How Inflation Impacts Interest Rates and Markets

Inflation affects numerous aspects of the market, and many factors influence inflation rates. Read more about the contributing factors and effects of the 2021-2022 inflation surge.

Introduction to the 2021-2022 Inflation Surge

Inflation is the rate at which prices for goods and services increase, especially that caused by persistent excessive expansion of the money supply. A moderate inflation level can be considered a sign of a healthy economy because a growing economy generates growing demand for goods and services. But if inflation is too low or too high, a destructive cycle can result.

The most obvious impact of persistently high inflation is that real purchasing power will decrease if consumer earnings have not risen in tandem with inflation. What could have been purchased a year prior for $100 might now cost much more. This loss of real purchasing power can slow down consumer spending, increasing the likelihood of recession.

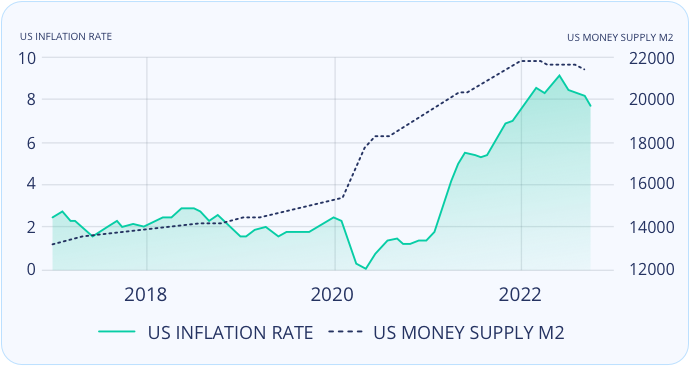

The U.S. economy has experienced surging inflation since mid-2021. Although the cause of this inflation surge has been the subject of heated debate, many factors are thought to contribute to it. The Covid-19 pandemic created enormous demand for consumer staples while grinding supply chains to a halt, driving prices up sharply and creating shortages. At the same time, U.S. monetary policymakers responded with significant increases in the money supply, starting in early 2020. In early 2022 the breakout of a war between Russia and Ukraine created large disruptions in the global markets for wheat and natural gas, among other commodities. The relative strength of the labor market has driven up producer prices, which are also ultimately reflected in inflation figures. All of these factors are often mentioned as contributors to the inflation surge.

What Role does the Federal Reserve Play in Inflation?

Like other central banks, the Federal Reserve attempts to maintain inflation at moderate, targeted levels, by influencing interest rates. When inflation is too high, the Federal Reserve will typically raise interest rates to lower inflation, accepting that this will most likely slow down the economy and increase unemployment. When inflation is too low, the Federal Reserve will typically lower interest rates to stimulate the economy, accepting that this will necessarily bring inflation up to some degree. It's important to remember that today's inflation rate release is only one data point. Investors usually pay close attention to how the Fed will digest more information before its next announcement.

When the Fed is trying to balance the economy, taming inflation by raising interest rates is the overarching goal. However, this requires caution. Aggressive or "hawkish” tightening policies risk triggering a recession and potentially destabilizing the entire financial system. As shown in the below chart, the inflation rate has accelerated since early 2021. The Fed responded by approving their first interest rate increase of 25 basis points in March 2022, with more aggressive hikes in the following meetings. Raising rates at a pace the market can absorb and managing expectations are very important for a successful plan.

How Does the Market Respond?

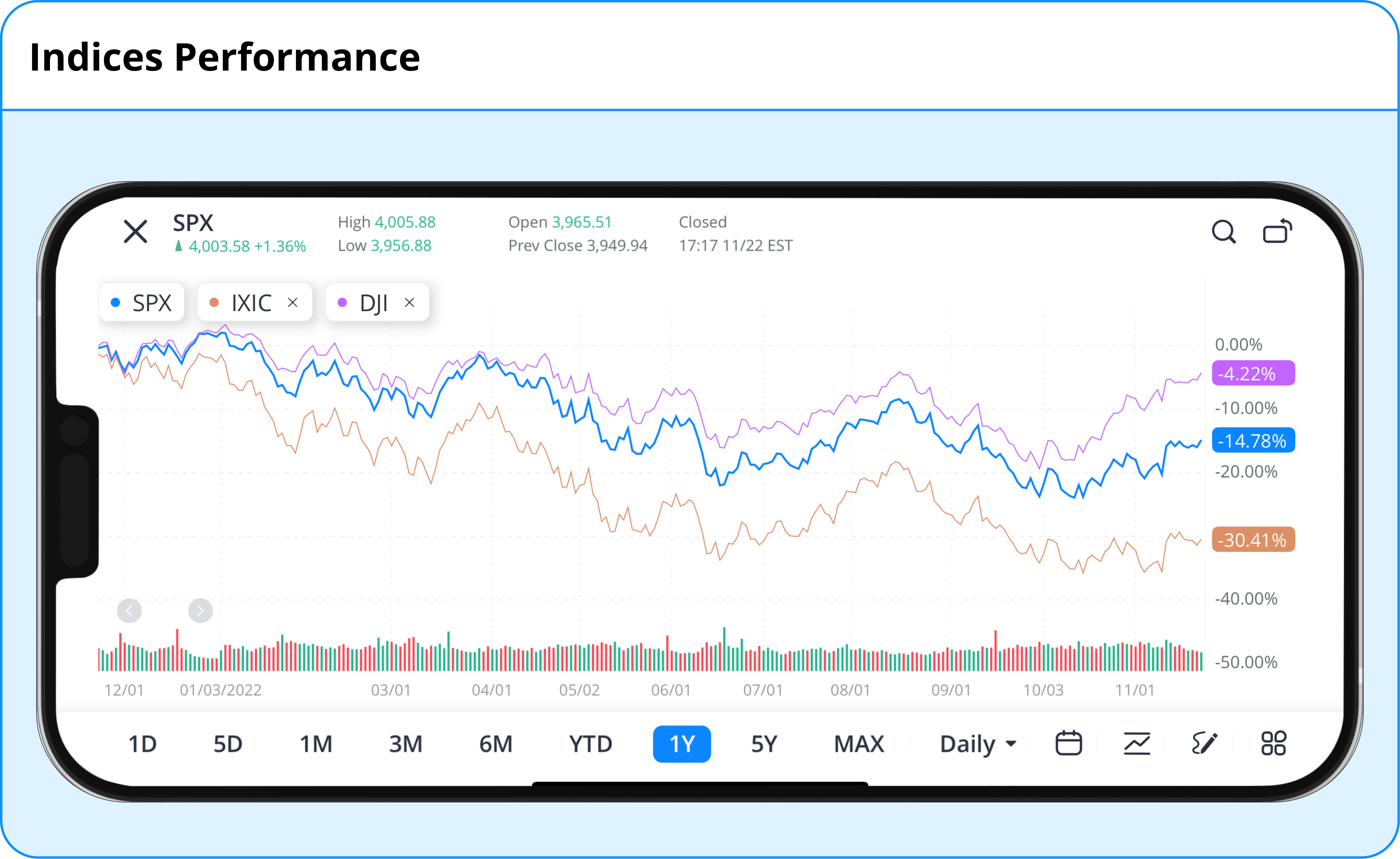

In most cases, major indices will fall on the announcement of a rate hike, because rising interest rates raise borrowing costs for companies and consumers and weigh on economic activity. Growth stocks are particularly sensitive to rising interest rates due to the negative outlook higher interest rates create for future cash flows, tamping down projections and stunting investment in growth prospects.

Hedging tools can help investors protect themselves in down markets when the net assets in their portfolios are lower. Some financial institutions may establish long put positions to diversify the downside market risk in their portfolio, such as $S&P 500 Index options. The high demand for put options will drive higher trading volume relative to calls, leading to a higher Volume Put/Call Ratio or Open Interest Put/Call Ratio. Some investors may then use SPX Put/Call Ratio as an indicator to gauge market sentiment. For example, the Volume Put/Call Ratio in 2015 was as high as 3.77 because of market fears due to global economic issues, such as the GDP growth slowdown in China and a Greek debt default.

The Bottom Line

There are plenty of ways to prepare for inflation. Knowing inflation investing strategies can help you choose a strategy that might match your investment time horizon and risk tolerance.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal