Why Okta (OKTA) Is Up 6.9% After Raising Guidance And Highlighting AI Security Momentum

- In the past week, Okta reported third-quarter fiscal 2025 results with revenue of US$742 million and net income of US$43 million, showing higher earnings per share year-on-year and raising full-year fiscal 2026 revenue guidance to about US$2.91 billion.

- The quarter also highlighted traction in newer areas such as AI-focused security products and expanding large customer contracts, which supported stronger profitability and an uplift in remaining performance obligations versus analyst expectations.

- We’ll now examine how Okta’s raised full-year revenue guidance and growing AI security offerings may influence its existing investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Okta Investment Narrative Recap

To be comfortable owning Okta, you need to believe identity remains a core layer of enterprise security and that Okta can monetise AI driven use cases while defending share against broader security platforms. The latest results and raised fiscal 2026 revenue outlook support the near term profitability and AI product traction catalysts, but do little to resolve the bigger risk that consolidating cybersecurity suites could pressure Okta’s pricing power and growth if enterprises increasingly favour bundled platforms.

The most relevant update here is Okta’s new fiscal 2026 guidance for total revenue of about US$2.91 billion, implying roughly 11% year on year growth. This outlook, alongside stronger remaining performance obligations, ties directly into the catalyst of enterprises consolidating identity onto unified platforms, but it also sets a clearer bar against which investors will judge whether newer offerings like AI agent security can offset competition from large security suites.

Yet even with improving results, investors should be aware that intensifying competition from full stack security platforms could still...

Read the full narrative on Okta (it's free!)

Okta's narrative projects $3.6 billion revenue and $414.2 million earnings by 2028. This requires 9.5% yearly revenue growth and roughly a $246 million earnings increase from $168.0 million today.

Uncover how Okta's forecasts yield a $118.80 fair value, a 38% upside to its current price.

Exploring Other Perspectives

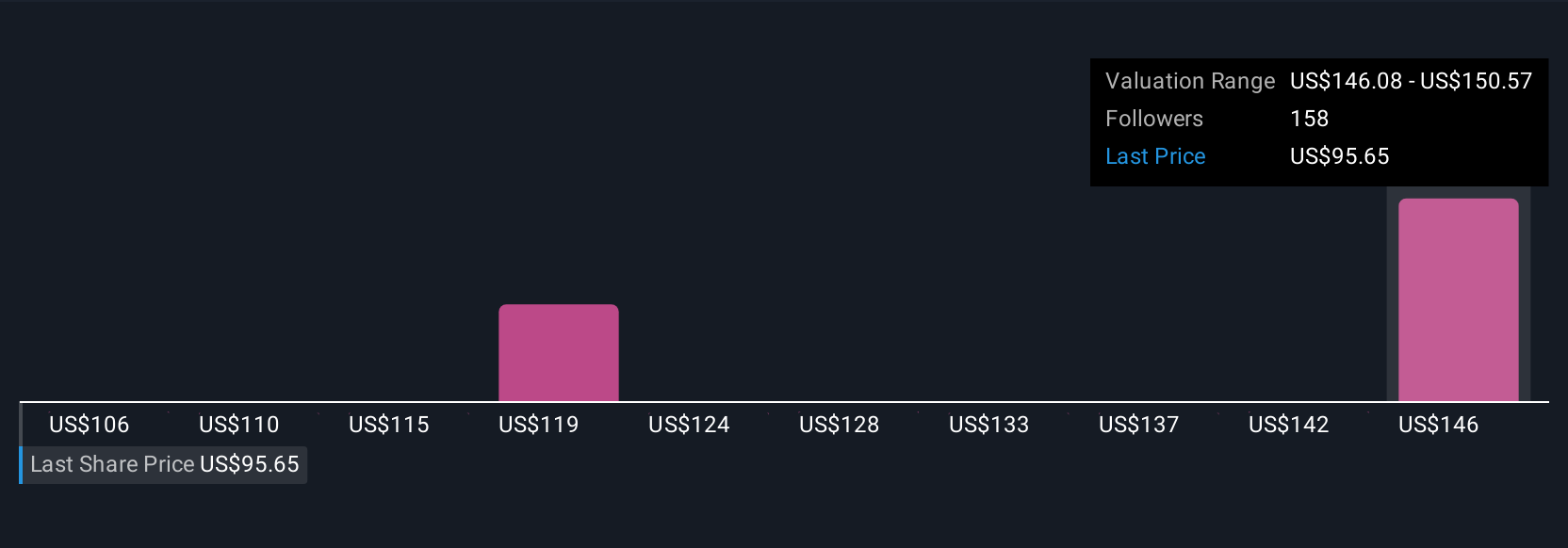

Seven Simply Wall St Community fair value estimates for Okta cluster between US$105.65 and US$147.87, highlighting how differently individual investors price its potential. As you weigh those views, remember that Okta’s ability to stay differentiated as identity and security platforms converge could be critical for its longer term performance.

Explore 7 other fair value estimates on Okta - why the stock might be worth just $105.65!

Build Your Own Okta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Okta research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Okta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Okta's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal