How Investors May Respond To Antero Resources (AR) Options Surge Around Natural Gas and NGLs Outlook

- In recent days, Antero Resources has experienced a sharp increase in options market activity, highlighting growing investor interest in its natural gas and NGLs business.

- This options surge suggests traders are actively positioning around potential volatility or company-specific developments, adding a fresh layer of complexity to how the stock is being viewed.

- Next, we’ll examine how this heightened options positioning could influence Antero Resources’ investment narrative built around exports, capital efficiency and shareholder returns.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Antero Resources Investment Narrative Recap

To own Antero Resources, you generally need to believe in the enduring role of natural gas and NGLs and the company’s ability to convert that exposure into consistent cash generation. The recent spike in options activity mainly highlights shifting sentiment rather than changing the core story, and it does not materially alter the key short term catalyst around pricing and export optionality or the central risk from long term decarbonization trends.

The recent Q3 2025 earnings release is particularly relevant here, with Antero reporting US$1,213.99 million of revenue and returning to quarterly profitability. That backdrop gives extra context to the options surge, as traders are now reacting to a business that has moved back into the black while still facing structural risks tied to future fossil fuel demand. Yet investors should keep in mind that...

Read the full narrative on Antero Resources (it's free!)

Antero Resources’ narrative projects $6.1 billion revenue and $745.2 million earnings by 2028. This requires 7.9% yearly revenue growth and roughly a $266 million earnings increase from $478.9 million today.

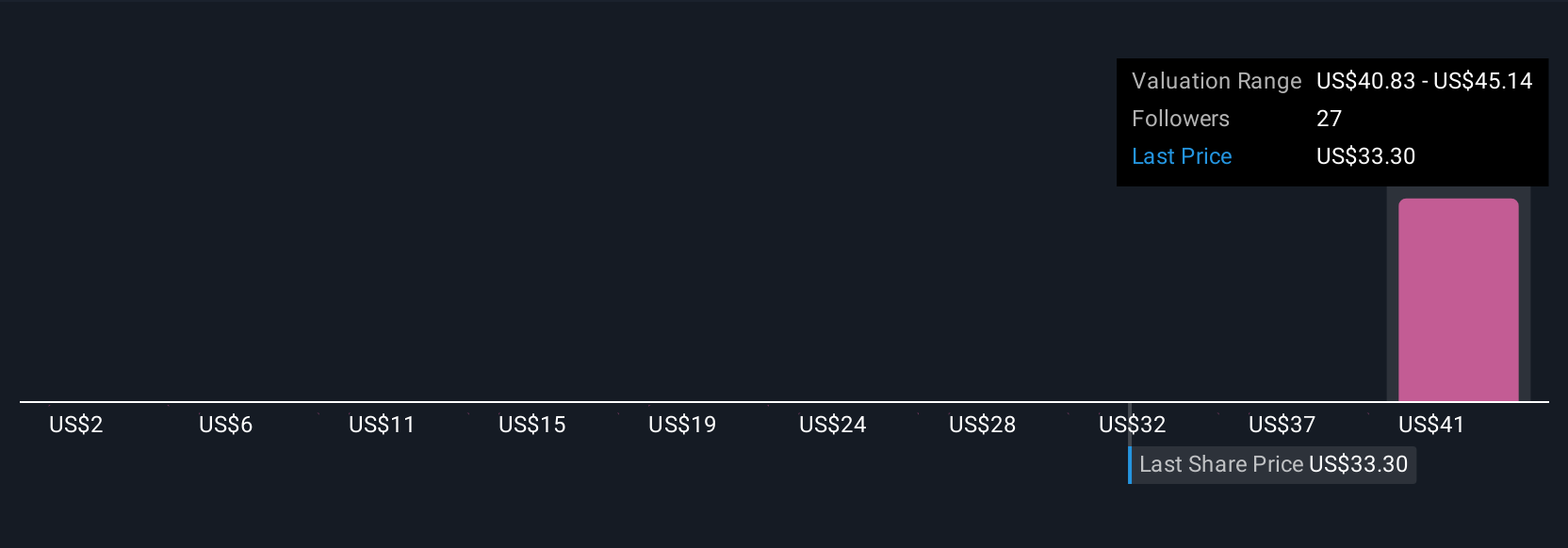

Uncover how Antero Resources' forecasts yield a $42.14 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have three fair value estimates for Antero, ranging from US$29 to about US$97, underscoring how far apart individual views can be. Against that backdrop, the long term risk that decarbonization could structurally pressure natural gas demand is a key factor readers may want to weigh as they compare these different viewpoints.

Explore 3 other fair value estimates on Antero Resources - why the stock might be worth 21% less than the current price!

Build Your Own Antero Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Antero Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Antero Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Antero Resources' overall financial health at a glance.

No Opportunity In Antero Resources?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal