How An Analyst’s Copper-Focused Upgrade At Silvercorp Metals (TSX:SVM) Has Changed Its Investment Story

- In recent days, Silvercorp Metals was upgraded from Hold to Buy by an analyst, reflecting confidence in the miner’s stronger production profile, improving margins, and expansion into copper alongside its core silver operations.

- This reassessment highlights how adding copper exposure and enhancing production efficiency could reshape Silvercorp’s earnings mix and risk profile within the metals and mining sector.

- We’ll now explore how this upgrade, driven by Silvercorp’s margin improvement and copper diversification, reshapes the company’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Silvercorp Metals Investment Narrative Recap

To own Silvercorp Metals, you need to believe in its ability to translate its China focused silver base and new copper exposure into sustainable, profitable production. The recent analyst upgrade, tied to stronger output and better margins, supports that thesis but does not eliminate the near term risk around Chinese regulatory scrutiny and potential mine disruptions after the recent fatality.

Among recent developments, the latest quarterly production update for the period to September 30, 2025 stands out. Silvercorp increased ore processed and maintained silver output while adding more gold, which aligns with the idea that efficiency gains and a broader metals mix, including copper, could be a key short term earnings catalyst if cost pressures remain under control.

But while the upgrade highlights upside, investors should still be aware of the risk that tighter Chinese regulation could...

Read the full narrative on Silvercorp Metals (it's free!)

Silvercorp Metals' narrative projects $504.4 million revenue and $143.0 million earnings by 2028.

Uncover how Silvercorp Metals' forecasts yield a CA$12.88 fair value, a 18% upside to its current price.

Exploring Other Perspectives

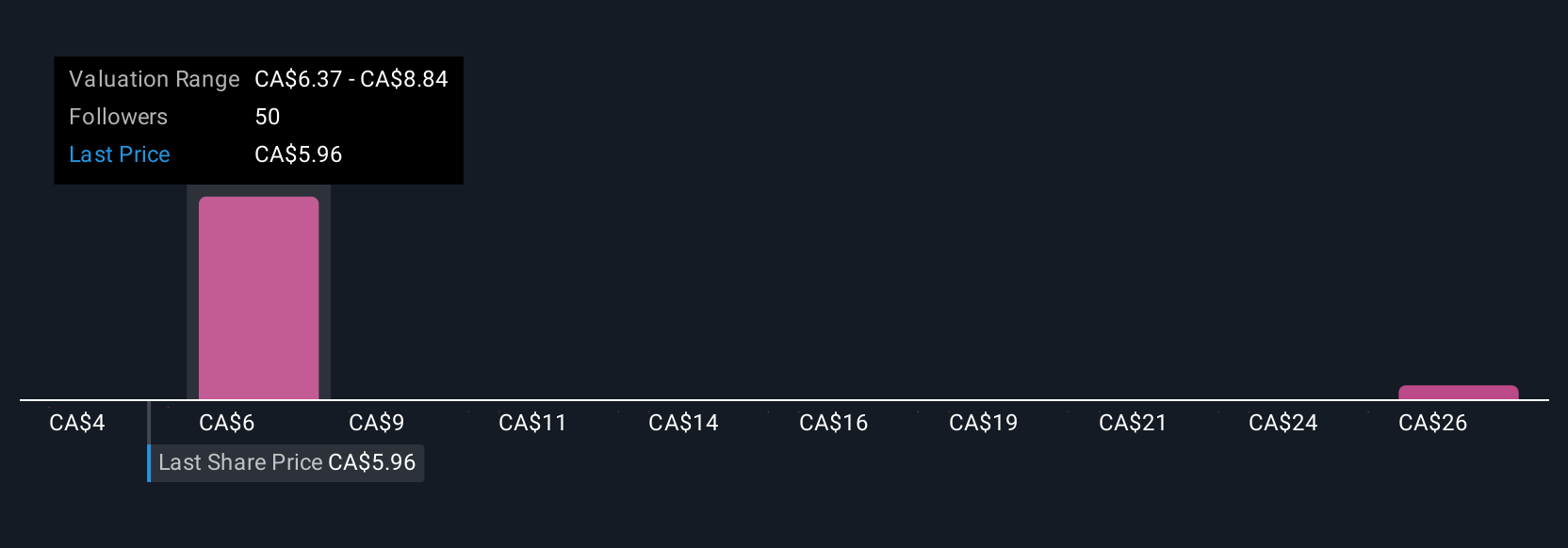

Eight members of the Simply Wall St Community value Silvercorp anywhere between roughly CA$2.34 and CA$15.74, reflecting very different expectations. Set against this, the recent upgrade tied to margin improvement and copper diversification raises important questions about how much of that potential is already in the price.

Explore 8 other fair value estimates on Silvercorp Metals - why the stock might be worth less than half the current price!

Build Your Own Silvercorp Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silvercorp Metals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Silvercorp Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silvercorp Metals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal