- PREMIUM

- LIVE QUOTES

- INSTITUTIONS

What do I need to know about the Webull Option Seller Report?

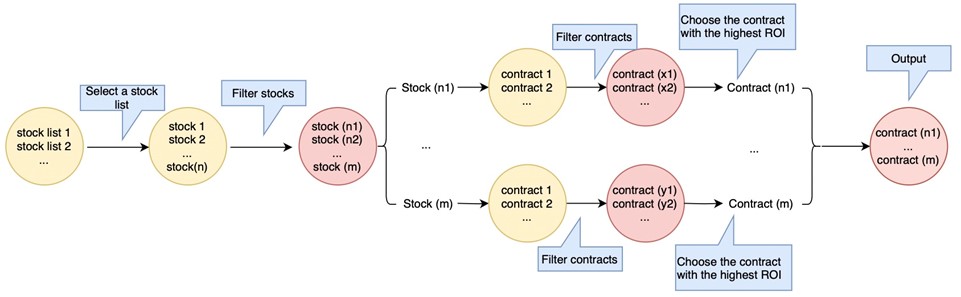

What is the Webull Option Seller Report? Webull’s Option Seller Report is a tool designed to help option sellers sort through thousands of option contracts with different strike prices and expiration dates to get the highest ROI. If you are new to options writing, this tool may help you get started selling options. If you are an experienced option seller, it may enhance the option writing process. How do you use the Option Seller Report? Step 1 - Select a stock list As an option seller, you may want to screen for suitable option contracts to sell out of a larger pool of symbols. This tool supports two specific stock lists for this purpose: Whole Market and S&P 500. "Whole Market" presents you with a list of all symbols you can sell options on from the whole market. "S&P 500" shows option-tradable symbols from among the 500 companies that make up S&P’s famous index. Step 2 - Choose an option strategy Before you select a contract, you must decide what strategy to use. This tool currently supports two basic option selling strategies: Cash-secured Puts and Covered Calls. Step 3 - Set a stock filter After selecting a strategy, you may want to screen for underlying stocks which demonstrate specific patterns. For example, when you choose a Cash-secured Put, you may be more interested in stocks that are neutral or bullish in trend. This tool has the moving average (MA) technical indicator integrated in its search function, allowing you to filter contracts based on this indicator. For example, you can set filters to see the last price above MA5, MA5 crossed above MA10, etc. Step 4 - Set an option filter Once you’ve set the Stock Filter, you’ll have a filtered list of stocks to choose from. But each stock has many option contracts with different strike prices and expiration dates that may need further filtering. For example, you might want to filter out contracts that are too illiquid or too far out-of-the-money, or you might want to select contracts that are nearing expiration. To screen for suitable option contracts, we offer 5 Option Filter parameters: Moneyness, Minimum Open Interest, Days to Expiration, Return on Investment, and Delta. Step 5 - Choose the right options contract Using the Option Filter, all option contracts (Call or Put) under each stock are screened, and the top 100 by largest ROI will be selected from those that fit the screening criteria. However, the contract with the largest ROI is not always the most suitable. To help you make an informed decision, we’ve added more indicators to the final list, for even more precise screening of contracts. |

|

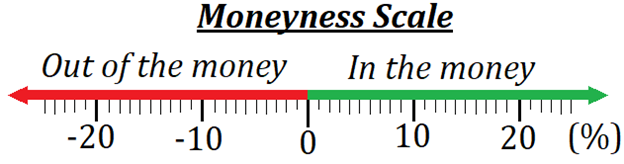

How do you set a Stock Filter? This tool is integrated with the “Moving Average” technical indicator, and you can set filter conditions based on this indicator. Up to 5 filter conditions can be set. How do you set an Option Filter? To screen for suitable option contracts, we offer 5 Option Filter parameters: Moneyness, Minimum Open Interest, Days to Expiration, ROI, and Delta. Moneyness Moneyness refers to a contract’s intrinsic value, based on how far the contract is in the money —in other words, how profitable or unprofitable it would be for the holder of the option to exercise (not taking into account premiums paid or received). The percentage figure for moneyness can either be positive or negative based on whether the contract is in-the-money or out-of-the-money. See the graphical depiction of the relationship between the percentage of moneyness versus whether the option is either in the money or out of the money. |

|

To see an example of how moneyness is calculated, let’s imagine an OTM put contract with an underlying stock price of $100 and a strike price of $80. Using the equation (80-100)/100 we calculate a moneyness of -20%. This means that the stock price must fall by 20% before it will become profitable for a put holder to exercise. The further out-of-the-money a contract is, the more the price of the underlying must move before the contract is profitable to exercise. In this way, a contract being further OTM is better for the option seller. However, a lack of moneyness also means the seller receives a smaller premium, as there is less likelihood that the contract will have any value to the buyer. The default range of moneyness is set to -25%-0%, but can be set to a custom range. Minimum Open Interest Open interest tracks how many open positions there are for a particular contract. Higher open interest typically indicates more liquidity. By setting a minimum on open interest, you are able to filter out contracts with lower liquidity. The default minimum open interest is set to 100, but can be set to any amount. Days to Expiration (DTE) The days to expiration (DTE) of an option is the number of days remaining until the option expires. Option sellers often focus on contracts with smaller DTE, because as the expiration date approaches, Time Decay will become significantly larger (except for deep in-the-money/out-of-the-money contracts). The default range of DTE is set to 0-45 days, but this range can be modified. Return on Investment (ROI) Return on Investment (ROI) is a popular profitability metric used to evaluate how well an investment has performed. ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay. The default range of ROI is set to 0% to 100%. You can modify this amount. Delta Delta is the theoretical estimate of how much an option's value may change given a $1 move in the underlying security. For a short call, the value of Delta is between -1 and 0, and for a short put, the value of Delta is between 0 and 1. Delta can also be used to help assess the likelihood that an option will end in-the-money at expiration. As a general rule, the smaller the absolute value of Delta, the lower the probability that the contract will be assigned.

ROI

ROI if assigned ROI if assigned = [premium + (strike price – stock price)]/ (stock price- premium)) This indicator is only available for Covered Calls, and it represents the maximum rate of return for investors who receive an assignment on their covered call position. This return calculation includes the premium collected from the sale of the call, and the potential gain from stock price rise. For OTM Covered Calls, ROI and ROI if assigned are in a trade-off relationship. ROI gets smaller the further away the strike price is from the stock price, while the ROI-if-assigned gets larger. Note: ROI Calculations for covered calls use the price of the underlying stock at the current time. If you sell a covered call against a pre-existing long stock position, the actual Return on Investment will be based on your cost basis in that position, which may be different from the current stock price.

|

Option trading entails significant risk and is not appropriate for all investors. Option investors can rapidly lose the entire value of their investment in a short period of time and incur permanent loss by expiration date. You need to complete an options trading application and get approval on eligible accounts. Please read the Characteristics and Risks of Standardized Options and Option Spread Risk Disclosure before trading options. |

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal