Semtech (SMTC) Is Up 7.3% After Q4 Sales Guidance And Buyback Completion Has The Bull Case Changed?

- In the third quarter of fiscal 2026, Semtech reported net sales of US$267.0 million, reduced its net loss to US$2.9 million, and completed a long-running US$675.19 million share repurchase program that retired 19,043,495 shares since 2008.

- The company also issued fourth-quarter guidance calling for net sales of US$273 million, plus or minus US$5 million, signaling continued momentum in its data center and LoRa portfolios despite lingering margin pressure.

- We’ll now examine how Semtech’s fourth-quarter sales guidance and data center strength affect the existing investment narrative around growth and margins.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Semtech Investment Narrative Recap

To own Semtech, you need to believe its data center and LoRa businesses can outgrow and eventually outweigh current margin pressure, turning recent revenue gains into consistent profitability. The latest quarter’s modest net loss improvement and slightly higher fourth quarter sales guidance support that thesis at the margin, but do not fundamentally change the biggest near term swing factor, which is how product mix between higher margin data center and lower margin IoT evolves.

The completion of the long running US$675.19 million buyback, which retired over 19 million shares since 2008, matters mainly for how investors think about per share metrics rather than near term operations. In the current context, the more consequential update is fourth quarter fiscal 2026 sales guidance of about US$273 million, plus or minus US$5 million, because it ties directly into the key catalyst around data center demand and its ability to support better margins over time.

Yet even with that momentum, investors should be aware that accelerating growth in lower margin IoT systems could still...

Read the full narrative on Semtech (it's free!)

Semtech's narrative projects $1.3 billion revenue and $253.1 million earnings by 2028.

Uncover how Semtech's forecasts yield a $80.21 fair value, in line with its current price.

Exploring Other Perspectives

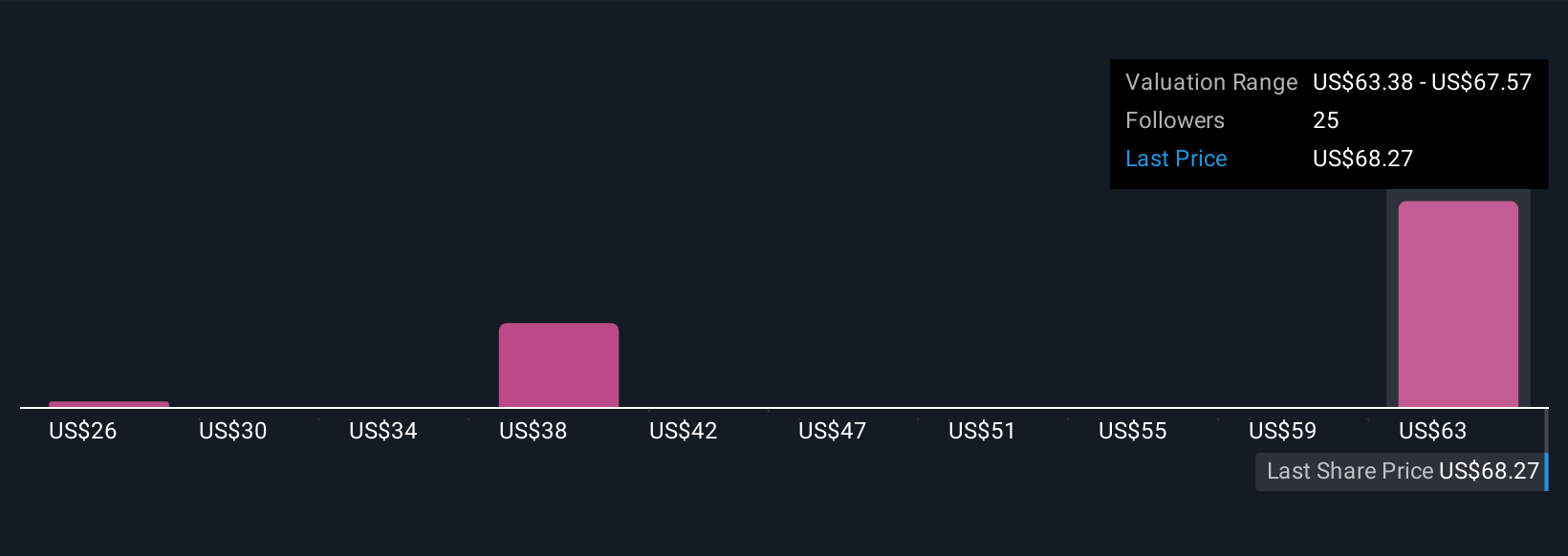

Five fair value estimates from the Simply Wall St Community span a wide US$25.69 to US$80.21, underlining how far apart individual views can be. As you weigh those opinions, keep in mind that Semtech’s growth is increasingly being driven by segments that may dilute margins, which has important implications for how sustainable any earnings recovery might be.

Explore 5 other fair value estimates on Semtech - why the stock might be worth less than half the current price!

Build Your Own Semtech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Semtech research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Semtech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Semtech's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal