NVR (NVR) Valuation Check After Latest Rating Upgrade and Rebuilding Share Price Momentum

NVR (NVR) ticked higher after a rating upgrade, a move that usually reflects a more constructive view on its prospects and can nudge fresh attention toward the homebuilder and its mortgage operations.

See our latest analysis for NVR.

The upgrade comes after a choppy few months, with the share price at $7,538.08 and a recent 1 month share price return of nearly 4 percent. However, the year to date share price return and 1 year total shareholder return have been weaker, suggesting long term holders are still well ahead thanks to a strong 3 year total shareholder return, while near term momentum is only cautiously rebuilding.

If this shift in sentiment toward NVR has you reassessing the housing cycle, it could be a smart moment to explore auto manufacturers as another way to tap into consumer driven trends.

With shares still below analyst targets but recent earnings showing slightly negative growth, investors now face a key question: is NVR quietly undervalued after this pullback, or is the market already pricing in its next leg of growth?

Price-to-Earnings of 14.9x: Is it justified?

NVR trades on a 14.9x price-to-earnings multiple at the last close of $7,538.08, a level that suggests a modest premium to its closest peers.

The price-to-earnings ratio compares what investors are paying today for each dollar of current earnings, a key yardstick for a mature, profitable homebuilder like NVR. Because earnings are expected to decline by around mid single digits annually over the next few years, a higher multiple implies the market is still ascribing value to the company’s strong profitability profile and balance of homebuilding and mortgage operations rather than to rapid growth.

Against that backdrop, NVR screens as more expensive than both the US Consumer Durables industry average of 11.5x and the peer group at 13x. This underlines that investors are prepared to pay a premium for its high return on equity of roughly the mid 30s and historically high quality earnings. Yet the current 14.9x multiple sits slightly below an estimated fair price-to-earnings ratio of 15.6x, which points to a valuation that could edge higher if sentiment and fundamentals stabilize around that fair ratio benchmark.

Explore the SWS fair ratio for NVR

Result: Price-to-Earnings of 14.9x (ABOUT RIGHT)

However, softer revenue and earnings trends, alongside recent share price underperformance, could signal prolonged housing demand pressure and limit the potential for multiple expansion.

Find out about the key risks to this NVR narrative.

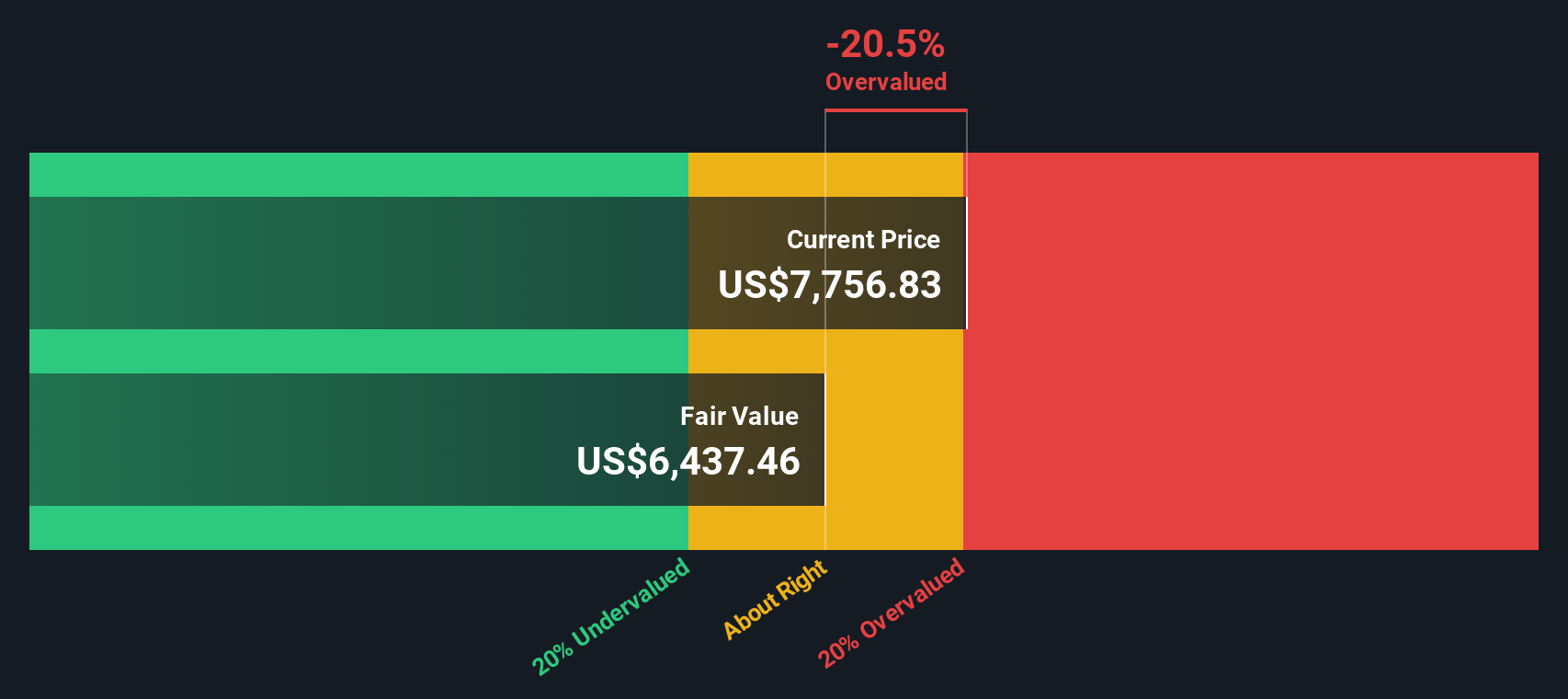

Another View: DCF Flags a Mild Overvaluation

Our DCF model tells a cooler story than the earnings multiple, with NVR trading at $7,538.08 against an estimated fair value of about $7,238.98. That slight premium suggests the market might already be accounting for its quality and returns. This raises the question: where is the real edge for new buyers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NVR for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NVR Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a complete view in minutes, Do it your way.

A great starting point for your NVR research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s screener to work, or you could miss opportunities that match your strategy better than NVR ever will.

- Capture early stage upside by scanning these 3574 penny stocks with strong financials that combine tiny market caps with balance sheets and earnings strong enough to support real, scalable growth.

- Target mispriced quality by focusing on these 908 undervalued stocks based on cash flows where cash flow potential and intrinsic value point to a meaningful margin of safety.

- Position yourself for the next digital shift with these 81 cryptocurrency and blockchain stocks that are building real businesses on blockchain, payments, and token driven ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal