Greentown China Holdings (SEHK:3900): Valuation Check After Robust Unaudited Operating Update and Sentiment Shift

Greentown China Holdings (SEHK:3900) just released unaudited operating data for the eleven months to November 2025, showing sizeable contracted sales and healthy sales area across both self investment and project management projects.

See our latest analysis for Greentown China Holdings.

The latest operating update seems to be nudging sentiment in the right direction, with a roughly 10 percent 1 month share price return contrasting with a still negative 1 year total shareholder return. This suggests early momentum but a longer recovery journey.

If Greentown's rebound has you rethinking your China property exposure, it could be worth widening the lens and exploring fast growing stocks with high insider ownership for other potential compounders.

With shares still down over the past year despite a sizeable discount to analyst targets and intrinsic value estimates, the key question now is whether Greentown is genuinely undervalued or whether the market is already pricing in a sustained recovery.

Price-to-Sales of 0.1x: Is it justified?

On a price-to-sales basis, Greentown China Holdings looks deeply discounted, with its 0.1x multiple suggesting the share price may be underpricing the business versus peers.

The price-to-sales ratio compares the company’s market value to its annual revenue. This is particularly relevant for asset heavy, cyclical real estate developers where earnings can be volatile or negative.

Greentown screens as good value not only against direct peers, where similar companies trade around 0.3x sales, but also against the wider Hong Kong Real Estate industry at roughly 0.7x sales. This gap implies the market is applying a steep valuation penalty to its current unprofitable status even though losses are expected to narrow as earnings grow.

Our fair price-to-sales ratio estimate of about 0.6x highlights how extreme that discount is, suggesting potential upside if sentiment normalises closer to underlying fundamentals.

Explore the SWS fair ratio for Greentown China Holdings

Result: Price-to-Sales of 0.1x (UNDERVALUED)

However, sustained revenue contraction and ongoing net losses could signal deeper structural challenges, limiting any re-rating despite today’s steep valuation discount.

Find out about the key risks to this Greentown China Holdings narrative.

Another View: DCF Points to Deeper Value

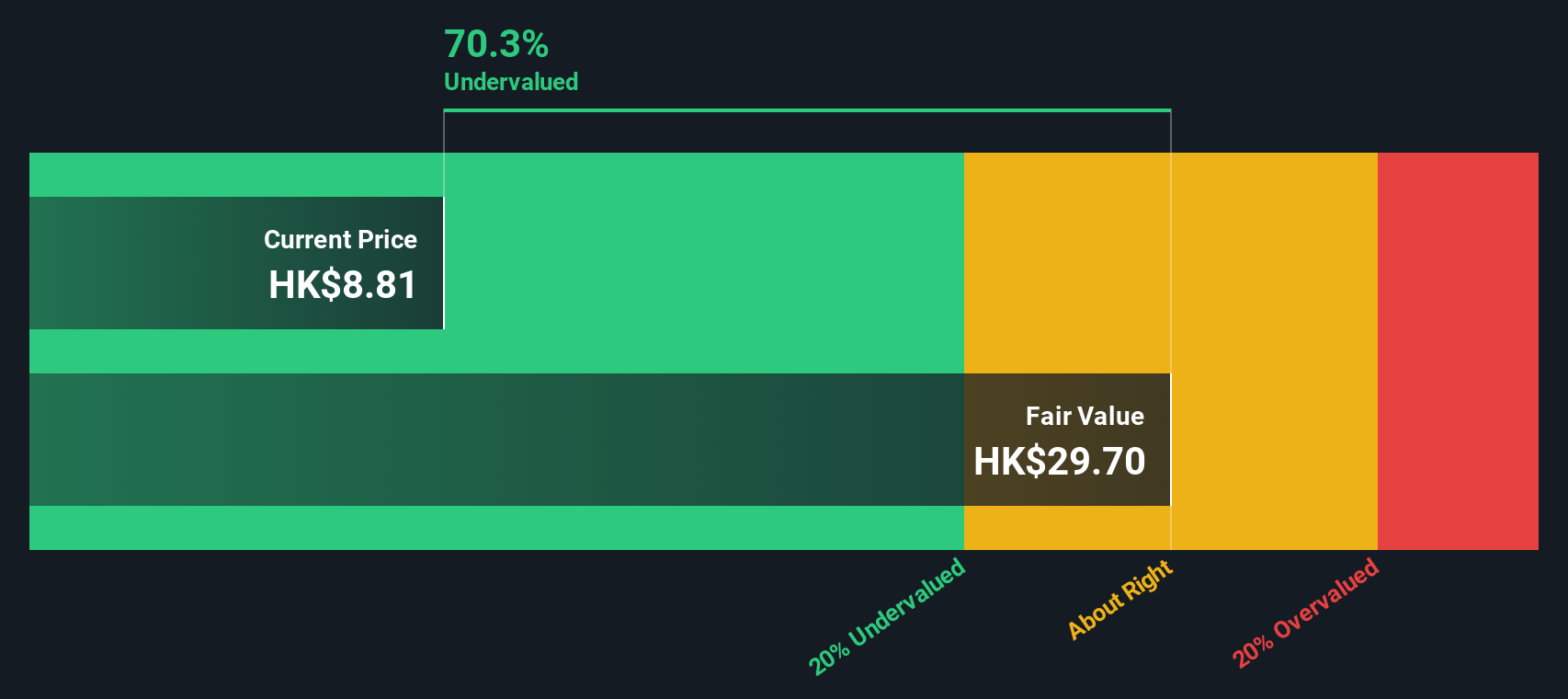

While the 0.1x price to sales suggests value, our DCF model is even more optimistic, indicating Greentown could be trading around 69.5 percent below its fair value of roughly HK$29.88. If both tools are roughly aligned on upside, the main risk may relate more to timing than to direction.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greentown China Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greentown China Holdings Narrative

If you are unconvinced by this view or would rather rely on your own analysis, you can quickly construct a personalised perspective in just a few minutes: Do it your way.

A great starting point for your Greentown China Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Greentown might have sparked your interest, but you will give up a world of opportunity if you do not scan the market for other standout setups.

- Capture early-stage growth potential by reviewing these 3574 penny stocks with strong financials that pair smaller market caps with financial resilience and room for meaningful upside.

- Capitalize on powerful secular themes through these 26 AI penny stocks, where artificial intelligence meets scalable business models and accelerating adoption.

- Lock in quality at a sensible price using these 908 undervalued stocks based on cash flows that screen for companies trading below their cash flow driven fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal