What Chips&Media, Inc.'s (KOSDAQ:094360) 25% Share Price Gain Is Not Telling You

Chips&Media, Inc. (KOSDAQ:094360) shareholders have had their patience rewarded with a 25% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

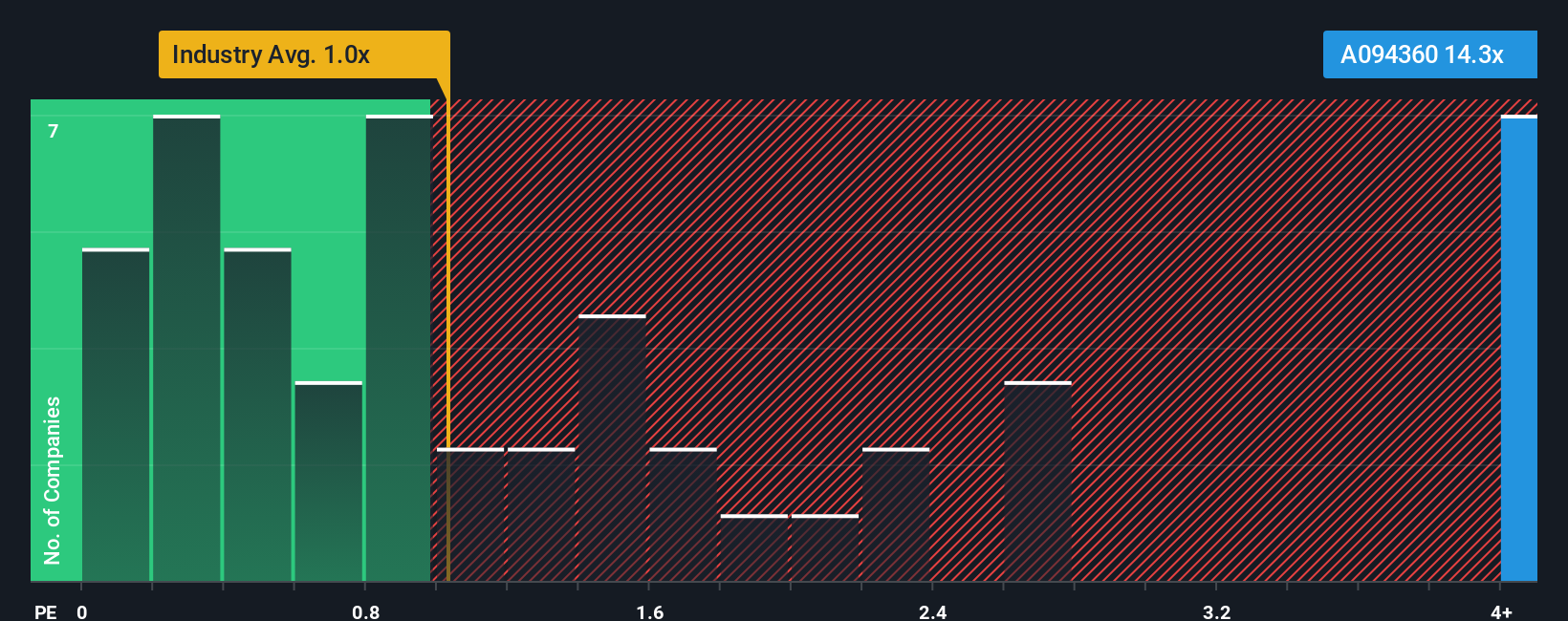

Following the firm bounce in price, given around half the companies in Korea's Communications industry have price-to-sales ratios (or "P/S") below 1x, you may consider Chips&Media as a stock to avoid entirely with its 14.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Chips&Media

What Does Chips&Media's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Chips&Media has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chips&Media.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Chips&Media's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 9.3% gain to the company's revenues. Revenue has also lifted 13% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 49% per annum, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Chips&Media's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Chips&Media's P/S?

The strong share price surge has lead to Chips&Media's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Chips&Media currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about this 1 warning sign we've spotted with Chips&Media.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal