Why Globant (GLOB) Is Up 11.9% After Deepening Its FIFA AI and Salesforce Ties

- In late 2025, FIFA announced an expanded agreement with Globant to enhance its digital platforms and build a new mobile app to support multiple tournaments, while naming Globant a Tournament Supporter for the FIFA World Cup 2026 and FIFA Women's World Cup 2027.

- Coming alongside Globant’s Converge 2025 AI event and top-tier Salesforce recognition, this deeper FIFA collaboration highlights how the company is weaving together sports, cloud, and enterprise AI capabilities across its client base.

- Now we’ll explore how Globant’s enhanced Salesforce recognition and Converge 2025 AI focus could reshape its investment narrative and growth drivers.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Globant Investment Narrative Recap

To own Globant, you need to believe it can turn its AI, cloud, and experience-design capabilities into steadier growth and healthier margins, despite today’s muted revenue outlook and thin 4% net margin. The expanded FIFA deal adds brand visibility and proof points for its Enterprise AI and digital platforms, but it does not yet change the key near term swing factor: whether slower sales cycles in North America and Europe convert into higher quality, recurring AI work.

Among the recent announcements, Globant Converge 2025 looks most relevant here, because it is designed to move clients from AI experimentation to full execution on Globant’s Enterprise AI stack and AI pod subscription model. If that transition gains traction across accounts like FIFA and Globe-spanning cloud partners, it could gradually reduce reliance on one off project work and improve the balance between growth and profitability.

Yet while the story sounds promising, investors should be aware that slower enterprise decision making and delayed deal conversion could still...

Read the full narrative on Globant (it's free!)

Globant's narrative projects $3.0 billion revenue and $242.1 million earnings by 2028. This requires 6.1% yearly revenue growth and an earnings increase of about $131.8 million from $110.3 million today.

Uncover how Globant's forecasts yield a $84.33 fair value, a 18% upside to its current price.

Exploring Other Perspectives

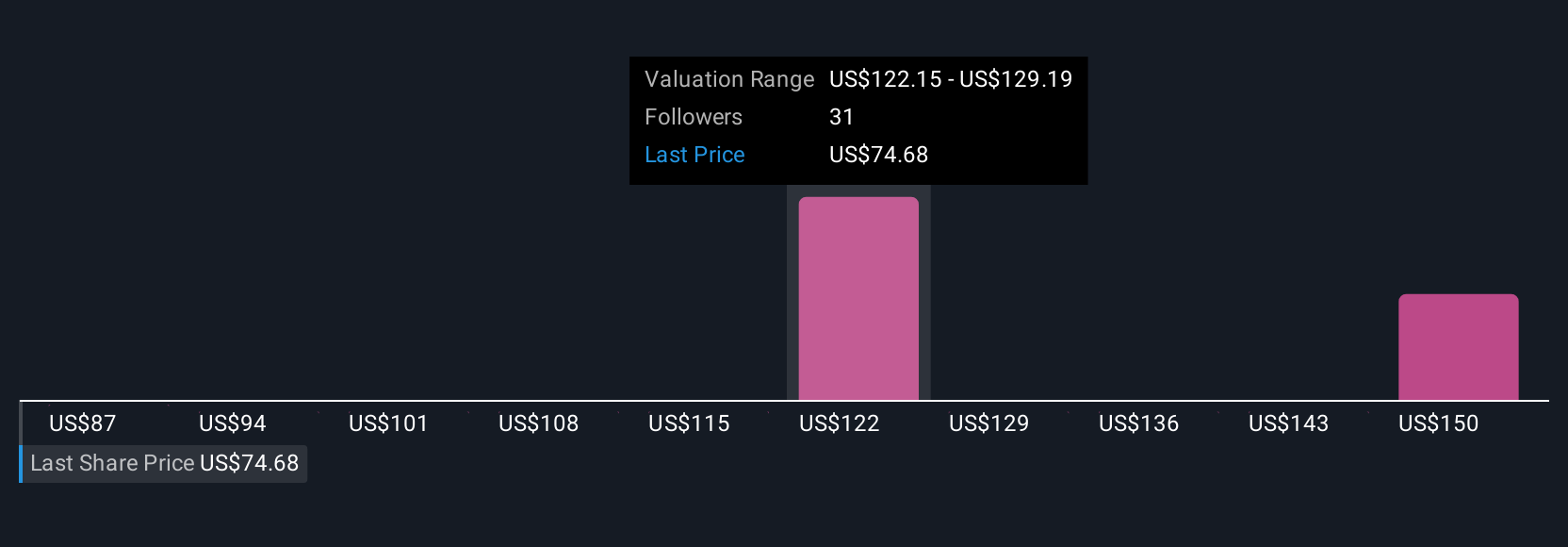

Six fair value estimates from the Simply Wall St Community span roughly US$68 to US$122 per share, showing how far apart individual views can sit. You are weighing these opinions against a business where AI driven catalysts and lingering demand softness may both shape how quickly any perceived mispricing closes, so it is worth comparing several contrasting viewpoints before deciding what Globant’s story means for you.

Explore 6 other fair value estimates on Globant - why the stock might be worth as much as 71% more than the current price!

Build Your Own Globant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Globant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globant's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal