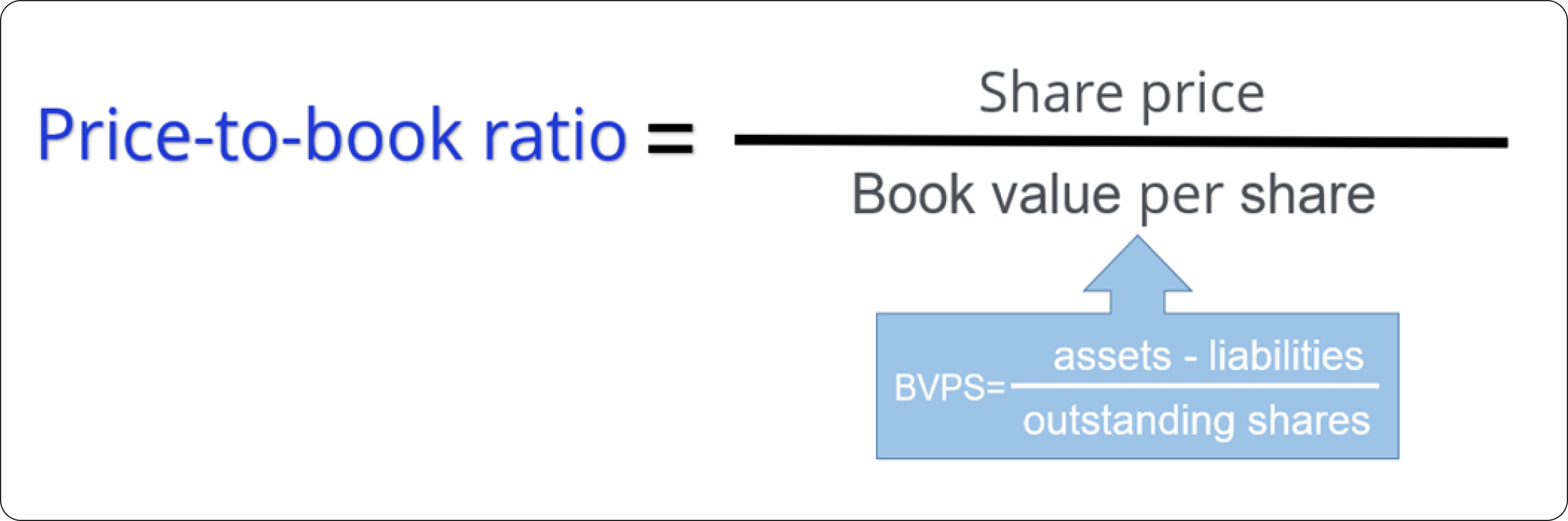

- Price-to-book ratio is used to evaluate a stock's current market price compared to the company's book value. A stock could be undervalued if the P/B ratio is less than 1, which means the BVPS is more than the current price.

- Debt-asset ratio compares a company's debt obligations to its total assets. A debt-asset ratio of less than 100% indicates that a company has more assets than debt. To establish if it is undervalued, a company’s debt-asset ratio should always be compared with the average of its competitors. The smaller the debt-asset ratio, the relatively safer the stock.

Compare a stock with the indicators of its major competitors. When several indicators are all pointing in the same direction, you have probably spotted the undervalued stock.

Choose a symbol and go to the details page. Click Company>Financials>Peer Comparison to find these indicators and the stock’s ranking.

How to Find Undervalued Stocks on Webull

With Webull Screener, you can filter last price, BVPS, debt to asset, P/E, and other indicators to locate undervalued stocks. Click here to access Screener>>>

Refer to the GIF below for instructions on how to use the Screener:

Disclaimer: All companies, symbols or indicators’ parameters provided are for educational and informational purposes only and do not constitute an investment recommendation or advice.

The Bottom Line

A bear market may not be the right time to take outsized risks, but investors can keep their money as safe as possible by choosing the right stocks and persisting with a long-term outlook.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal