Upward Earnings Revisions Could Be A Game Changer For Fiverr International (FVRR)

- In recent days, Fiverr International has attracted increased attention after analysts collectively raised their earnings estimates and assigned the company a top-tier rating based on revised profit expectations.

- This shift in analyst sentiment highlights how rising confidence in Fiverr’s earnings power, rather than new product announcements, is shaping market interest.

- We’ll now examine how this wave of upward earnings revisions may reshape Fiverr’s investment narrative and expectations for future profitability.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Fiverr International Investment Narrative Recap

To own Fiverr International, you need to believe its upmarket shift, AI-enabled services and growing profitability can outweigh competitive pressure and marketplace maturation risk. The recent wave of upward earnings estimate revisions reinforces the near term earnings momentum story, but it does not materially change the core risk that slower active buyer growth could eventually limit revenue and profit scalability.

The most relevant recent development is Fiverr’s Q3 2025 report, where revenue reached US$107.9 million and net income improved to US$5.54 million. This step up in profitability aligns closely with analysts’ higher earnings expectations and supports the catalyst that higher margin, AI-enhanced and value added services could continue to lift earnings, even if overall revenue growth moderates.

Yet behind rising earnings expectations, investors should still be aware of how intensifying competition could pressure margins and growth...

Read the full narrative on Fiverr International (it's free!)

Fiverr International's narrative projects $533.3 million revenue and $60.0 million earnings by 2028. This requires 8.4% yearly revenue growth and a $41.8 million earnings increase from $18.2 million today.

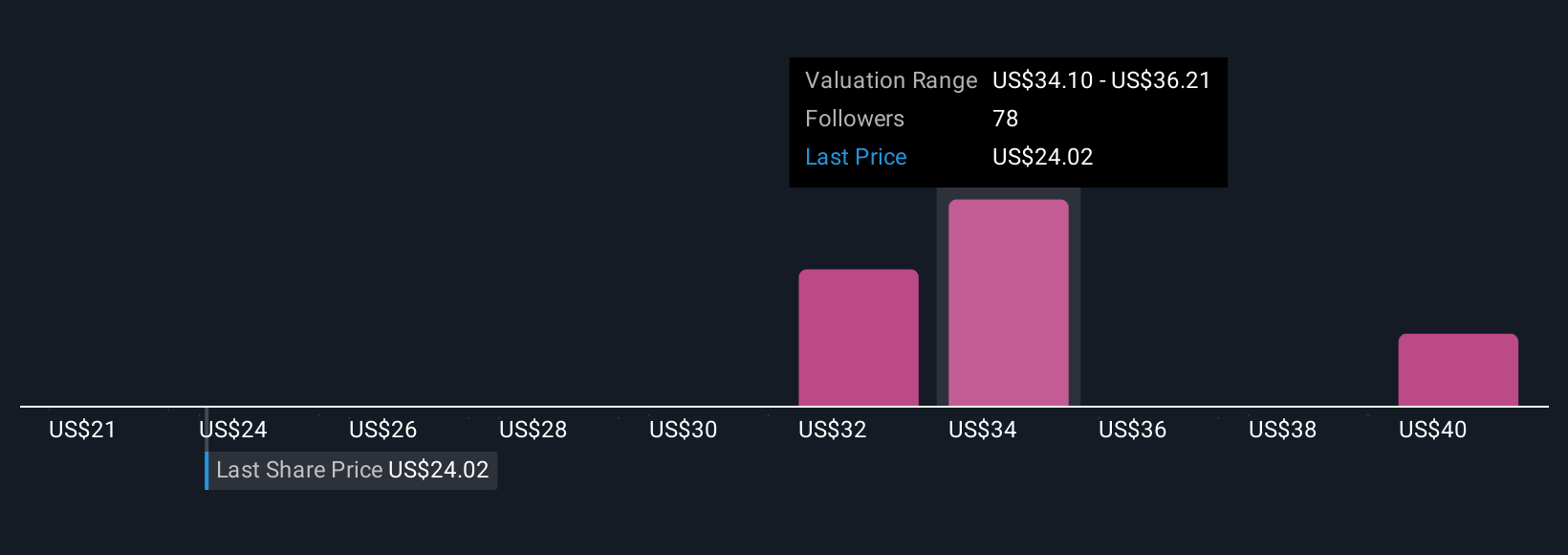

Uncover how Fiverr International's forecasts yield a $32.56 fair value, a 51% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community cluster between about US$32.56 and US$40.28, highlighting a wide spread of individual views. Against this, the growing reliance on higher value, AI enabled services as a key earnings catalyst may not fully offset risks around slower marketplace expansion, which is something readers should explore through several contrasting opinions.

Explore 6 other fair value estimates on Fiverr International - why the stock might be worth just $32.56!

Build Your Own Fiverr International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiverr International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fiverr International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiverr International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal