Altus Group’s C$350 Million Buyback And Insider Buying Could Be A Game Changer For Altus (TSX:AIF)

- Altus Group Limited (TSX:AIF) recently launched a substantial issuer bid to repurchase up to C$350 million of its shares at C$50.00–C$57.00, funded with cash on hand and running through January 8, 2026, alongside board approval of a new buyback plan.

- Around the same time, Director William Brennan increased Long Path Partners’ stake with a roughly C$1.88 million insider purchase, reinforcing the perception that both management and key shareholders see value in Altus Group’s current positioning.

- We’ll now examine how this substantial issuer bid, together with fresh insider buying, could reshape Altus Group’s existing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Altus Group Investment Narrative Recap

To own Altus Group, you need to believe in its pivot toward higher quality, recurring software and data revenue in commercial real estate, despite soft transaction activity and cautious client spending. The substantial issuer bid and insider buying do not change the near term earnings risk tied to slower VMS deal flow, but they can influence how much of that risk is reflected in the share count and per share metrics.

The substantial issuer bid of up to C$350,000,000 at C$50.00 to C$57.00 per share stands out as most relevant here, because it directly intersects with Altus Group’s existing focus on margin expansion and higher value software revenue. If executed meaningfully, the reduced share base could amplify the impact of any progress on recurring bookings and product adoption at a time when investors are closely watching the balance between growth investments and earnings volatility.

But against this backdrop of buybacks and insider interest, investors should still be aware of the risk that prolonged macro uncertainty and delayed client deals could...

Read the full narrative on Altus Group (it's free!)

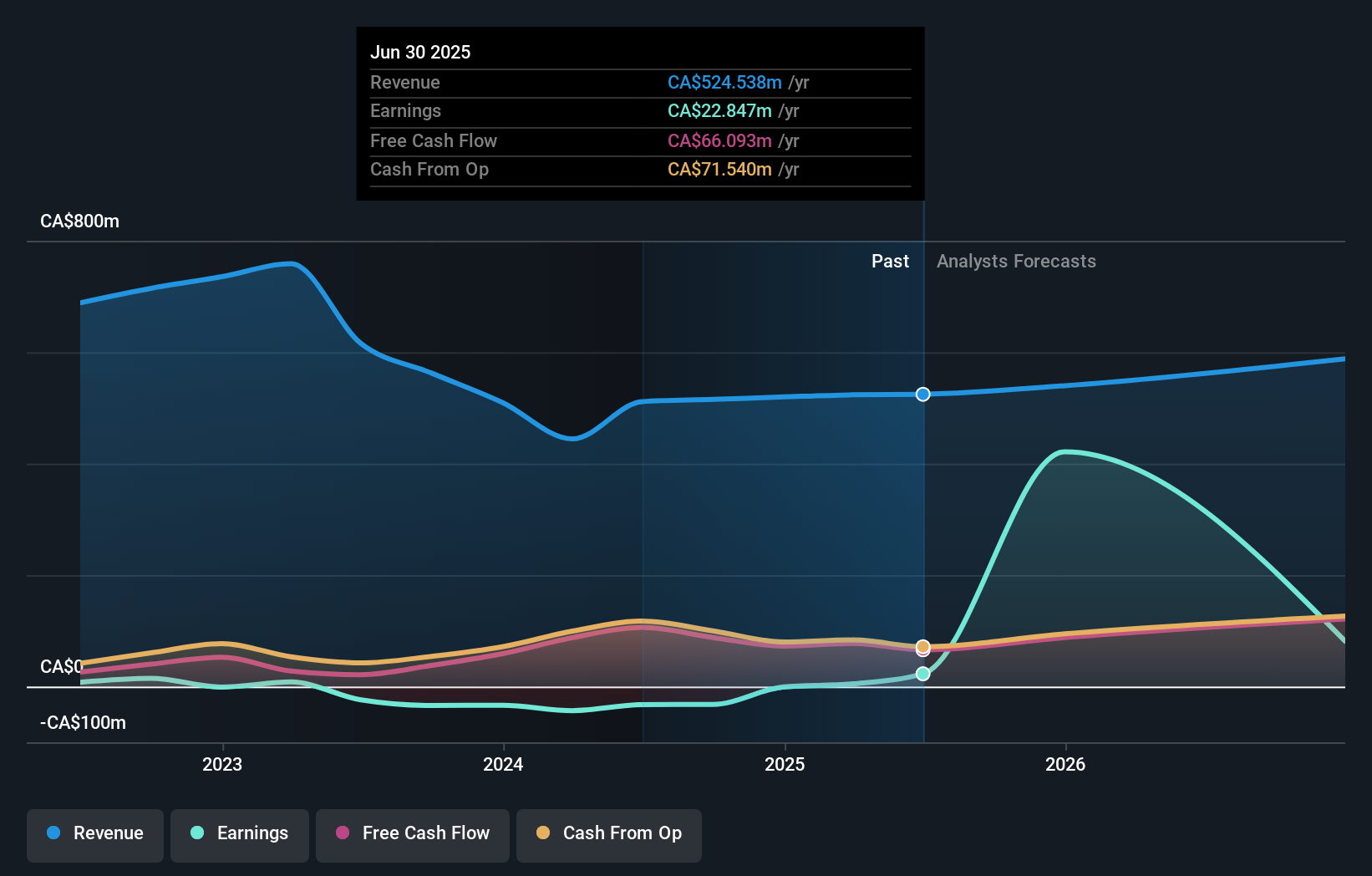

Altus Group's narrative projects CA$655.8 million revenue and CA$212.3 million earnings by 2028. This requires 7.7% yearly revenue growth and an earnings increase of about CA$189.5 million from CA$22.8 million today.

Uncover how Altus Group's forecasts yield a CA$60.12 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate Altus Group’s fair value in a tight C$60.13 to C$62.62 range, highlighting how closely some private investors cluster their views. You can set those opinions against the risk that persistent cautious client spending and delayed VMS deals may keep revenue growth uneven and earnings hard to predict, and then decide which outlook you find more convincing.

Explore 2 other fair value estimates on Altus Group - why the stock might be worth as much as 13% more than the current price!

Build Your Own Altus Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Altus Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Altus Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Altus Group's overall financial health at a glance.

No Opportunity In Altus Group?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal