Intel (INTC) Valuation Check as Apple Chip-Making Speculation Fuels a Sharp Share Price Rally

Intel (INTC) is back in the spotlight after a flurry of reports suggested it could start manufacturing Apple’s M series chips by 2027, a potential validation moment for its foundry turnaround.

See our latest analysis for Intel.

The speculation around Apple has landed on top of an already powerful move, with Intel’s share price climbing to about $41.41 and delivering a roughly 105% year to date share price return alongside a near 98% one year total shareholder return. This signals strong momentum behind the turnaround story rather than a short lived squeeze.

If this kind of rebound has you wondering what else could surprise to the upside, it might be worth scanning high growth tech and AI stocks for the next potential inflection story.

But after a 100 percent plus surge, improving earnings, and a price already sitting above the average analyst target, is Intel still trading below its true potential, or are investors now fully pricing in the foundry comeback?

Most Popular Narrative: 11.1% Overvalued

With Intel last closing at $41.41 against a narrative fair value of about $37.27, the current price already leans ahead of the modeled recovery path.

Supportive balance sheet actions and aggressive investment in product and foundry buildout are viewed as increasing the probability that Intel can narrow its technology and scale gap with leading foundry peers over time, which underpins higher valuation multiples.

Want to see what kind of revenue trajectory, margin rebuild, and future earnings multiple are being baked into that fair value? The narrative leans on a specific growth glide path, a carefully calibrated profitability rebound, and a premium forward valuation usually reserved for category leaders. Curious which of those moving parts does the heavy lifting in the model, and how sensitive the outcome is to each assumption? Dive into the full narrative to unpack the numbers behind this price.

Result: Fair Value of $37.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, serious execution risks around Intel’s complex foundry buildout, along with potential margin pressure from low priced contracts, could still derail the recovery narrative.

Find out about the key risks to this Intel narrative.

Another Lens on Value

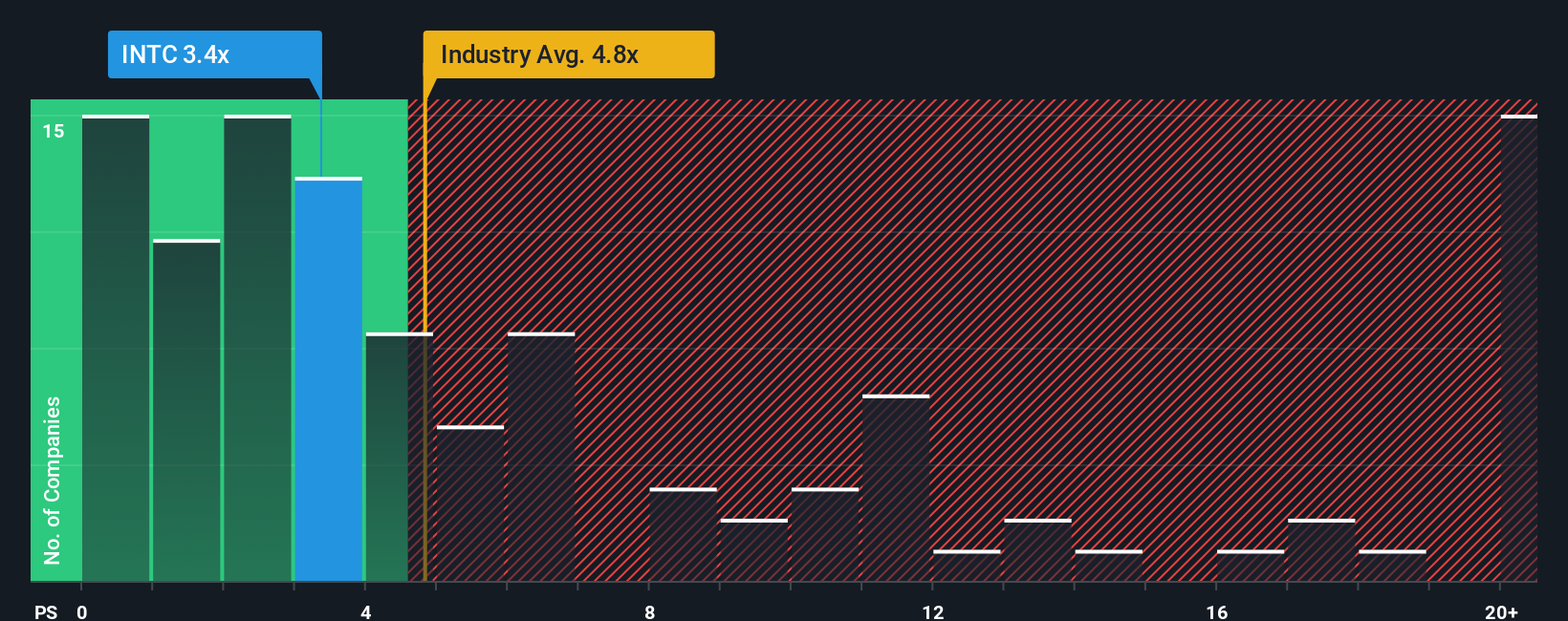

While the narrative fair value suggests Intel is about 11% overvalued, its 3.7x price to sales looks cheap next to the US semiconductor industry at 5.5x and peers at 15.1x, and even below a 5.5x fair ratio. Is sentiment lagging the fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intel Narrative

If you see the story differently, or simply prefer hands on research, you can easily build a personalized thesis in just a few minutes: Do it your way.

A great starting point for your Intel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Intel might only be the start of your opportunity set, and if you stop here you could miss some of the market’s most compelling setups on Simply Wall St’s Screener.

- Capitalize on mispriced quality by scanning these 908 undervalued stocks based on cash flows that pair solid cash flows with attractive entry points before the crowd catches on.

- Ride structural growth trends by targeting these 30 healthcare AI stocks where innovation, data, and medicine intersect to power long runway stories.

- Position early in digital finance by reviewing these 81 cryptocurrency and blockchain stocks pushing blockchain, payments, and tokenization into the mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal