FarmerCore Service Overhaul and Portfolio Shift Could Be A Game Changer For AGCO (AGCO)

- In recent months, AGCO has begun overhauling its dealer service model through its FarmerCore initiative, shifting toward an “Amazon-style” on-farm service network supported by mobile fleets, smaller dealer locations, and parts depots while also exiting low-margin grain and protein operations and pursuing company-wide cost savings.

- This transformation points to a deeper realignment of AGCO’s business toward higher-margin precision technology, more profitable aftermarket service, and a leaner operating structure aimed at strengthening competitiveness.

- We’ll now explore how FarmerCore’s on-farm service focus and related restructuring could reshape AGCO’s investment narrative for long-term-oriented investors.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

AGCO Investment Narrative Recap

To own AGCO, you need to believe that farmers will keep adopting more technology-heavy equipment and that AGCO can translate that shift into steadier, higher-margin service and parts revenue. The FarmerCore rollout and related restructuring support that story but do not materially change the near term tension between cost savings efforts and the risk that weak demand and elevated dealer inventories in North America continue to pressure margins.

The FarmerCore announcement ties directly to AGCO’s push into precision technology and aftermarket service, sitting alongside its expanded Trimble partnership and exit from grain and protein as part of a broader simplification of the business. Together, these moves are intended to refine where AGCO competes and how it supports its installed base, which matters for how resilient earnings could be if industry demand in Europe and North America stays soft.

Yet while FarmerCore targets more profitable service work, investors should still be aware that prolonged weak demand and inventory overhangs could...

Read the full narrative on AGCO (it's free!)

AGCO’s narrative projects $12.1 billion revenue and $800.1 million earnings by 2028.

Uncover how AGCO's forecasts yield a $119.86 fair value, a 14% upside to its current price.

Exploring Other Perspectives

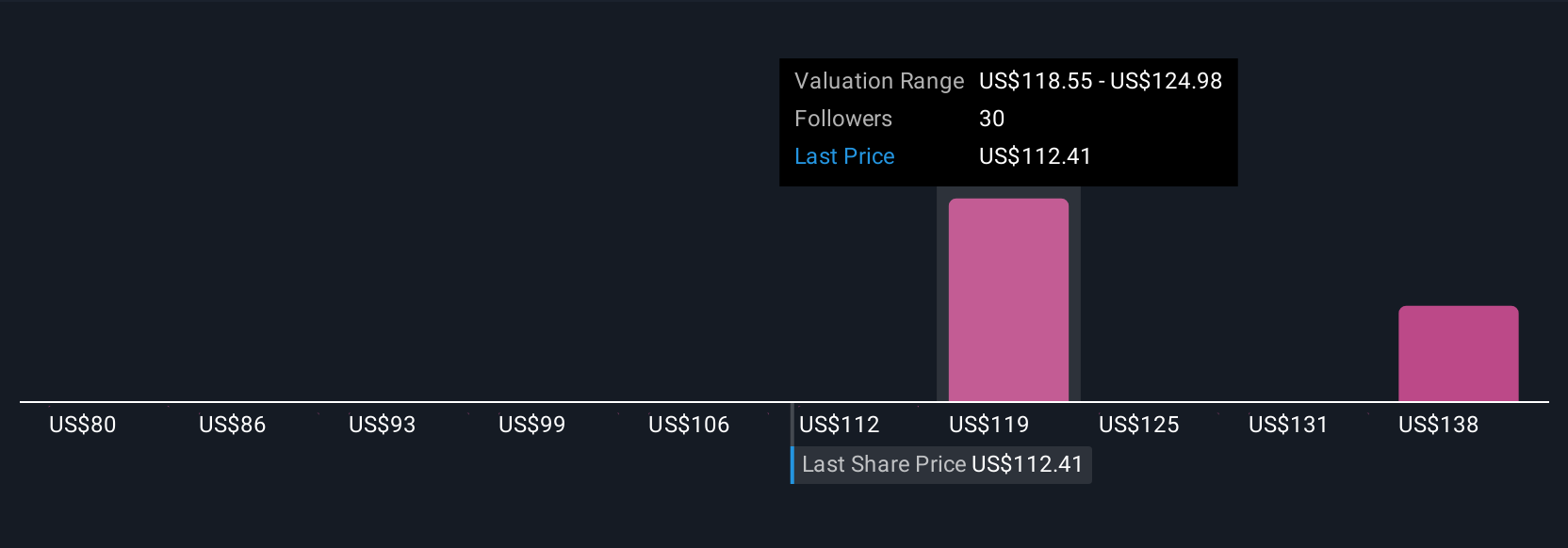

Four Simply Wall St Community valuations for AGCO span about US$80 to roughly US$179 per share, showing how far apart individual views can be. Readers should weigh that dispersion against AGCO’s reliance on recovering demand in North America and Western Europe, and consider how differently that core risk might play out for the business.

Explore 4 other fair value estimates on AGCO - why the stock might be worth as much as 70% more than the current price!

Build Your Own AGCO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AGCO research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AGCO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AGCO's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal