Does Insider Selling Amid Upbeat 2026 Outlook Change The Bull Case For TransDigm Group (TDG)?

- On December 1, 2025, TransDigm Group executive Patrick Murphy sold 290 shares, following a year in which he consistently reduced his holdings, against a backdrop of predominantly selling activity across the company’s insiders.

- At the same time, TransDigm’s Q4 earnings prompted major banks to highlight robust aftermarket growth, successful acquisitions, and a confident fiscal 2026 outlook focused on disciplined capital allocation.

- We’ll now examine how TransDigm’s upbeat fiscal 2026 outlook, built on aftermarket momentum and acquisitions, affects its existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TransDigm Group Investment Narrative Recap

To own TransDigm, you generally need to believe that its high‑margin aftermarket parts and acquisition engine can keep compounding earnings despite OEM and balance sheet pressures. The latest insider sale fits a wider pattern of selling but, set against Q4 results and a confident fiscal 2026 outlook, it does not appear to materially change the main near term catalyst in aftermarket growth or the key risk around leverage and interest costs.

The Q4 FY2025 report, which highlighted solid aftermarket performance and successful acquisitions, is the most relevant backdrop to Patrick Murphy’s sale. Analysts focused on this strength when raising price targets, suggesting that near term sentiment is being driven more by operational momentum and capital allocation plans than by insider transactions, even as investors weigh ongoing OEM production headwinds and balance sheet risk.

Yet investors should also be aware of how TransDigm’s high leverage and interest coverage constraints could affect returns if conditions turn...

Read the full narrative on TransDigm Group (it's free!)

TransDigm Group's narrative projects $10.8 billion revenue and $2.5 billion earnings by 2028. This requires 8.0% yearly revenue growth and about a $0.7 billion earnings increase from $1.8 billion today.

Uncover how TransDigm Group's forecasts yield a $1578 fair value, a 17% upside to its current price.

Exploring Other Perspectives

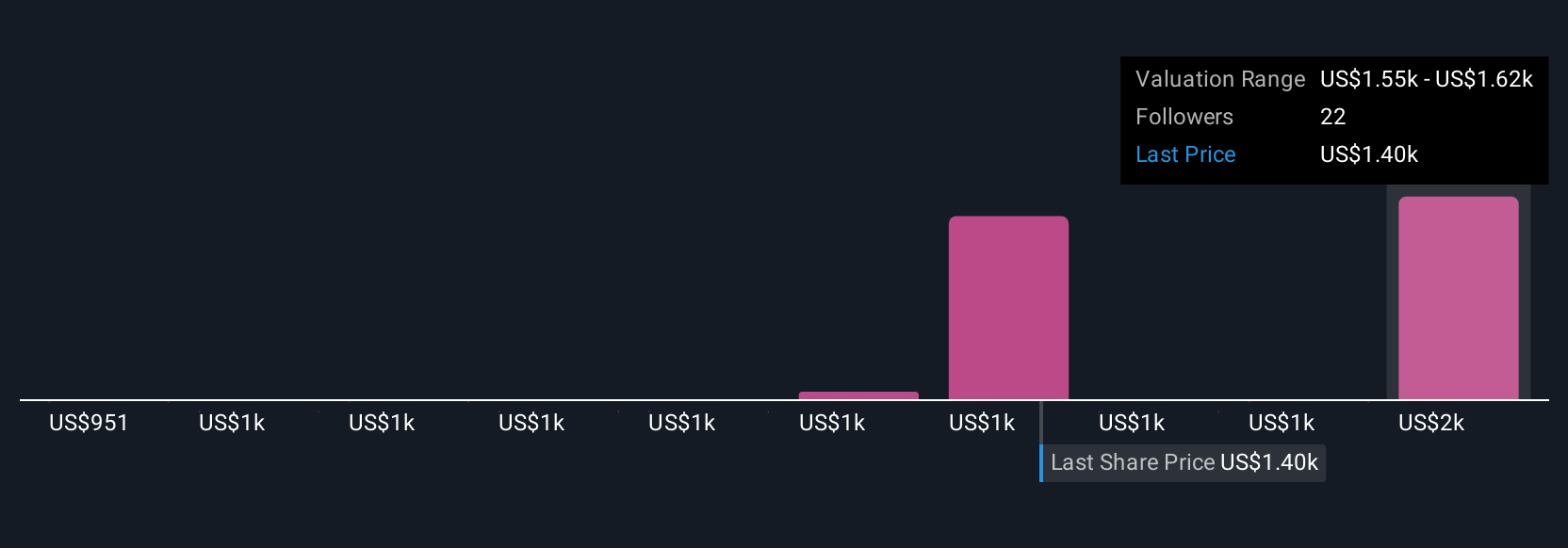

Five Simply Wall St Community fair value estimates for TransDigm span roughly US$1,121 to US$1,578 per share, underscoring how far apart individual views can be. Against that backdrop, the company’s reliance on aftermarket revenues from aging aircraft fleets has important implications for how you judge its long run performance and resilience, so it is worth exploring several of these perspectives before deciding what the stock is worth.

Explore 5 other fair value estimates on TransDigm Group - why the stock might be worth as much as 17% more than the current price!

Build Your Own TransDigm Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransDigm Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TransDigm Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransDigm Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal