Carvana (CVNA): Assessing Valuation After S&P 500 Inclusion and Record Profitability Turnaround

Carvana (CVNA) is back in the spotlight after being tapped to join the S&P 500, a milestone that caps its turnaround from a distressed pandemic play to a profitable, large cap e commerce auto retailer.

See our latest analysis for Carvana.

The S&P 500 nod caps a wild run, with Carvana’s share price returning about 100% year to date and its three year total shareholder return above 7,800 percent as bullish upgrades, record results, and high profile endorsements fuel momentum.

If Carvana’s surge has you rethinking the auto space, this is a good moment to explore other opportunities among auto manufacturers that might be building their own turnaround stories.

With the stock hovering just below analyst targets after an extraordinary rally, the real debate now is whether Carvana’s transformation is still underappreciated in its valuation or if markets are already paying up for years of future growth.

Most Popular Narrative: 4.7% Undervalued

Compared to Carvana’s last close at $399.77, the most followed narrative pegs fair value slightly higher, implying modest upside if its growth story holds.

The acceleration in consumer preference for purchasing vehicles online and increased comfort with high-value e-commerce transactions positions Carvana to capture a larger share of the used vehicle retail market, supporting outsized long-term unit and revenue growth. Ongoing advancements in Carvana's data-driven technology, including integration of AI for operational efficiency and customer-facing processes, enable continual process improvement, reducing per-unit costs and fueling net margin expansion.

Want to see why a fast climbing revenue base, rising margins, and a punchy future earnings multiple still add up to upside? The full narrative unpacks the exact growth runway, profit step up, and valuation bridge behind that fair value call, and some of the assumptions may surprise you.

Result: Fair Value of $419.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained 40% plus unit growth could strain logistics and reconditioning, while intensifying digital competition might erode margins faster than bullish investors expect.

Find out about the key risks to this Carvana narrative.

Another View: Rich on Earnings

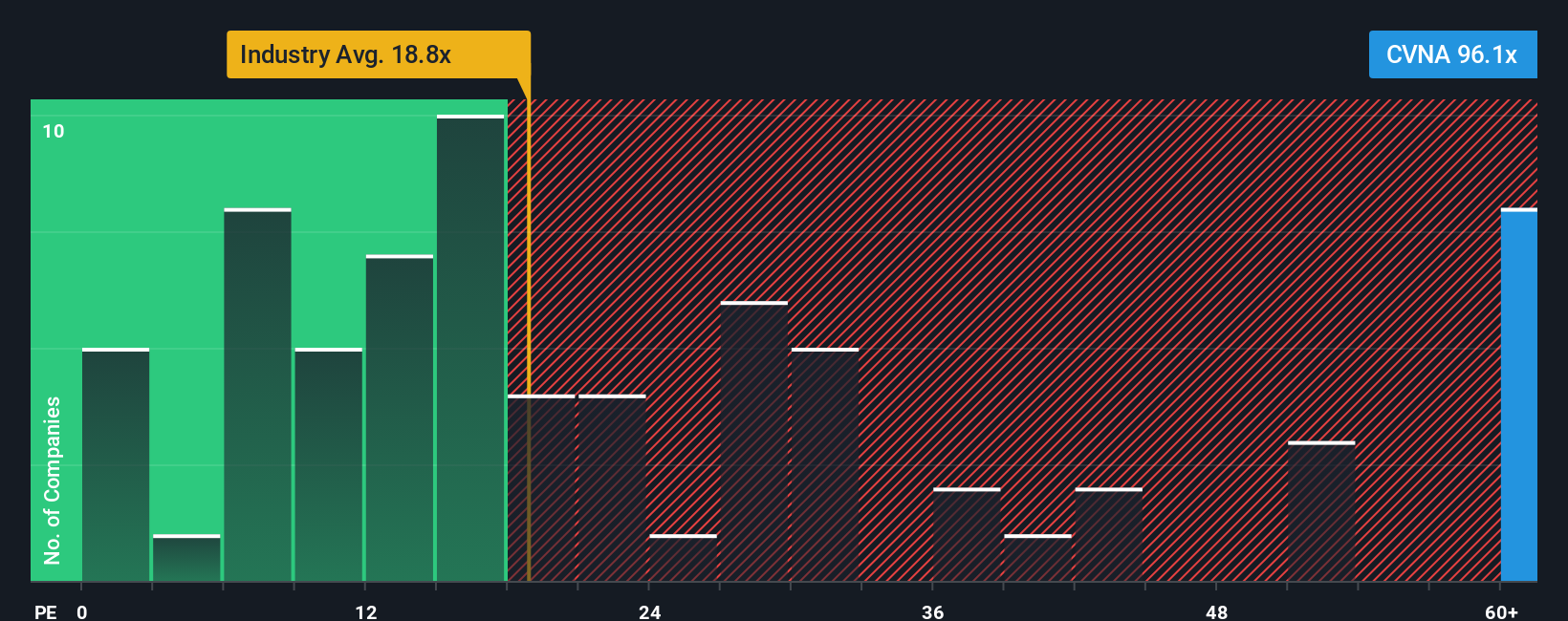

On earnings, the picture looks less forgiving. Carvana trades at about 89.9 times earnings, more than four times the US Specialty Retail average of 20 times and well above a fair ratio of 41.3 times, which signals meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carvana Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Carvana might be stealing headlines today, but your biggest wins could come from the next idea you uncover using the Simply Wall St Screener.

- Capture potential multi baggers early by scanning these 3572 penny stocks with strong financials showing strong balance sheets and real business momentum, not just hype.

- Position ahead of the next productivity boom by targeting these 30 healthcare AI stocks that blend defensible medical moats with transformative AI capabilities.

- Lock in growing cash returns by zeroing in on these 15 dividend stocks with yields > 3% that combine healthy yields with sustainable payout ratios and resilient earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal