Is Ouster (OUST) Evolving From LiDAR Hardware Vendor To Core Autonomy Platform Enabler?

- Recent coverage of Ouster highlighted its role as a pure-play LiDAR provider serving autonomous vehicles, industrial automation, robotics, defense, and smart infrastructure, in a market expected to expand rapidly over the next several years.

- The company’s growing exposure to multiple advanced technology themes, combined with projections for strong year-over-year revenue growth, has intensified investor attention on LiDAR as a foundational enabling technology rather than a niche hardware component.

- We’ll now explore how Ouster’s expanding presence across high-growth LiDAR end-markets could reshape its existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ouster Investment Narrative Recap

To own Ouster, you have to believe LiDAR becomes a core sensing layer across vehicles, infrastructure, and automation, and that Ouster can translate that position into sustained revenue growth despite ongoing losses. The recent coverage spotlighting its multi-theme exposure and projected 35% year-over-year revenue growth reinforces the near term growth catalyst, but does not materially change the key risk that intense competition and pricing pressure could still weigh on margins and financial progress.

The news ties most clearly to Ouster’s push into Intelligent Transportation Systems via its BlueCity traffic solution, including the US$2 million Chattanooga contract that scales deployments across 120 intersections. This kind of real world smart infrastructure rollout directly supports the growth narrative around LiDAR as foundational technology, while also testing whether Ouster can convert early wins into repeatable, higher margin software and services revenue across cities in the US, Europe, and Asia.

Yet, while enthusiasm has risen sharply, investors should be aware that competition from Chinese LiDAR makers and legacy infrastructure technologies could still...

Read the full narrative on Ouster (it's free!)

Ouster's narrative projects $335.6 million revenue and $30.3 million earnings by 2028.

Uncover how Ouster's forecasts yield a $39.50 fair value, a 59% upside to its current price.

Exploring Other Perspectives

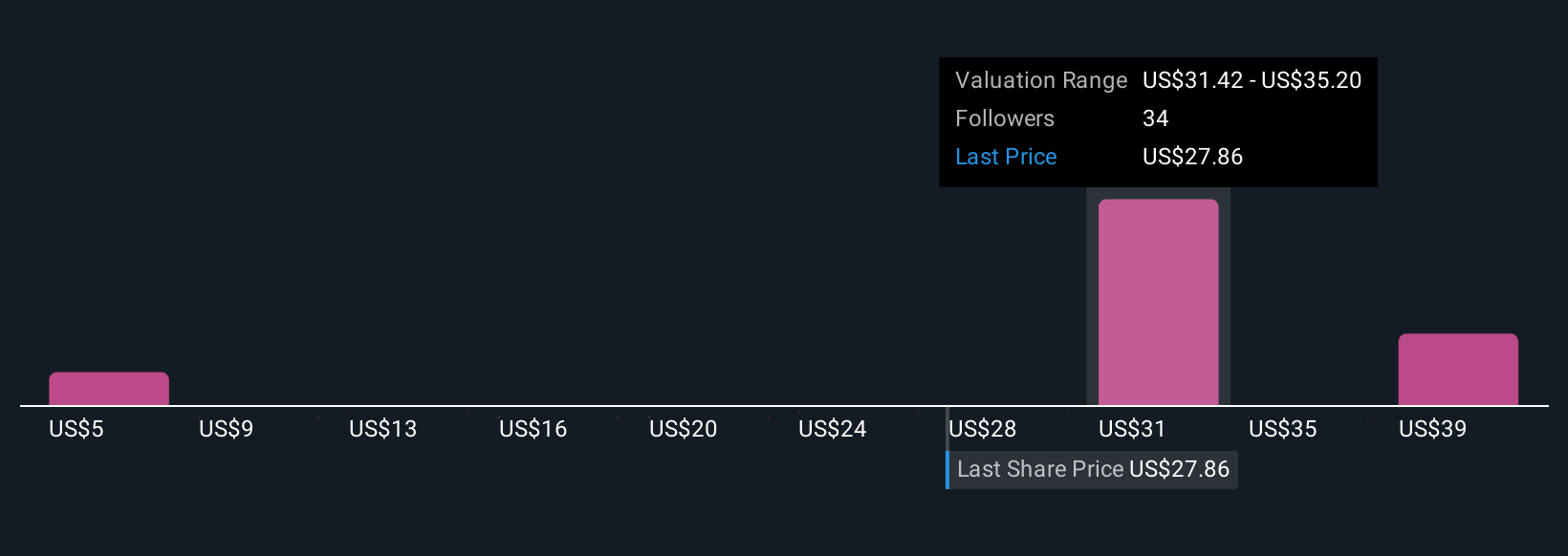

Twelve fair value estimates from the Simply Wall St Community span roughly US$5.77 to US$64.46 per share, underscoring how far apart individual views can be. Against that backdrop, Ouster’s growing smart infrastructure footprint through BlueCity contracts could matter a lot for how you think about its future revenue potential and competitive position, so it is worth weighing several of these perspectives before forming your own view.

Explore 12 other fair value estimates on Ouster - why the stock might be worth less than half the current price!

Build Your Own Ouster Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ouster research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ouster research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ouster's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal