UiPath (PATH) Turns GAAP Profitable and Deepens Veeva Ties – Is Its Automation Edge Shifting?

- In the past week, UiPath reported third-quarter fiscal 2026 results with revenue of US$411.11 million, its first GAAP-profitable quarter, and annual recurring revenue up 11% year over year, while also guiding fourth-quarter revenue to US$462–467 million.

- UiPath also joined the Veeva AI Partner Program to integrate its Test Manager with Veeva Validation Management, aiming to digitize and automate highly regulated software testing and validation workflows with audit-ready, paperless processes.

- Next, we’ll examine how UiPath’s first GAAP-profitable quarter and automation-focused Veeva partnership could reshape its existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

UiPath Investment Narrative Recap

To own UiPath, you need to believe that demand for enterprise automation and agentic AI will keep deepening customer adoption across its platform, offsetting near term macro, deal timing, and SaaS transition headwinds. The first GAAP profitable quarter and slightly ahead consensus Q4 revenue guidance support the case that profitability and scale are improving, but they do not remove key short term risks around slower ARR growth, geopolitical deal delays, and FX pressure on reported results.

The Veeva AI Partner Program announcement is especially relevant here, because it embeds UiPath’s Test Manager inside a highly regulated, workflow intensive environment where automation and audit readiness are mission critical. If this type of partnership helps existing customers expand usage, it could reinforce one of UiPath’s main catalysts: deeper platform adoption within current accounts to support ARR growth and better operating leverage over time.

But against that, investors should be aware that increased macro volatility and delayed deal closures could still...

Read the full narrative on UiPath (it's free!)

UiPath’s narrative projects $1.9 billion revenue and $243.6 million earnings by 2028. This requires 8.6% yearly revenue growth and a $311.1 million earnings increase from -$67.5 million today.

Uncover how UiPath's forecasts yield a $15.93 fair value, a 15% downside to its current price.

Exploring Other Perspectives

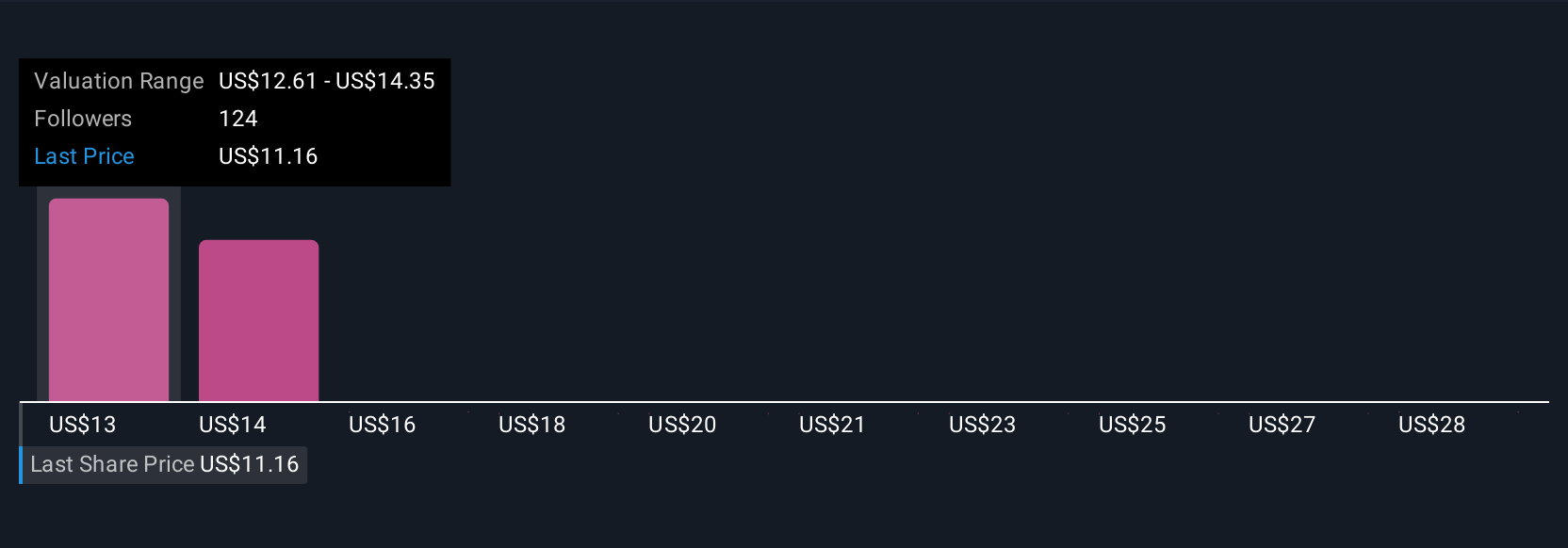

Thirteen Simply Wall St Community fair value estimates span roughly US$13.70 to US$21.54, underscoring how differently individual investors view UiPath’s earnings and revenue potential. You can weigh those against the recent GAAP profitability milestone, which may support the catalyst of improved margins but still sits alongside concerns about softer ARR growth and deal timing that could influence the company’s future performance.

Explore 13 other fair value estimates on UiPath - why the stock might be worth 27% less than the current price!

Build Your Own UiPath Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UiPath research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free UiPath research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UiPath's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal