Shrinking Net Interest Margin And EPS At Preferred Bank Might Change The Case For Investing In PFBC

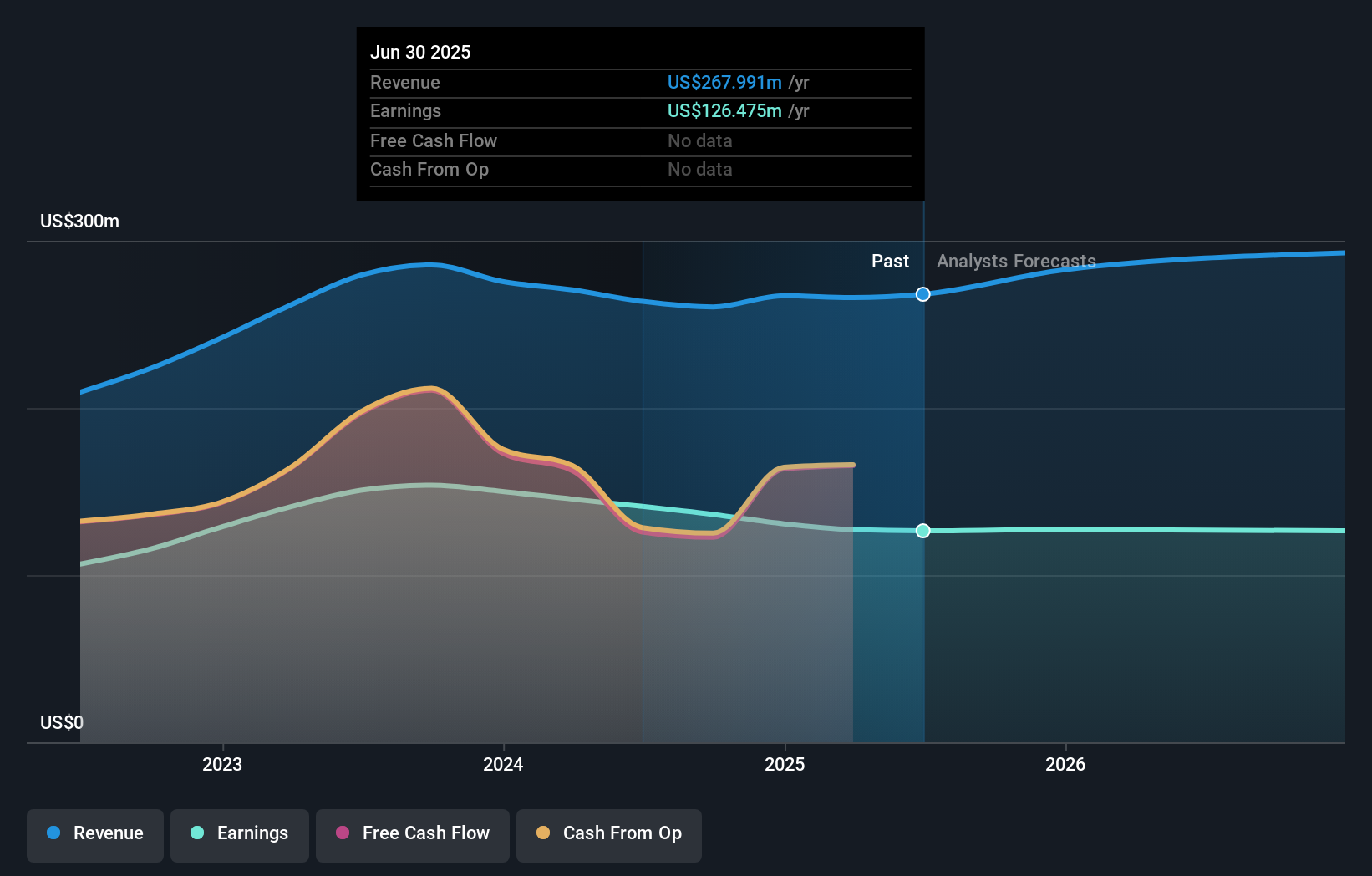

- Recent analysis of Preferred Bank highlighted that over the last few years its net interest income has grown more slowly than peers, while its net interest margin shrank by 74 basis points and earnings per share fell by 4.7% annually, pointing to pressure on profitability even before today’s date of 7 Dec 2025.

- These trends suggest that Preferred Bank’s loan book and funding mix may be facing tougher competition and weaker economics than many comparable banks, raising questions about the durability of its recent profit performance.

- Next, we’ll examine how the shrinking net interest margin might alter Preferred Bank’s investment narrative built on disciplined growth and efficiency.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Preferred Bank Investment Narrative Recap

To own Preferred Bank, you need to believe its relationship banking model and disciplined cost control can sustain attractive returns even as growth slows. The recent evidence of shrinking net interest margin and falling EPS puts more weight on the short term catalyst of stabilizing core profitability, while reinforcing the biggest risk that funding costs and loan yields stay under pressure. If these margin trends persist, the bank’s efficiency story could look less compelling in the near term.

Among recent announcements, the Q3 2025 results are most relevant to these concerns. While quarterly EPS and net income improved year over year, net interest income for the first nine months of 2025 was slightly below the prior period, echoing the broader pattern of slower net interest income growth and margin compression. For investors, this mix of resilient earnings per share and softer underlying interest income intensifies the focus on how sustainable current profitability really is.

Yet behind the recent earnings resilience, there is a margin risk that investors should be aware of if competition for deposits continues to...

Read the full narrative on Preferred Bank (it's free!)

Preferred Bank’s narrative projects $320.4 million revenue and $126.6 million earnings by 2028. This requires 6.1% yearly revenue growth and a negligible $0.1 million earnings increase from $126.5 million today.

Uncover how Preferred Bank's forecasts yield a $107.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide range, from US$107 to about US$244. With profitability pressured by slower net interest income growth than peers, readers may want to compare these different views before deciding how comfortable they are with Preferred Bank’s earnings profile.

Explore 2 other fair value estimates on Preferred Bank - why the stock might be worth just $107.00!

Build Your Own Preferred Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Preferred Bank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Preferred Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Preferred Bank's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal