Is McKesson’s (MCK) ORLYNVAH Distribution Deal a Small Step or a Bigger Strategy Signal?

- In late November 2025, Iterum Therapeutics announced that its oral antibiotic ORLYNVAH became available through McKesson’s specialty distribution channel, enabling certain physicians to order the drug directly in line with their practice preferences.

- This addition highlights how McKesson’s growing specialty distribution capabilities complement its broader shift toward higher-growth areas like oncology, specialty drugs, and tech-enabled services, which underpin its repeatedly raised fiscal 2026 earnings guidance.

- Next, we’ll examine how McKesson’s portfolio realignment, including the Medical-Surgical spin-off and expanding specialty distribution, reshapes its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

McKesson Investment Narrative Recap

To own McKesson, you need to believe its shift toward specialty drugs, oncology, and tech-enabled services can steadily improve earnings quality despite low-margin distribution roots and regulatory pressure on drug economics. Iterum’s ORLYNVAH joining McKesson’s specialty channel is directionally aligned with this thesis, but by itself looks immaterial for the near term, where execution on specialty growth and exposure to drug pricing policy remain the key catalyst and risk.

The most relevant recent announcement alongside this news is McKesson’s fiscal 2026 update, where it reported solid Q2 results and raised full year adjusted EPS guidance again, supported by specialty and oncology. ORLYNVAH’s inclusion in McKesson’s specialty distribution fits that same narrative of improving mix, but it also reinforces how sensitive McKesson’s long term margin story could be to future policy-driven pressure on drug pricing and reimbursement.

Yet even as specialty expands, investors should still be aware of how intensifying policy scrutiny on drug pricing could...

Read the full narrative on McKesson (it's free!)

McKesson's narrative projects $478.8 billion revenue and $5.3 billion earnings by 2028. This requires 8.2% yearly revenue growth and about a $2.1 billion earnings increase from $3.2 billion today.

Uncover how McKesson's forecasts yield a $934.79 fair value, a 16% upside to its current price.

Exploring Other Perspectives

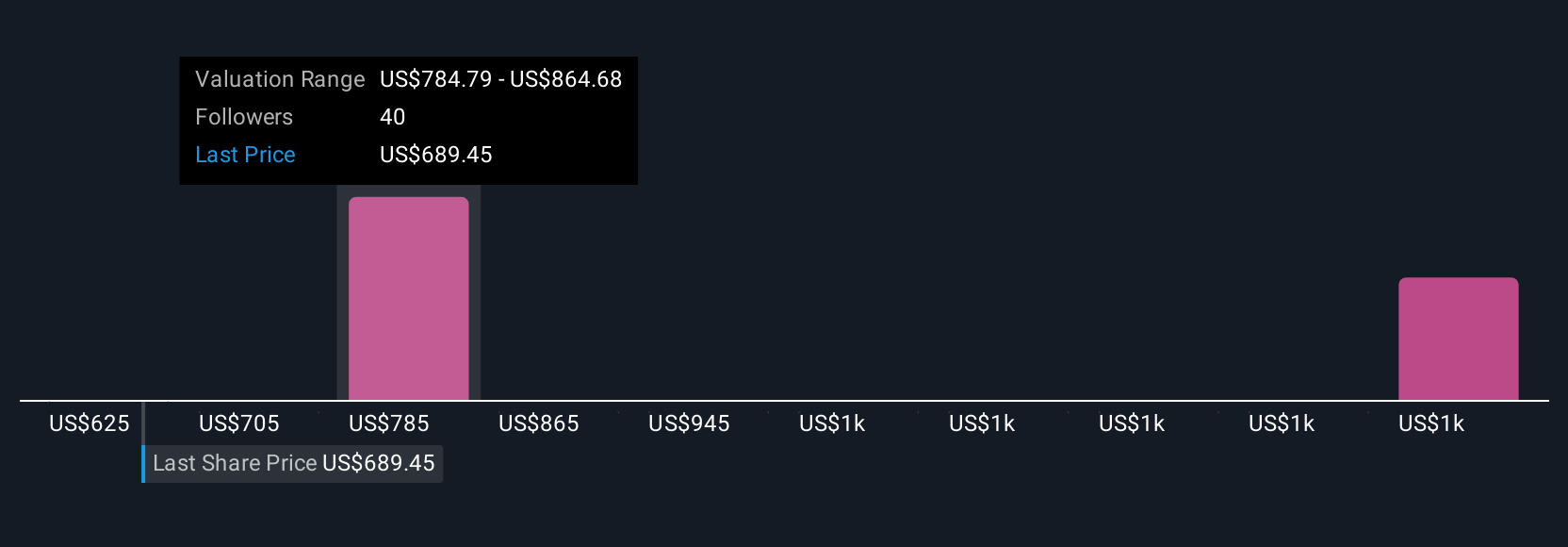

Five Simply Wall St Community valuations span roughly US$665 to about US$1,399 per share, showing how far apart individual views on McKesson can be. Against that backdrop, you may want to weigh how its growing reliance on specialty and oncology earnings could interact with future regulatory pressure on drug pricing and margins.

Explore 5 other fair value estimates on McKesson - why the stock might be worth as much as 73% more than the current price!

Build Your Own McKesson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free McKesson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McKesson's overall financial health at a glance.

No Opportunity In McKesson?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal