YETI (YETI): Has the EPS Growth Story Pushed the Stock Beyond Its True Value?

YETI Holdings (YETI) just saw its share price jump roughly 25% after a year in which earnings actually fell 17%, a move powered by investors leaning into upbeat multi year earnings growth forecasts.

See our latest analysis for YETI Holdings.

That jump sits on top of a strong recent run, with the 1 month share price return of 19.51% and 90 day share price return of 21.52% contrasting with a much more modest 1 year total shareholder return of 2.17%. This suggests momentum has only really picked up lately as the market reprices YETI for potential earnings acceleration rather than past results.

If YETI’s surge has you wondering what else could be rerating, it might be a good time to explore fast growing stocks with high insider ownership as another source of ideas.

But with the share price now above the average analyst target and investors clearly paying up for a multiyear growth story, is YETI still undervalued or is the market already pricing in every ounce of future momentum?

Most Popular Narrative: 5.8% Overvalued

With YETI Holdings last closing at $43.36 against a narrative fair value of about $41, the story leans toward a mildly stretched valuation built on improving fundamentals.

The company's accelerated international expansion, particularly robust growth and brand engagement in Europe and the rapid ramp up in Japan and Asia, is unlocking a large revenue opportunity in underpenetrated markets, this is expected to drive sustained double digit growth internationally and diversify global revenue streams.

Want to see what powers that confidence? The narrative quietly leans on measured revenue gains, firmer margins, and a future earnings multiple that challenges today’s market skepticism.

Result: Fair Value of $41 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that confidence could unravel if U.S. drinkware demand stays weak or if intense promotional discounting forces YETI to sacrifice pricing power and margins.

Find out about the key risks to this YETI Holdings narrative.

Another Lens on Value

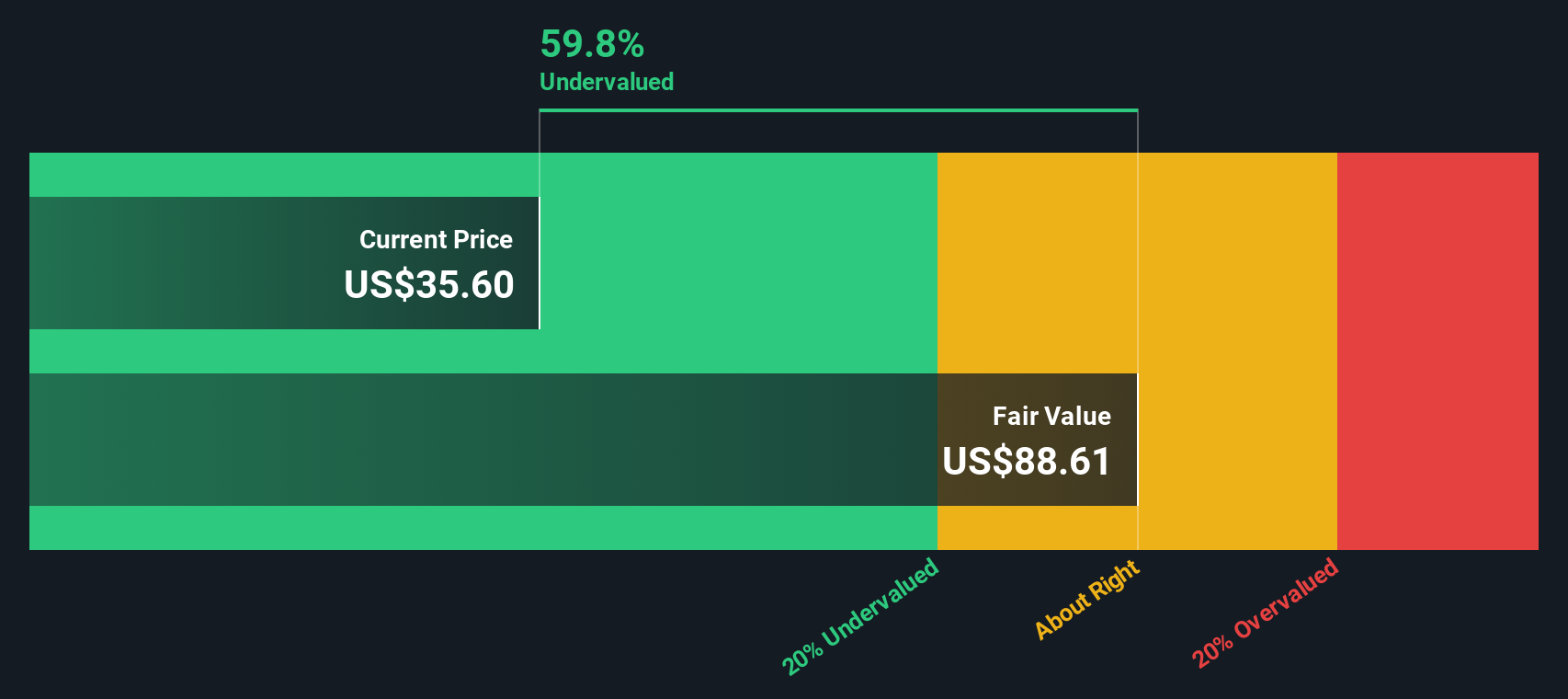

While the narrative fair value suggests YETI is about 5.8% overvalued, our DCF model tells a very different story. It points to a fair value near $95, or roughly 54% above the current price. If the cash flows are right and the narrative is too cautious, which signal matters more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out YETI Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own YETI Holdings Narrative

If you see the story differently or simply prefer digging into the numbers yourself, you can quickly build a personalised view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding YETI Holdings.

Ready for More High Conviction Ideas?

Before the market moves on without you, put fresh ideas on your radar with a quick, targeted scan of high potential opportunities using our most popular screeners.

- Capture powerful compounding potential by targeting reliable income payers through these 15 dividend stocks with yields > 3% that can anchor your portfolio with steady cash flows.

- Position yourself early in structural growth themes by zeroing in on innovators powering medical breakthroughs via these 30 healthcare AI stocks.

- Seize mispriced opportunities by focusing on quality companies trading below their estimated cash flow value using these 907 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal