BJ’s Wholesale Club (BJ): Assessing Valuation as New Springfield, Sumter and Casselberry Openings Signal Renewed Expansion

BJ's Wholesale Club Holdings (BJ) is back in expansion mode, rolling out three new clubs and gas stations this December in Massachusetts, South Carolina, and Florida, a fresh signal of confidence in its core markets.

See our latest analysis for BJ's Wholesale Club Holdings.

Despite this measured rollout, the stock has been treading water lately, with a slightly negative 3 month share price return but still a positive year to date share price return. At the same time, a strong 5 year total shareholder return suggests the longer term growth story remains intact and recent momentum is cooling rather than reversing.

If BJ's steady expansion has you thinking about where growth might come from next, it could be worth exploring fast growing stocks with high insider ownership for other potential standout names.

Yet with BJ’s shares down over the past year but still trading below analysts’ targets, the key question now is simple: is this a timely entry point, or is the market already pricing in that future growth?

Most Popular Narrative: 16.3% Undervalued

With BJ's last closing at $91.33 versus an implied fair value around $109, the most widely followed narrative points to upside if its growth plan delivers.

Expansion of BJ's physical footprint, with 25 to 30 new clubs planned over two years, especially in high-growth suburban and Sunbelt markets, supports sustained topline revenue growth and fixed cost leverage, which helps drive margin expansion.

Want to see how steady mid single digit growth, mildly tighter margins, and a richer future earnings multiple all combine into that upside case? The narrative walks through the revenue ramp, margin path, and share count assumptions that need to hold for this valuation to stick, and how a higher earnings multiple becomes part of the story rather than an outlier bet.

Result: Fair Value of $109.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer general merchandise trends and rising wage and price investments could squeeze margins and undermine the case for a higher future earnings multiple.

Find out about the key risks to this BJ's Wholesale Club Holdings narrative.

Another View: Earnings Multiple Sends a Caution Flag

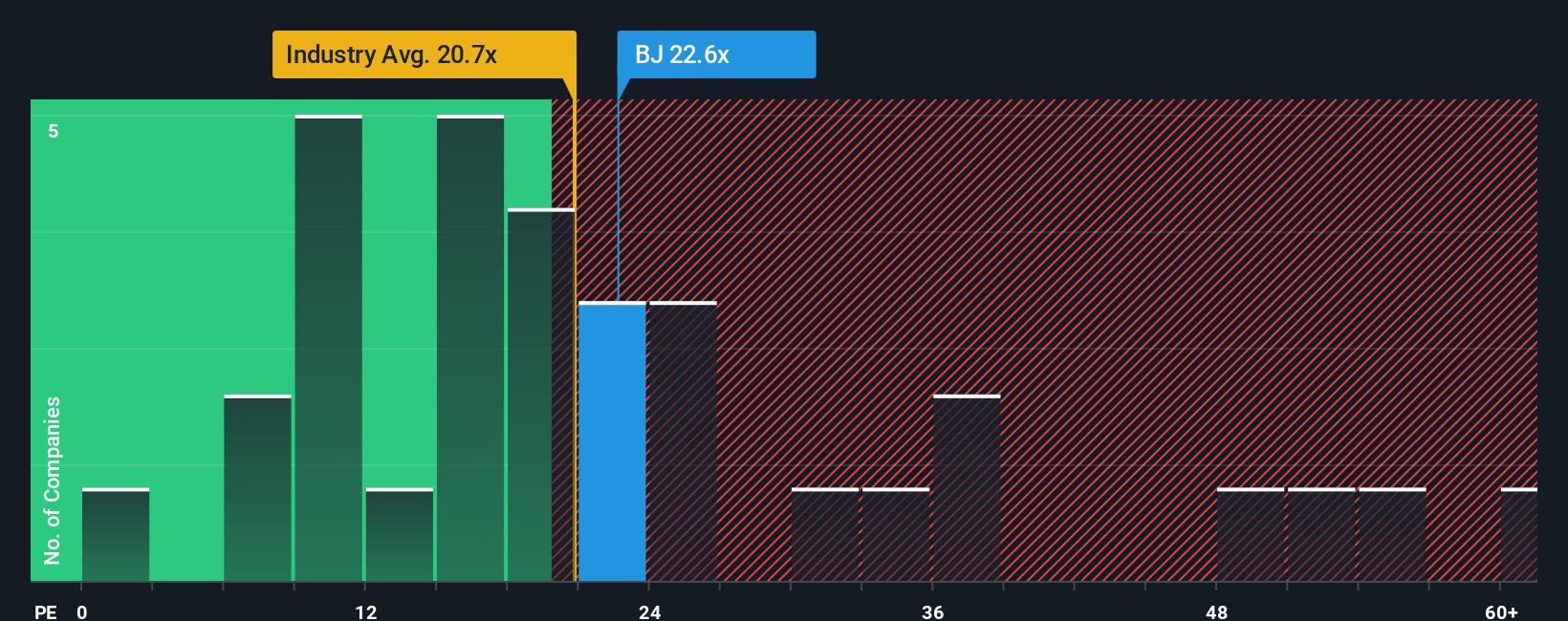

While the narrative points to around 16% upside, BJ's current price already embeds a lot of optimism. At about 20.8 times earnings, the stock trades roughly in line with the Consumer Retailing industry and peers, but above its fair ratio of 18.3 times. This implies limited margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BJ's Wholesale Club Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunity by scanning focused stock lists built from real fundamentals, not hype, and give your watchlist an immediate upgrade.

- Strengthen your income potential by targeting reliable payers through these 15 dividend stocks with yields > 3% with the balance sheets to support those yields.

- Explore innovation by focusing on early movers in smart automation and machine learning via these 26 AI penny stocks.

- Filter for quality names that appear attractively priced using these 908 undervalued stocks based on cash flows based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal